A Coin Picker’s Market

Summary

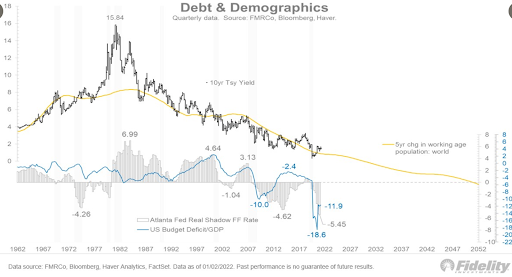

Risk assets continue to take a beating as the Fed became even more hawkish in tone, indicating a rate hike as early as March, for a total of three this year, as well as a potential reduction in their balance sheet. However, interest rate hikes do not trigger sustained market sell offs. Between 2016 and 2018, rates rose in tandem with equities and we only saw a sell off at the end of the two year period, the same is true between 2004 and 2006. Companies will start reporting earnings at the end of January and the outlook is positive. While rates may rise (though we cannot seem to get past the 1.7% level for the 10 year), real rates are still negative and the long term trajectory is still down, meaning there will still be appetite for alternatives such as DeFi. Moreover, if the Fed does follow through with an aggressive tightening, this will only cause rates to plummet given that they run the risk of throttling growth. For digital assets, a lack of new capital is a constraint for now, as institutions await regulatory clarity and retail activity has stagnated, meaning a coin picker's market, where detailed knowledge of individual protocols becomes more relevant.

Macro

After the hawkish minutes from the December Fed meeting were released, the sound of bonds selling off could be heard around the world. Traders are now pricing in a 71% chance that the Fed will raise its short-term target rate from its range of 0% to 0.25% by the end of its March meeting. That is up from about 32% a month ago, shortly after Omicron emerged, according to CME (Chicago Mercantile Exchange) data. Fed officials are forecasting three rate hikes in total for the year. Another surprise was that some officials are considering shrinking their $8.8 trillion bond portfolio.

Yields on the ten year treasuries shot up and briefly touched a post-pandemic high, rising over 20 bps since December 31, as worries over the Omicron variant impacting the global economy lifted. Lower quality high growth/negative cash flow and meme stocks, encapsulated by the Arkk Innovation Fund, started the year on the wrong footing as the focus is on moving up the quality curve.

Higher yields could prove short-lived if the Fed insists on hiking just as inflation and growth are easing

Long term interest rate trends have been on a downward trajectory for decades

US ISM BELOW EXPECTATIONS, PRICES EASING

The ISM manufacturing PMI data release for December came in below expectations (58.7) and the weakest since January 2022, resulting in initial dollar weakness. However, better than expected employment figures may be supporting the hawkish Fed speech. Inflation on the other hand could be easing as prices paid at 68.2 was the lowest since November 2020, but the Fed's insistence on curbing inflation could push yields back down. As a rule of thumb, a print above 50 reflects an expanding manufacturing sector.

SOFT DECEMBER JOBS REPORT

There were 207,000 initial jobless claims last week, a low number but the December jobs report showed only 199k new jobs, well below expectation, with the jobless rate down to 3.9%. A tightening labor market is one factor behind the Fed’s pivot toward raising rates sooner than previously signaled, although labor participation is an issue.

KEEP ON PUMPING

OPEC and a coalition of Russia-led oil producers agreed to continue pumping more crude, as the group bet that the Omicron variant of Covid-19 won’t have the sort of devastating effect on demand as previous waves of the virus.They will raise production by 400k barrels per day (bpd) in February, which is what they agreed to last year, until we reach pre-pandemic levels. Prices rose on deadly protests in oil-rich Kazakhstan against rising fuel prices, where Russian troops were called in.

Crypto

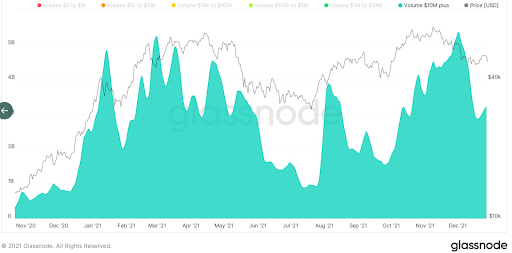

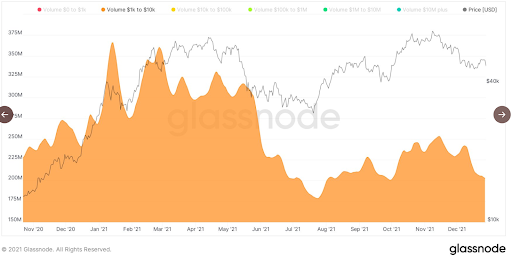

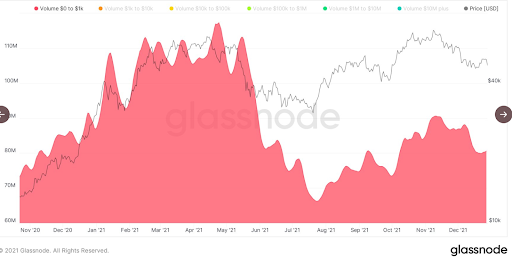

What will it take for retail to return? Bitcoin trading dominated by larger transaction sizes while active address for both BTC and ETH have stagnated.

