CONTROL+ALT+DELETE: A Quarter to Forget

Summary:

Despite the rebound as peace talks ensued and oil prices retreated, U.S. equities closed down for the quarter while bonds had their worst quarter in decades. The 2yr/10yr yield curve inverted as yet more rate hikes were priced in. Housing, which remains hot, is a concern.

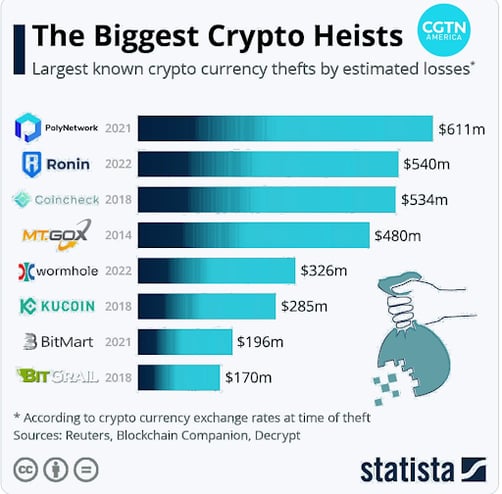

Digital assets bounced along with equities but lost steam. Besides ApeCoin, of the large caps, Solana and Terra outperformed for the month while metaverse/gamefi lagged after a strong 2021. Fantom failed to recover after the key developers walked off. Speaking of credibility, the riskier nature of cross-chain bridges was on display with the +$600 mn hack on the Ronin bridge. Regulation also continues to cause headaches in the U.S. and the EU. However, this is not stopping companies, whether crypto or mainstream, from investing in mining, NFTs and global expansion.

Macro

MARKETS SMOKED THE PEACE PIPE

US markets rebounded from the year’s lows earlier this month post-Fed meeting and on more encouraging signs from peace talks between Russia and Ukraine in Turkey, although the steam wore off midweek. The S&P was up 5% for the month as of Friday morning but down -5% YTD, the Nasdaq was up +6% and -10%, respectively.

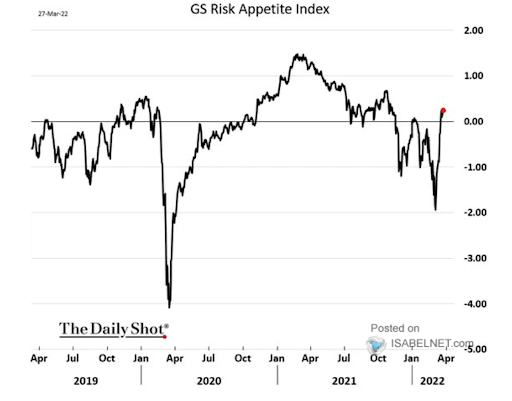

While it is tricky to foretell short-term moves, on this occasion the GS Index signaled the market recovery, as it fell to levels that 90% of the time indicate positive returns over a 3-6 month period, according to the bank. The metric tracks how investors moved away from growth and cyclicality towards defensives across asset classes.

The GS Risk Appetite Index indicated oversold conditions in mid-March

Data from the US Federal Reserve shows US household’s equity ownership levels holding at highs of 29% of total assets and nearly double the long-term average. It could be a structural change, where the trend of growing retail investment is here to stay.

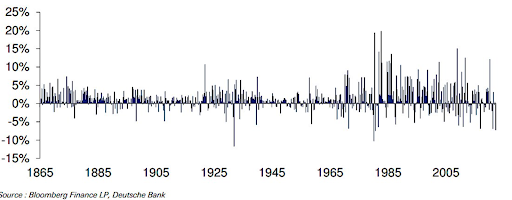

Bonds saw one of the worst quarters on record. In times of uncertainty, bonds tend to do well but the US ten year went up to levels not seen since the spring of 2019, at one point above 2.50% this week. Rebalancing by large bond funds and Japan’s fiscal year-end helped to bring yields down towards the end of the week.

The Japanese themselves announced that they will boost purchases of ten-year government bonds next quarter even as the yen weakens (over 5% in March) in an effort to cap yields. Longer-term yields retreated, with those for 20-year JGBs falling 9.5 basis points to a two-year low of 0.670%.

