Censorship-Resistant

Summary:

The markets gave back part of their recent gains this week, with bitcoin posting a large intraday move down on Thursday on the potential escalation of the Ukraine conflict, with a flight to gold. Ultimately, the crux of the issue is whether the Fed can engineer a soft landing. Very high PPI and strong retail sales data added to concerns, though it did not cause large dislocations in the bond market again. Street estimates for 2022 GDP growth and earnings are softening, though.

In crypto, we highlight the use of bitcoin by those supporting anti-vaxxer Canadian truckers who saw their donations frozen by the government with the use of emergency powers. It is more common to see groups use crypto to protect their freedoms under authoritarian regimes but these instances will do a lot to educate the public about the use cases of the technology. As will Conaco Phillips launching a flare capture program to reduce emissions with bitcoin mining, as hash rates reach record levels. Finally, we look at top-performing GameFi darling and Snoop Dogg partner, Gala Games in more detail.

Macro

PRICING POWER

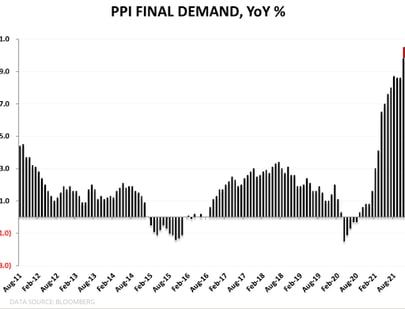

Seeking to protect their margins and seeing resilient demand, suppliers ramped up prices last month, causing further pressure on consumer inflation. The producer-price index (PPI), a gauge of wholesale prices charged by manufacturers, rose a seasonally adjusted 1% in January month-over-month, versus December’s revised 0.4% rise. The gains reflect pandemic-related disruptions from the Omicron variant of Covid-19 at the start of the year and continued strength in consumer demand.

Producer prices rose 9.7% on a 12-month basis, nearly the same as the prior month. Even excluding pandemic distortions still showed that inflation was unusually high as prices rose at a 5.6% annualized rate from the same month two years ago, well above the pre-pandemic peak of 2.9% in 2018.

CONSUMERS ARE FEELING THE PINCH

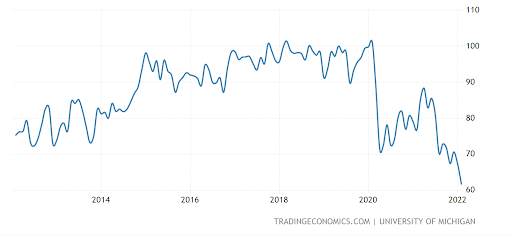

In inverse correlation to inflation data, the University of Michigan consumer sentiment for the US fell steeply for a second month to 61.7 in February of 2022, the lowest level since October 2011 and significantly below market forecasts of 67.5. Drivers include weakening personal financial prospects, largely due to rising inflation, less confidence in the government's economic policies, and a less favorable long term economic outlook.

U.S. consumer confidence fell to the lowest since 2011

BUT STILL OPENING THEIR WALLETS

Despite the downturn in consumer confidence, January retail spending surprised with its strength on Thursday, +3.8% mom, the highest posting since March 2021. The government doesn’t calculate the role of inflation in retail spending, which clearly had some impact, while credit spend is also on the up.

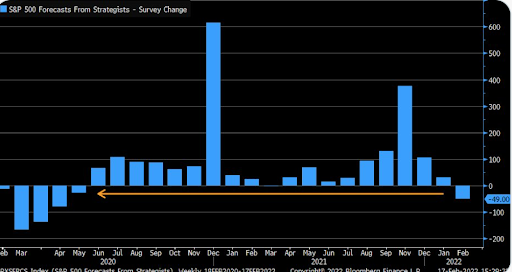

THE FED ISN’T THE ONLY ONE BEHIND THE CURVE

Racing to catch up to reality, banks continue to cut their growth and earnings forecasts for the year. Goldman Sachs has again trimmed its estimates, predicting a sharp slowdown as $1 trillion in fiscal support wanes. The bank now expects GDP to increase by 3.2% for the year, down from its previous estimate of 4.2%.