Source: Will Clemente

Little in the way of short term catalysts for the main cryptocurrencies given stagnant retail participation (as per active wallets) and regulation still not in place for institutions to make a bigger splash. Moreover, the funding rate remains positive, showing that capitulation has not occurred. It will remain a coin picker’s market as investors redeploy the same capital to a broader set of projects.

ETHEREUM UPGRADE

Vitalik Buterin tweeted a roadmap for the Beacon Chain, showing scalability improvements are the next target before the upcoming transition to proof-of-stake. Vitalik’s roadmap showed the first upgrades post-Merge will be calldata expansion and basic sharding, both of which lower costs down for rollups and layer 2s.

E-YUAN ADDED TO WECHAT

Chinese technology conglomerate Tencent has added support for the country’s digital yuan to its WeChat Pay wallet, which has over a billion users. Users will have the option to pay using the digital yuan, which is in its pilot phase. So far, in the last year, almost $10 bn in transactions have settled digitally.

Regulation

A SIGN OF THINGS TO COME

The Commodity Futures Trading Commission (CFTC) started the year by fining NY-based crypto betting platform Polymarket USD$1.4mn. The platform, founded in 2018, lets users bet on current events using digital assets but US federal laws define the bets as options contracts which require registration. The agency has asked that derivatives markets, particularly those in DeFi be proactive about engaging with the CFTC, a warning shot to players in the DeFi derivatives market, perhaps.

ANOTHER CRYPTO HEARING IS COMING, THIS TIME ON THE ENVIRONMENT

A Congressional subcommittee is preparing a hearing to examine the environmental impact of cryptocurrencies, especially bitcoin mining, according to The Block. The timing and the witness list have yet to be determined, but the hearing could take place as soon as the end of the month. Environmental groups wrote to leaders in the House and Senate asking for oversight as miners took over old power plants. Senator Elizabeth Warren wrote to Greenidge, the most well-known mining operation in the New York controversy, asking them to account for their practices.

MORE MINING BANS

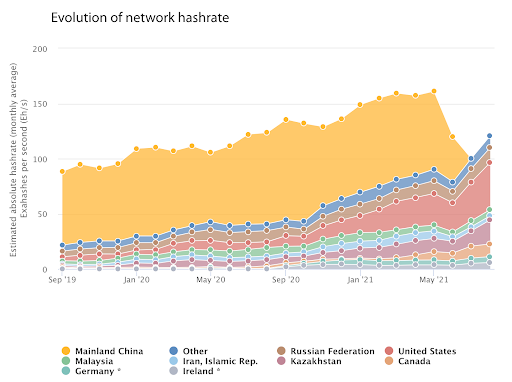

Kosovo announced it will temporarily ban cryptocurrency mining in an attempt to ease its energy crisis, coming on the heels of a similar move by Iran. It declared a state of emergency in December so as to increase its budget for costly imports of energy and order power outages. In the case of Iran, the temporary move is more significant, as it represents just under 4% of total hash rate. With hash rates fully recovered post China ban in 2021, this does not represent a risk to the bitcoin ecosystem.

However, Kazakhstan, a market that has gained importance since the China ban, has been looking to restrict miners in certain areas given energy constraints as well. This week, there were deadly protests triggered by rising fuel prices and Russian troops had to step in. A flight of miners from that market may be a blessing in disguise as the energy used is not renewable.

Cambridge Bitcoin Electricity Consumption Index - Geographical distribution of hashrate changed significantly in 2021

NFTs / DeFi / Metaverse

BUDGE OVER CRYPTO, HERE COME NFTS

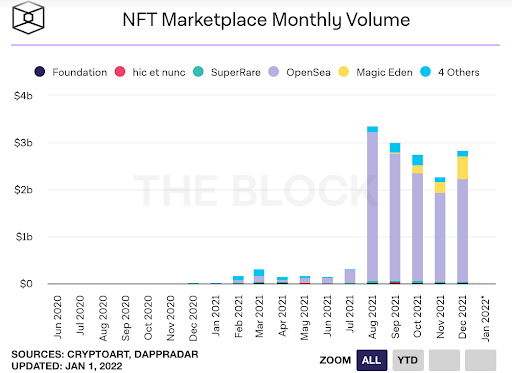

In what may be the news of the week, Paradigm and Coatue announced a $300 million investment in NFT marketplace OpenSea, valuing the company at $13.3bn in a Series C round. The dominant platform, founded in 2017, was valued at $1.5bn just last July in a Series B round, before volumes exploded. The announcement comes as NFT volumes have picked up again in the month of December to almost $3bn and ahead of Coinbase and FTX launching their own NFT platforms. In the last year, volumes have risen 600x and at 2.5% fee per transaction, the valuation makes sense.