Quarterly US 10 yr Treasury total return series - Q122 was one of the worst on record

THE MEXICAN STANDOFF CONTINUES IN GEOPOLITICS

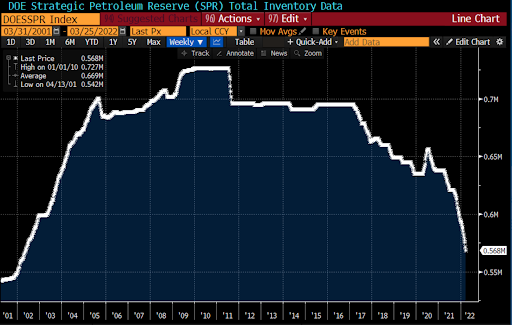

In a desperate attempt to keep a lid on prices at the pump, the US government announced that they are weighing the release of strategic oil reserves to the tune of 1mn bpd or a total of 180 mn, a third of reserves, bringing the level to a 40 year low as Russia remains firm in its demand that gas exports be paid in roubles. To put this into perspective, it would only total about 8 days of consumption.

The US is considering using up a third of its oil reserves to repress prices at the pump

HOUSING IS HOT, SPENDING IS NOT

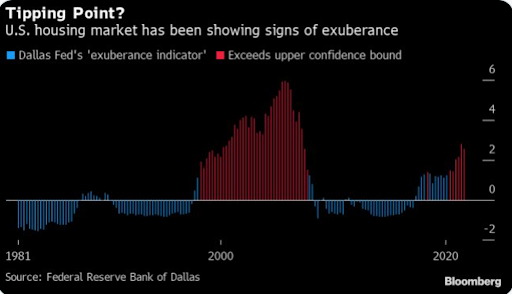

One of the key sectors that the Fed is looking to slow down is housing, where 50% of wealth is concentrated and where signs of bubble-like behavior have been appearing over more than five quarters as per the Dallas Fed. This is something that hadn't happened since the early 2000’s.

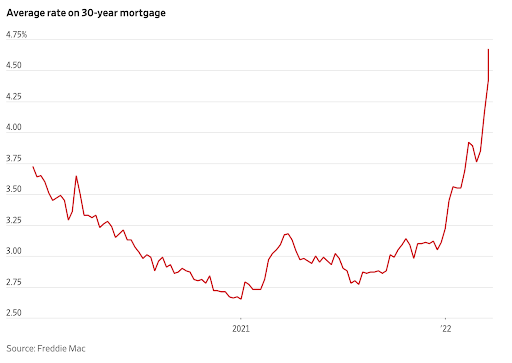

Fedspeak has already caused a substantial rise in 30-year fixed mortgage rates but mortgage applications are still up. Home prices rose 15% YoY in February. The fact that most mortgages are long term (15/20 yr) and fixed-rate makes the job of the Fed harder as there is less of a transmission mechanism than with flexible mortgages.

Exuberant behavior in housing is worrying central bankers

Long-term mortgage rates are approaching 5%, levels not seen in four years

Source: WSJ

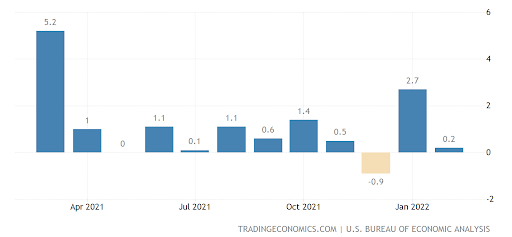

Even though incomes rose by 0.5% and the unemployment level fell in the same period, workers cut back on their spending more than expected as inflation ate into the gains. January had also been quite strong.

CHINA: YOU CAN KISS THAT +5% GROWTH TARGET GOODBYE

China’s key financial hub and home to 25 million people, Shanghai began a phased lockdown this week as an Omicron wave led to the highest number of cases since the early stages of the pandemic. Even though the absolute numbers are small, the move is in keeping with China’s zero-tolerance strategy, as only half of 80-plus-year-olds have two or more vaccination injections.