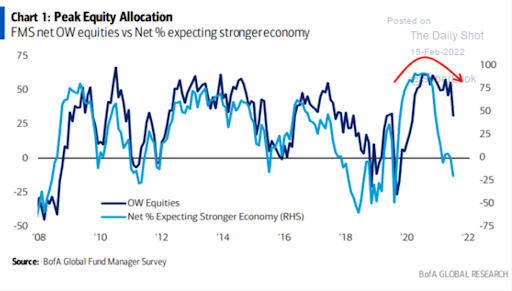

Fund managers have been reducing their equity positions on slower growth expectations based on the Merrill Lynch Fund Manager Survey

Earnings estimates are getting cut. Worry about companies that couldn’t deliver in Q4, they may struggle in a slowing environment

Source: Liz Ann Sonders, Fidelity

CHINESE INFLATION CONTINUES TO EASE

Inflationary pressure in China continued to ease in January, which will give the government much needed room to continue to relax monetary policy. The PPI rose a lower-than-expected 9.1% from a year earlier, down from December’s 10.3%. Softening coal and steel prices helped.

Prices paid by consumers also rose at a slower pace in January, with the CPI edging up by 0.9%, compared with 1.5% in December.

Crypto

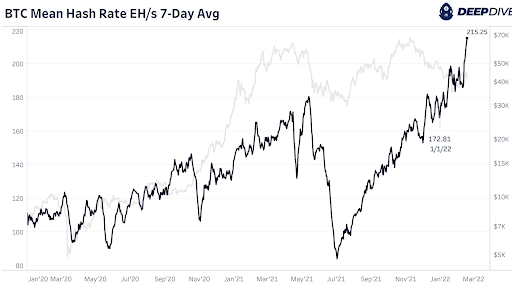

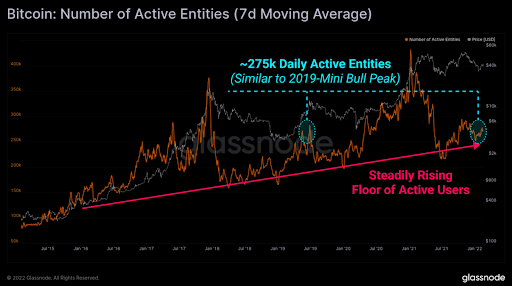

Leaving aside short-term, the strength of the Bitcoin network continues to improve as evidenced by record-breaking hash rates and a steadily rising base of active users.

BITCOIN IS FREEDOM

One of the biggest stories of the week and not just in crypto was the attempt by the Canadian government to curtail Canadian anti-vaxxer truckers protests by cutting off their access to funds, without a court order and invoking emergency powers. It is more common to think of use cases of crypto in this regard in authoritarian regimes or failed states, but this was an eye-opener on how much the state has broadened its powers during recent times.

The truckers, who have clogged up roads in Ottawa for weeks in protest against vaccine mandates, had their GoFundMe donations blocked after authorities raised concerns. This is when crypto fans jumped in and raised almost $1mn in donations on crypto crowdfunding platform Tallycoin, showcasing the power of the Bitcoin network as censorship-resistant.

WALL STREET COMES TO CRYPTO

From the New York Stock Exchange (NYSE) filing for a trademark referencing a marketplace for virtual goods and NFTs to JP Morgan setting up shop on Decentraland. The streets of the metaverse will soon begin to resemble a virtual replica of the high street, with bank branches vying for space alongside retailers. While investment is welcomed, the vision of the virtual world as a more creative, decentralized and fun space may have lost some of its luster.

While NYSE’s filing doesn’t signal an imminent launch to compete with Coinbase, it shows that traditional financial institutions are hedging their bets. ICE, NYSE’s parent company, had already launched a crypto venture, Bakkt, originally focused on trading bitcoin futures, which did not pan out, and is now providing technology to companies with customer loyalty schemes and integrating them with crypto. The NYSE likely sees the enormous potential in trading NFT’s backed by all sorts of physical and digital assets. Whether they can execute versus crypto native firms only time will tell...

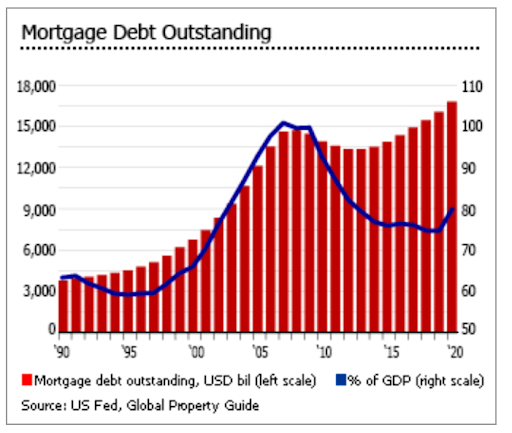

NFT MORTGAGES - A HUGE POTENTIAL MARKET

In one of the first transactions of its kind, a home was sold in Florida in an on-line auction using NFTs for 210 ETH. The transaction was managed by Propy and involved transferring property ownership to a limited liability company. The previous transaction was last May and made Propy the first company to launch a real estate NFT with the aim of appealing to younger buyers.

