Changing Engines Mid-Flight

Summary:

The markets got the JPow memo as we price in almost 150 bps additional hikes. As a result, the super dollar reigns supreme causing damage elsewhere. In crypto, September 6 is an important date as the Bellatrix upgrade prepares the Beacon chain for the Ethereum Merge, a feat which has been equated with changing engines mid-flight. Fed officials must feel the same about their mandate.

The Merge itself is due between the 10th and 20th of the month, while the FED policy meeting is on the 21st. Crypto players didn’t get the Fed memo, though, as leverage in ETH futures and options remained elevated with volumes rotating from BTC to ETH ahead of the event. ETH borrow rates in DeFi are also up.

Macro

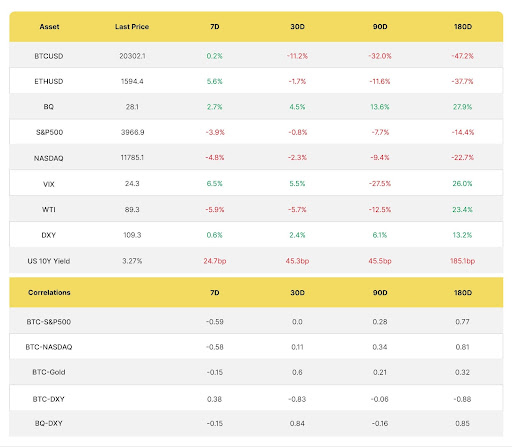

*Prices at the time of writing

Powell’s eight-minute speech was short but punchy as real yields are now positive across the curve. The dollar and the two year-Treasury yield at 3.45% jumped to levels not seen since 2007 as the market digested the Fed no pivot memo.

A sturdy jobs report on Friday, exceeding expectations at 315k jobs created (298ke), means a 75 bps hike is still in play for September 21. There was an uptick in the jobless rate to 3.7% as more people are looking for work.

There is no respite from the super dollar either, despite talk from some ECB officials of a 75 bps hike at their September meeting. On the flip side of a stronger greenback is the commodities index (BCR) resuming its downward trend given their inverse relationship.

A dollar tailwind is that the U.S. is ahead of the curve on quantitative tightening (QT). This is an important month because the Fed is ramping up QT, the process of reducing its swollen balance sheet while at the same time continuing the rate hiking cycle.

ON THE QT

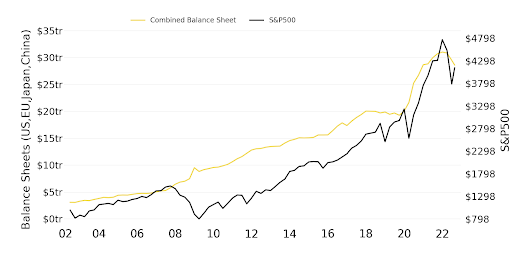

Although not really hush, hush and on the Q.T., monetary QT has not received the same attention as interest rates, The background is that the pandemic triggered a ramp-up in the expansion of government balance sheets on an unprecedented scale to soften the economic blow.

The quantitative easing trend took off back in 2008 with the subprime mortgage crisis, although Japan was the first country to tinker with the concept in 2001. The country already had zero interest rates in place and had to find alternative methods of monetary easing. It proved a fruitless effort in combating inflation but the precedent was set.

Before Covid hit, we had already gone through three rounds of QE and aborted attempts at quantitative tightening (QT), namely in 2018, prompting the term QE Infinity. Hence why QT implementation by the US Fed is so relevant. It has never been done successfully before.

Balance sheets have expanded to much higher levels as a result of the pandemic, making stepping back from the program without market repercussions challenging. This month marks a twofold increase in the pace at which the Fed is reducing its portfolio to $95 bn per month ($60 bn in Treasuries and $35 bn in mortgage-backed securities or MBS). The agency had accumulated $3.3 trillion of government bonds and $1.3 trillion in MBS over the last two years.

QT has distorted the markets in unintended ways, pushing yields down. The US government owns a quarter of Treasury debt, the ECB 40% and the Bank of Japan, 50%, and rising. This not-so-invisible hand of government has pushed investors into higher-risk assets in a hunt for yield so the reverse is true with tightening.