As reference, the three top auction houses raked in a record US$15bn in sales in 2021 and Sotheby’s, with over $7bn in sales, was taken private at $3.7 bn two years ago, after achieving $4.8bn in sales in 2019 but a loss on the net income line. Not long ago, the CEO of Coinbase, Brian Armstrong, declared that their NFT marketplace could be bigger than the crypto operations (currently valued at $50bn, with $7bn in annual revenues).

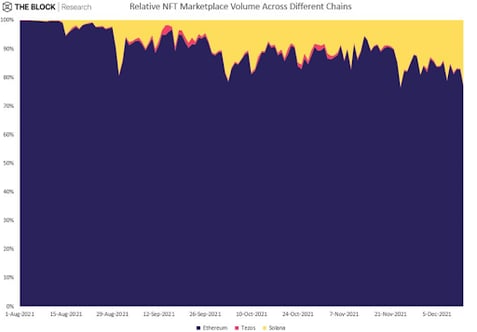

OpenSea dominates NFT waters, but Solana’s Magic Eden is also making waves

Source: The Block

Solana now commands 20% of NFT volumes

Coatue also invested in Dapper Labs, the platform for NBA Top Shot on the Flow blockchain, which was valued at $7.6bn last October.

BUYER BEWARE

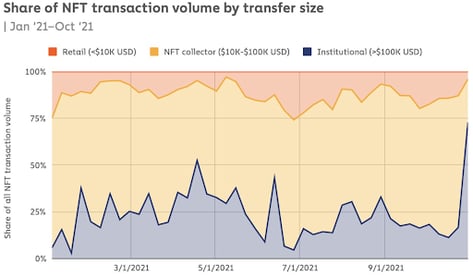

For retail investors looking to turn a profit flipping NFTs, the recent Chainalysis report is sobering. One of the key findings is that whales dominate the space, with the most profitable flippers (5%) accounting for 80% of profits on secondary sales, with 2.5x more flips and higher priced purchases as well as a focus on unique collections.

Big pockets dominate the NFT market

CONVEX FINANCE IS NOW NO. 2 ON ETHEREUM

Curve Finance is a decentralised stablecoin exchange where members lock in their coins to gain voting rights. These rights include deciding the token rewards for each Curve pool. Delphi Digital recently highlighted the so-called “Curve Wars”. Yield providers such as Convex Finance have lured Curve holders with high staking rewards so that they can then gain the voting rights via veCRV (voting escrowed CRV) and influence the liquidity pools the rewards go to.

Convex Finance, built on Curve, is the single largest owner of veCRV, with almost half of the total supply. Between Curve, the number one protocol on Ethereum, and Convex, they have over $40 bn in TVL. CRV holders staking their coins on Convex Finance receive cvxCRV tokens and can trade them, receive trading fees and CRV rewards and earn Convex’s governance token. Some protocols buy Convex tokens directly that can also give them access to veCRV governance rights.

TOKENIZED REAL WORLD ASSETS COME TO AAVE

A permissioned version of the DeFi liquidity protocol, Aave Arc, has launched and Fireblocks approved 30 financial institutions to participate in it. In a permissioned pool, every user is verified and meets KYC/AML standards and the liquidity pool is segregated from others. As opposed to other users, the ones whitelisted for Aave Arc will only be able to veto proposals for regulatory or compliance reasons.

EXODUS WALLET APP INTEGRATES SOLANA NFT MARKET, MAGIC EDEN

Exodus, the crypto wallet, partnered with Magic Eden, the Solana-based NFT marketplace to integrate it into its mobile app. This way, collectors can transfer NFTs from their browser-based wallets or Solana marketplace to their mobile devices. Magic Eden has half as many users as OpenSea but twice as many transactions, with an impressive $486 mn dollars of transactional volume last December out of a total of almost $3bn.