In future, the company plans to allow the use of mortgages with USDC stablecoin, which would then open it up to a wider audience. Propy auctioned a property as an NFT. Bacon Protocol, on the other hand, launched NFT mortgages last November. They mint mortgages, giving homeowners the ability to exchange a lien on their property for an NFT that represents a portion of its value.

The U.S. mortgage market is 80% of GDP and real estate is the largest asset class globally

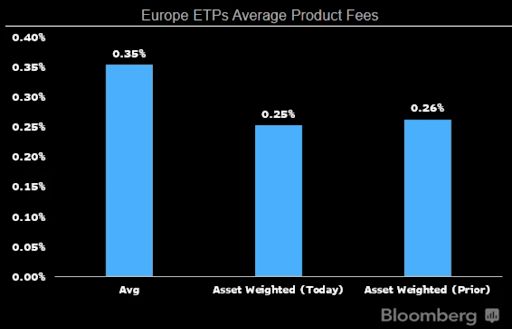

RACE TO THE BOTTOM: LOW-COST BITCOIN ETP IN EUROPE

Fidelity just launched their first spot bitcoin ETP in Europe with a fee of 75bps, making it the cheapest crypto ETP in the world but higher than average for all regional ETPs. This is an ongoing trend, with pressure from new launches and larger firms such as Vanguard, Invesco and HSBC able to lower fees based on scale.

REDUCING EMISSIONS: OIL GIANT IS SELLING STRANDED GAS TO BTC MINERS

Flare gas emissions became a pressing issue in the U.S. as oil production ramped up (the Americans became the largest oil producers in the world in 2018, ahead of Saudi Arabia and Russia). It is in this context that ConocoPhillips announced it has a Bitcoin pilot project operating in North Dakota that sells stranded gas to bitcoin miners in the Bakken. This will allow them to cut carbon emissions and provide miners with lower-cost energy.

According to the U.S. Energy Information Administration, the volume of U.S. natural gas vented and flared in 2019 reached its highest level since 1961, at 1.48 Bcf/d, with North Dakota and Texas accounting for 85 percent of the total. This level of flaring has presented the government with a real challenge, especially because of the release of both methane and CO2 emissions.

Authorities have been seeking commercial uses for the captured gas for years and bitcoin mining could be an elegant solution, not just in the US but in other oil-rich countries. Sky Truth monitors satellite-detected gas flares around the world.

Regulation

QUALIFIED STABLECOINS BILL ON THE CARDS

New Jersey Democratic Rep. Josh Gottheimer said he is close to introducing a bill that would create a new regulatory regime for stablecoins. He is planning to release a bill that would require stablecoin issuers to either become a bank, as per the federal regulator recommendation or to partner with a bank. Certain digital currencies could be designated as “qualified” stablecoins if they can be redeemed on a one-for-one basis for U.S. dollars. Qualified stablecoins could be issued either by a federally backed bank or a non-bank that agrees to maintain at least 100% reserve assets consisting of U.S. dollars, U.S. debt or any other assets the Office of the Comptroller of the Currency deems appropriate cash collateral.

BLOCKFI SETTLEMENT: TURNING THE PAGE

Crypto lending platform BlockFi will pay the U.S. Securities and Exchange Commission (SEC) $100 million in a settlement over claims that the company violated securities law through its interest account offering. It is the largest settlement ever in the space but will help provide clarity for others to offer similar products.

The company’s interest accounts allowed customers to earn a monthly interest payment on crypto. Under the SEC ruling, BlockFi’s accounts are considered securities because their users lend currency to the firm and so must be duly registered. BlockFi also illegally operated as an investment company as it issued securities and met an asset-based threshold qualifying it as an investment company — despite not being registered. In addition, the SEC said BlockFi misled investors about the level of risk in its loan portfolio and lending activity.

