2022: A Tale of Two Halves?

Summary:

The worst 1H since 1970 in the S&P 500, with over 60% of GDP erased in eight months and the Atlanta Fed Nowcast signaling another quarter of contraction. We are currently right in the belly of the recession with earnings estimates still in need of a reset. The good news is that statistically, there is little correlation between 1H and 2H performance. When we get such swift corrections, markets usually go on to have a positive second half. Risks in the short term are higher inflation in July/August pushing up long-term rates expectations again.

Macro

SOFT LANDING IS BECOMING “SIGNIFICANTLY MORE CHALLENGING”

Fed chairman, Jerome Powell, continues to have his head in the sand stating this week he is not worried about the shape of the yield curve, when for all intents and purposes we are inverted on the 2Y/10Y, the market’s favored harbinger of recession. If the Atlanta Fed Nowcast is right, GDP was -1% YoY in Q2, which would make for two consecutive quarters of economic contraction, with Q1 at -1.6%.

In the face of all evidence to the contrary, Powell said the economy remains in “pretty strong shape” and hopes growth stays positive, but the market isn’t buying it. Powell did at least acknowledge that a soft landing is becoming significantly more challenging the longer inflation stays high.

EUROPE: IS HISTORY REPEATING ITSELF?

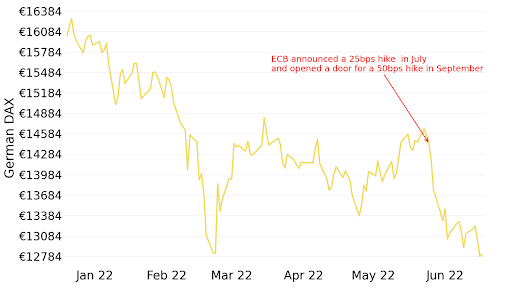

We should not hold on to any hope for European growth, either. German retail sales were weaker than expected (-3.6% yoy vs. -2%e) and the unemployment rate deteriorated to 5.3%, a seven-month high, from 5%, in part due to Ukrainians looking for work. It points to weaker future growth, which the markets are already signaling as the DAX is down 12% for the month and Europe continues to look vulnerable, in particular Italy, as the ECB tightens into a slowdown for the first time in 11 years. Last time the ECB raised interest rates, in 2011 to quell energy and food inflation, it deepened the debt crisis and slowed growth even further, particularly in the PIGS (Portugal, Italy, Greece and Spain).

The German stock market reacted negatively in anticipation of ECB rate hikes

THE CHINESE DRAGON AWAKENS

To end macro on a cheerier note, Chinese PMIs this week erased three months of economic decline as the county came out of lockdown. The factory and service sectors rose above 50, the level that separates contraction from growth, for the first time since February.

The benchmark CSI 300 index of companies listed on the mainland has climbed 13 per cent since its low in May as net foreign flows recovered through Hong Kong’s Stock Connect scheme. The rally was also boosted by easing measures, including a record cut to the country’s five-year mortgage rates of 15 bps to 4.45%.

Easing, a growth pick up and attractive valuations make for a market rally, which is rare at the moment with the caveat that politics can play a big role (i.e. crackdowns on tech, education). Even stripping out the perennially cheap banking sector, burdened with non-performing loans, the valuations are below their long-term average.

Chinese valuations are better than we have seen in a while as China originally held up better than the ROW with Covid

The CSI 300 ( a composite of the Shanghai and Shenzhen indices) is up 18% from its May lows

*The CSI 300 Index is a free-float weighted index that consists of 300 A-share stocks listed on the Shanghai or Shenzhen Stock Exchanges

Crypto

SELL IN MAY AND GO AWAY WAS THE RIGHT STRATEGY

After last week’s relief rally, bitcoin is back below 20k and the overall market is down 8% at the time of writing. Ethereum (-13.4%), Ripple (-14.5%), Solana (-22%), Avalanche (-21.2%) and Polygon (-22.5%) are all down heavily. It was a brutal month with BTC down 40%, the worst on record as fear and contagion set in, while ETH fell 47% in the period, proving its tendency to perform worse than BTC in a bear market.

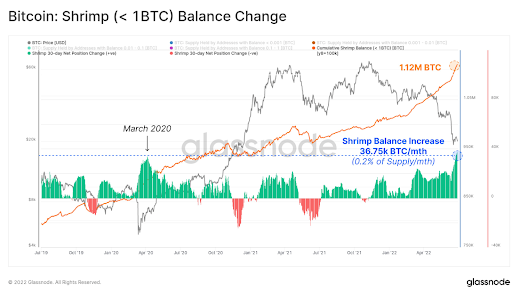

One intriguing development during the June swoon was that smaller investors continued to add to their positions with Shrimps (under 1 BTC balance) ramped up their accumulation of coins and now hold 1.12M BTC, according to Glassnode. Perhaps we can draw conclusions that it is the same cohort that continues to buy traditional equities, in particular ETFs.