Combined Balance Sheets of Major Central Banks versus the S&P500

Source: Bloomberg

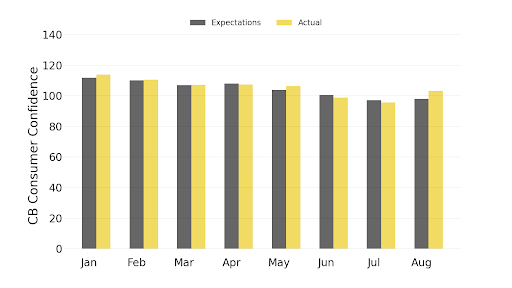

This week, in terms of relevant data, US consumer confidence came in better than expected after three monthly declines in a row. The index is now at 103.2, up from 95.3 in July. Both the present situation, helped by easing gasoline prices, and expectation indices improved but the latter remained below 80, meaning recession risks persist. Higher interest rates will dampen confidence as well.

The August US Consumer Confidence data was better than expected, helped by lower oil prices

Source: Bloomberg

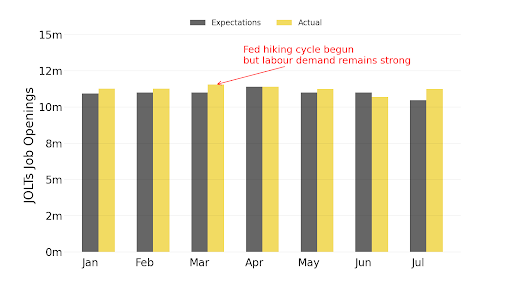

Earlier in the week, we got a preview of the health of the job market with the JOLTS report for the month, which measures the number of job openings that have not been filled by the end of the month. It is a top inflationary gauge that the Fed will be monitoring and signals no let up.

At 11.2 million openings, with only 5.6 7 million available workers, a labor shortage remains in place. Quits also fell to 4.18 mn but remains at high levels as a change in jobs has proven profitable for workers.

Job openings remained high in July, at 11.2mn, well above estimates of 10.3 mn

EUROPE: CLOSER TO THE LINE OF FIRE

Meanwhile, Europe has less room for maneuver than its American counterpart as it is more exposed to higher energy prices and this is now being reflected in inflation that has surpassed US levels. Energy is almost 50% of the CPI in Europe versus 30% in the U.S.

Inflation in the eurozone rose to a new record in August since 1997. Consumer prices were 9.1% higher than a year earlier, a pickup from 8.9% in July, higher than in the U.S.(8.5%). Core CPI, which is a less volatile measure as it excludes food and energy, came in at 4.3%, up from 4%.

Russia continues to pile on the pressure, as it unexpectedly shut down the Nordstream gas pipeline, its main venue to export gas to Europe. for so-called maintenance, after already reducing its export capacity to 20% of the total. European energy futures 1 yr forward tumbled from dizzying heights on signs that Europe is filling its gas tanks more quickly than expected, but still at worrying levels, triple what they were at the beginning of the year.

Crypto

*Prices at the time of writing

ETH IN LIGHTS

ETH and related asset, Polygon, stole the show, coming back to life at the end of a tough week across asset classes.

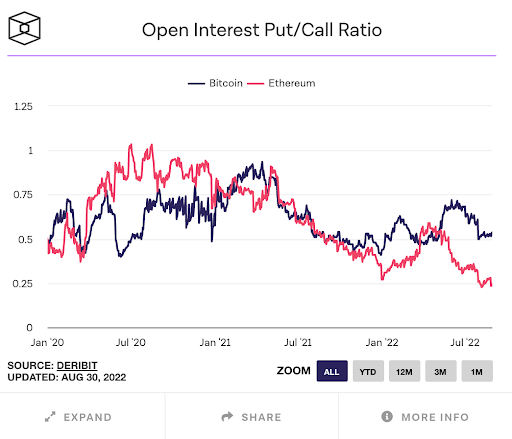

ETH activity remained high, with options open interest elevated at $7.2 bn, although not at the peak of $8.1 bn of mid-August. The put-to-call ratio at 0.25 is less than half that of BTC. The highest number of options are calls above $2.6k, with maximum interest at 3k.