WSJ BREAKS BINANCE INVESTIGATION BY SEC WHILE TRADFI IS ALSO UNDER SCRUTINY

The SEC has moved on from BlockFi and is looking into the relationship between the US arm of Binance and two trading firms with ties to the exchange founder, C.Z.. Meanwhile, conflicts of interest remain rampant in traditional finance as revealed by an investigation into OTC trading at some of the major US banks. The Justice Department also announced an inquiry into spoofing (placing fake trades) and scalping (making lots of trades in a short period of time to gain small profits) by short sellers.

Apparently, Sigma Chain AG and Merit Peak Ltd. act as market makers that trade crypto on the Binance.US exchange, which may have not been made clear to customers. Market makers bolster liquidity and profit from the small spread between the bid and offer price.

DeFi / NFTs / Metaverse

On February 12, CryptoPunk #5822, a bandana-wearing version and one of only nine alien punks, became the highest-selling CryptoPunk to date when it was sold for 8000 ETH, worth close to $23.7 million at the time. The punk was bought by Deepal Thapliyal , CEO of blockchain startup Chain, an avid NFT collector and is double the previous record.

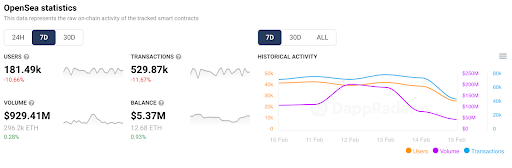

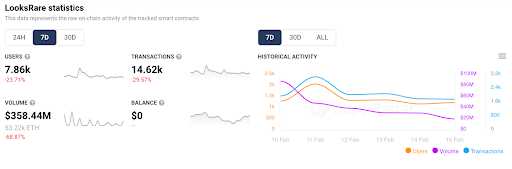

Despite the record-breaking CryptoPunk sale, transaction volumes and users ebbed over the last week, driven by LooksRare’s loss of momentum and lower floor prices. This is understandable after the strength of the January numbers and the halving of the LooksRare rewards program, which incentivized wash trading. It is a trend worth monitoring as it could be related to risk aversion or just a healthy reset after an extraordinary month.

Source: DappRadar

LOOKSRARE TEAM CASHES IN

According to a report by The Verge, it appears the LooksRare team transferred roughly 10,500 wrapped ETH (wETH), worth more than $31M, to personal wallets, made via the 2% exchange fees that go to LOOKS stakers.The token is off by 70% from its peak in January. Tokens start to vest on July 9. LooksRare airdropped 12% of the total LOOKS supply to stakers.

GALA GAMES AIMS TO MAKE BLOCKCHAIN GAMES YOU ACTUALLY WANT TO PLAY

Gala Games was one of the best performers within the top 50 coins over the last 30 days, wth a market cap of $2.1 bn. We wrote about the $5bn investment they announced last week, of which $2 bn is earmarked for gaming. Snoop Dogg’s promotional campaign with them for his record launch also helped performance. GALA currently has 1.3mn active users per month.

GALA is well positioned, with strong financial backing, experienced management and a mission to create play to earn games that are actually fun. The project aims to give power back to the gamers allowing them a say in game development, and control over their gaming assets, without the need to be crypto experts So far, many traditional gamers have pushed back on P2E and NFTs so if GALA can combine their blockchain expertise with compelling content, it can be a winning combination.

Gala boasts serious talent. It was founded by Eric Schiermeyer (the co-founder of Zynga and a gaming legend), Wright Thurston (one of the first major BTC miners), and Michael McCarthy (the brains behind gaming hits such as Farmville 2).

Potential catalyst? The platform runs on Ethereum, which faces network congestion issues and high transaction fees but GALA are putting the finishing touches on their very own blockchain. This will solve the issues and allow scalability and could be a potential catalyst.

Gala have released their first game, Town Star, in which users build a farm to compete in weekly competitions. NFTs can be used in the game to provide bonuses but are not required to play as in other P2E games. Mirandus, another game in the pipeline, is working to give players control over the in-game economy, what they earn or win or trade. They have a stable of other games in development.

Node operators earn GALA tokens and operate on a Proof-of-Availability basis which will be replaced by a stronger mechanism in future and become more decentralized. The total supply of GALA is approximately 50 Billion, while the circulating supply can be found here. Every year, on July 21, the distribution of GALA is set to be halved.

Until next week!

Disclaimer: The views expressed in this newsletter are my own and not intended as financial advice or a recommendation, but only for informational purposes. You should carry out your own independent research or consult a financial adviser if you are unsure. Please also be advised that I hold investments in some of the assets mentioned in this report, including digital assets, equities and ETFs.