CEDEFI UPDATE-LIQUIDATIONS GALORE

We learned on Wednesday that a court order in the British Virgin Islands had been made to liquidate crypto hedge fund Three Arrows Capitals. Earlier in the week, crypto broker Voyager Digital had issued a default notice to the fund for failing to make payments on a loan worth $600mn (comprising of $350mn of USDC and 15,000 BTC). The event has created pain for other crypto firms, with lender Genesis Trading standing to lose hundreds of millions from their exposure as well as BlockFi who have liquidated a $1B loan they gave to the fund.

Trouble continues at lending platform Celsius who still have all withdrawals frozen. A report this week by the Wall Street Journal illustrated how vulnerable the company’s structure was. They had a 19-1 assets-to-equity ratio - a ratio often used as an indicator of risk. This is double the risk a traditional bank normally takes on and was in fact more risky in Celsius’ case as the assets it held were mainly crypto which are highly-volatile. It was also selling under-collateralised loans (something which CEO Alex Mashinsky had always denied) with which the collateral was then used to borrow more money. A bankruptcy looks highly probable but the company is reportedly holding out in hope of avoiding such an eventuality.

Morgan Creek is trying to raise $250m to acquire a majority stake in crypto lender BlockFi. The company is already a large investor in BlockFi from their earlier rounds of fundraising and are therefore worried about FTX’s potential takeover bid which would see BlockFi’s existing equity shareholders and investors in earlier venture rounds wiped out. However, multiple sources are now reporting that, having provided a $250m revolving credit facility to BlockFi earlier this month, FTX are very close to sealing an acquisition for potentially as low as $25m. The CEO of BlockFi has since refuted the $25 mn price tag.

In addition to staking on the Anchor protocol and ETH on Lido, several of these lenders also have funds tied up in the Greyscale BTC Trust, which now trades at a 35% discount to the BTC spot price but which used to trade at a premium when there were less ways to gain direct access to BTC. Compounding their woes, the SEC has rejected an application by Grayscale to become an ETF. Becoming an ETF would remove this discount and also broaden access for bitcoin investment by allowing investors to redeem their stake more quickly and easily via the NYSE.

DeFi/NFTs

BATTLE OF THE BLOCKCHAINS: DYDX ABANDONS ETHEREUM IN FAVOR OF COSMOS

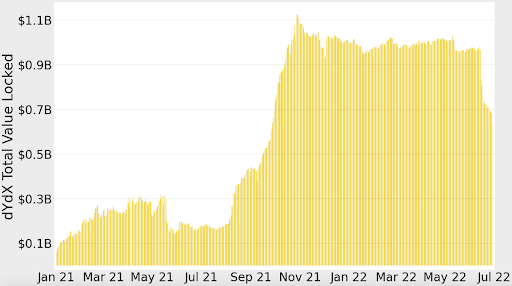

In big news, dydx, one of the most successful decentralized exchanges focusing on derivatives, announced that they will move away from Ethereum layer 2’s Starkware, a zero-knowledge scaling solution, choosing instead to build their own independent chain based on the Cosmos SDK and Tendermint Proof-of-Stake consensus protocol.

It’s certainly a bold move which few defi protocols as large as dydx have dared to make, but founder Anthony Juliano has never been shy about pushing the curve and they have been facing increased competition from other ecosystems. He has stated consistently that he’s not precious over which chain he uses, but simply wants to use whatever guarantees the best product. His four main goals are to maximize user experience, features, decentralization and security, all of which he believes can be boosted with this move - particularly in regards to decentralization.

It seems a significant reason for this move is that dydx will now be able to build their own sovereign blockchain without having to rely on third-party systems or services, but at the expense of less security. The creators of dYdX believe the new chain will allow the exchange to better optimize and handle the order book as the platform grows. The exchange uses traditional order books to reduce slippage.

Traders won’t pay gas fees to trade but only fees related to their trading activity according to size as they would do on a centralized exchange. The fees generated through trading will go to validators and stakers.

Dydx, the highly profitable defi derivatives exchange favored by institutions, took off in summer of 2021 but activity has waned lately

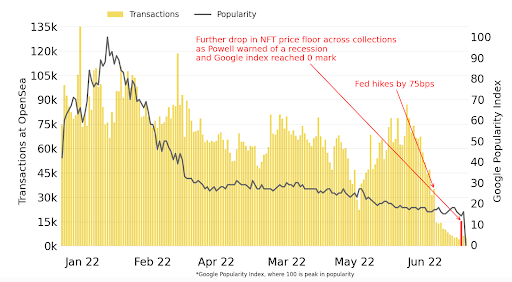

NFT WINTER SETS IN

A “crypto winter” has taken hold in NFT-land with transactions and popularity falling to a record low level as the Fed winds up ample liquidity conditions and markets are gripped by a potential recession.

Even the recent spike in volatility that we saw in the past week are attempts by investors to re-assess their investments in the NFT universe. Some of the top collections are "in the red" since the spike happened while other collections are holding on their value. The risk-off sentiment is expected to weigh on the NFT market further; however, the resilience of some of the top NFT collections to recent market volatility (ETH -44.2% MoM, BTC -36.8% MoM) is actually quite surprising and promising for the future of NFTs.

From Hero to Zero: NFT Transactions and popularity plummet

Until next week!

The Bequant Team

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice nor any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group. Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group