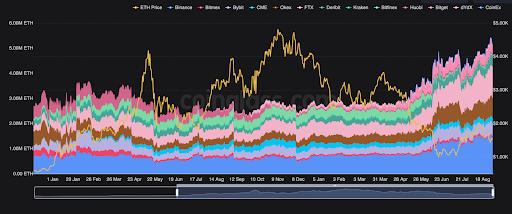

When looking at futures, ETH volumes also dominated with OI at elevated levels and ATHs in ETH terms. However, bias was bearish for most of the week as funding rates and 3M annualized basis resumed their downward trend, particularly in the case of ETH, with the term structure in backwardation.

On Friday, funding rates for perps turned positive briefly ahead of the US jobs report before going south again. The spot to futures volume on BTC doubled to 0.24 since the beginning of July while ETH went in the opposite direction, from 0.21 to 0.14 as the market speculated on the upcoming Merge via leverage.

ETH futures open interest (ETH terms) at all-time highs

Source: Coinglass

Source: The Block

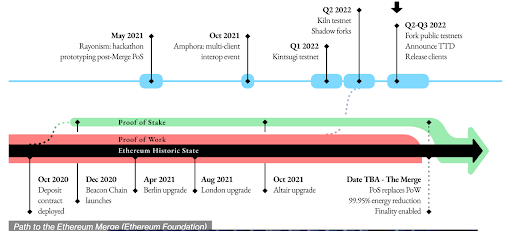

ON THE VERGE OF THE MERGE

It’s been 10 years since the idea was first proposed and we are finally on the verge of the handover to Proof of Stake for the Ethereum blockchain. This transition has been compared to attempting to change engines mid-flight, quite the feat. Exchanges are pausing their deposits and withdrawals in the time around the Merge between the Ethereum mainnet and the new Beacon Chain.

ETH borrow rates on Aave are rising as traders want to receive a potential Proof of Work hard fork token, with some concerned about potential replay attack risks which should not happen as assets will have different chain IDs.

Key dates to watch:

September 6:

- Bellatrix upgrade upgrades the Beacon Chain into a ready-to-merge state

September 10-20 (FOMC meeting on the 21st)

- Paris upgrade, switch from PoW to PoS, when the Total Terminal Difficulty (TTD) reaches a specific threshold difficulty of the final PoW block mined. After that, the next block will be PoS. This will happen 13 minutes after the upgrade.

Pros |

Cons |

|

Clears the way for sharding reduced gas fees and improved throughput down the line (from 30 to 100k tps).

|

Improved fees and scaling won’t happen after the Merge, as that will depend on sharding sometime in 2023. This will allow more capacity to store and access data. Layer 2 solutions will still be a needed complement, though. |

|

Reduced issuance. Annual issuance could go from 4.9 mn to 970k ETH (approx 5% to 1%). |

Stakers won’t be able to remove the coins they have staked on the Beacon Chain, until after the Shanghai upgrade, likely in 2023. |

|

Yield for validators could rise from 4% to 7% on current usage, with a potential increase in staking from the current 13 mn out of 120 mn total issuance. |

Potential sanctions at the blockchain level could be enforced by validators. Tornado Cash case and enforcement by USDC and leading protocols set a precedent for regulators sanctioning smart code. |

|

A 99.95% reduction in energy consumption via the elimination of proof of work will make Ethereum ESG-compliant |

A handful of crypto players such as Lido, Binance and Coinbase account for over 50% of ETH deposits. |

Path to the Merge

FROM PEGGED TO FREE-FLOATING

One of the co-founders of MakerDao, Rune, is proposing a way to make stablecoin DAI free-floating and eliminating the peg with the dollar. This comes after he suggested divesting from USDC collateral in the aftermath of the Tornado Cash sanctions.

The idea would be to buy ETH and gradually reduce reliance on real-world assets over a period of three years. The proposal would have to be voted on by the community members, some of which are less wedded to decentralization, such as VCs.

Until next week!

The Bequant Team

Martha Reyes

Emiliano Bruno

Artur Sakovich

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high-risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group.