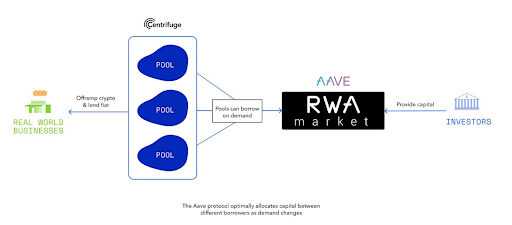

AAVE NOW ALLOWS TOKENIZED REAL WORLD ASSETS FOR LENDING & BORROWING

Aave, the leading lending and borrowing protocol added a market using real world assets (RWA) to its offering. They are partnering with Centrifuge, a company that tokenises business assets such as trade receivables and invoices, which can be used as collateral for loans. Permissioned pools will be available to meet KYC/AML requirements. The service offers lenders access to more markets and borrowers to additional sources of liquidity. This is a promising development that can disrupt peer to peer lending. Centrifuge started offering this option via Maker last April.

Bridging Tradfi and Defi via Lending and Borrowing in Tokenized Real World Assets

Source: Centrifuge

GAMING NFT FLOP

Ubisoft’s in-game NFT system, which launched earlier this month on the Tezos blockchain alongside Ghost Recon: Breakpoint, hasn’t proved popular, according to on-chain data The company minted 3k in game NFTs so far and has sold only 20, according to Rarible. Developers at Ubisoft were also not keen on the new strategy. The company that developed the game S.T.A.L.K.E.R. 2: Heart of Chernobyl has decided to cancel its NFT plans based on feedback it received from users demonstrating that GameFi won’t be as easy as just transposing NFTs onto existing games.

COUCH NFTs

In a world first, Samsung Electronics announced three TV models for 2022, Micro LED, Neo QLED and The Frame, that will enable NFT trading on the set via an integrated platform. They will support cloud gaming and video chat, too. LG is to follow suit and Shinhan Card, one of South Korea’s top credit card companies, launched an NFT service on its payment and lifestyle app. My NFT allows Shinhan card users to mint ownership of their physical belongings or memorable events as NFTs. It remains to be seen whether people will browse for NFTs on their TV’s rather than a phone app or computer. It is more likely they will use them as a medium of display. The company has been at the forefront, providing access to wallets on its smartphones since 2019.

CRYPTO CAMPAIGNING

The leading candidate for the South Korean presidency announced a fundraiser based on NFTs. Lee Jae-myung, the ruling Democratic Party's candidate in the 2022 presidential elections, will be giving NFTs to donors to his campaign. Donors will receive NFTs including a picture of Lee and a list of his policies in an attempt to interest young voters, who are typically less inclined to vote.

Investment Tracker

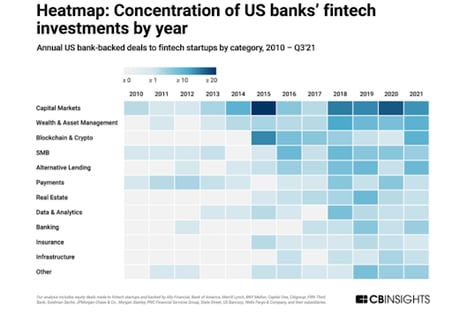

According to CB Insights, US banks have been investing again in Blockchain and Crypto after a two year hiatus in the number of deals. The other popular segments are capital markets and wealth and asset management. In all likelihood in the future there will be overlap between these three areas.

According to CB Insights, US banks have been investing again in Blockchain and Crypto after a two year hiatus in the number of deals. The other popular segments are capital markets and wealth and asset management. In all likelihood in the future there will be overlap between these three areas.

- Paradigm and Coatue announced a $300 million investment in NFT marketplace OpenSea, valuing the company at $13.3 bn in a Series C round. The dominant platform, founded in 2017, was valued at $1.5bn just last July in a Series B round, before volumes exploded.

- DeFi platform WonderFi will buy Canadian listed crypto exchange Bitbuy for $161.8 million in cash and shares, bringing the ability to purchase crypto and access to decentralized finance under one roof. With the deal, Wonderful adds 375k retail users. WonderFi is backed by famous investor, Kevin O’Leary and also Sam Bankman-Fried of FTX.

- Chinese crypto mining rig manufacturer Canaan has partnered with mining firms in Kazakhstan as it looks to further expand its presence outside of China into a growing market. They currently have over 10k miners in operation in that country but want to form a joint mining venture and aim to go from 32k terrahash per second to 850k. Perhaps the recent unrest in that country will curtail their plans.

- NFT studio Metaversal raised $50 million in a Series A funding round led by CoinFund and Foxhaven Asset Management. They produce and invest in iconic NFTs and the technology behind them. Use of proceeds will be an increase in its portfolio, which included an investment in the failed Constitution Dao project, and building an open metaverse. They company will also work with Dapper Labs (creator of NBA Top Shots) and NFT marketplace, Rarible.

Disclaimer: The views expressed in this newsletter are my own and not intended as financial advice or a recommendation, but only for informational purposes. You should carry out your own independent research or consult a financial adviser if you are unsure. Please also be advised that I hold investments in some of the assets mentioned in this report, including digital assets, equities and ETFs.