Manufacturing and services activity in China contracted in the month as many industrial centers were hit with the Omicron variant of Covid, affecting about a third of the country’s GDP and companies such as Apple and Tesla. More concerning, new export orders fell to 47.2 from 49 last month, indicating a global slowdown. The government’s stated growth target of 5.5% now seems at risk.

Crypto

Bitcoin was flat for the week and up +1.6% for the month while Ethereum did better (+5.5% and +11%, respectively) in line with the ecosystem as investors started looking at the transition to proof of stake potentially taking place in June and cutting issuance by 90%. Overall, digital assets rose +5.8% for the week and 9.8% for the month as of Friday morning, while still down -8% YTD. ApeCoin had the best performance in March after its listing earlier this month which led to $9bn being traded within the first 24 hours. Within the larger cap names, Solana and Luna stood out, +25% and +14% for the week.

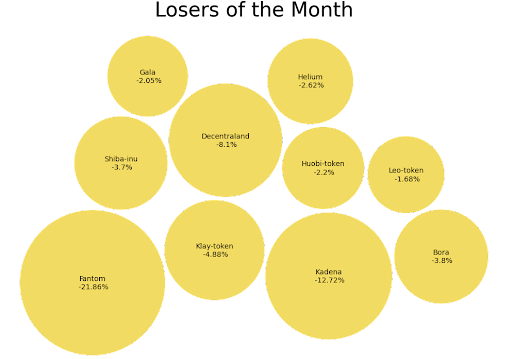

On the losing side, Fantom struggled to regain traction after Andre Cronje’s departure and Metaverse/GameFi plays such as Decentraland and Gala continue to take a back seat, a trend we’ve seen so far this year.

|

If you would like to receive our chart-based monthly snapshot of key market events for the month, please sign up HERE: https://research.bequant.pro/quantitative-report |

LESS SPECULATORS = BETTER FUNDAMENTALS

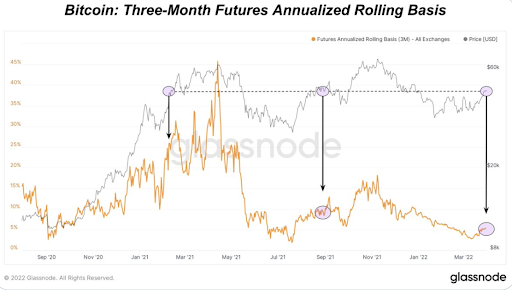

As the market rose from its lows, BTC traded above 47K. As analysts at Glassnode pointed out, the first time BTC crossed 47k, forward 3 month futures were trading at a 26% annualized premium to spot. The second time forward 3 month futures were trading at a 9% annualized premium. This time the premium was 5% showing that prices are rising with less leverage in the system.

Less leverage: forward 3 month futures are trading at a 5% annualized premium vs. 26% last year

Source: DylanLeClair, Glassnode

THE LIGHTNING NETWORK GAINS KRAKEN AS A NEW ADOPTER

U.S.crypto exchange Kraken announced it supports Bitcoin’s Lightning Network for cheap and instant customer deposits and withdrawals of BTC up to 0.1 BTC. The Lightning Network i’s a Layer 2 technology that uses micropayment channels to scale transactions and make them more efficient and is what Twitter Tips uses, for example. More exchanges are adopting the network to save their customers from high fees on smaller transactions.

Adoption is on the rise but slowing after the one-offs of El Salvador and Twitter adoption. According to DappRadar, there is over $110 million in Bitcoin locked into the Lightning Network, as BTC locked in the system surged from 1k to 3k last year and is now at 3.4k. Because the Lightning Network is a separate protocol from Bitcoin’s mainnet, it requires a different type of wallet so users can create payment channels.

BTC Locked in the Lightning Network at ATH but growth has slowed to more organic levels

Source: Finbold, DeFi Pulse

MASTER HODLR

MacroStrategy, a subsidiary of MicroStrategy, closed a $205 million bitcoin-collateralized loan with Silvergate Bank to purchase more bitcoin. The three-year loan was collateralized with $820 million in bitcoin or about 12% of MicroStrategy’s overall crypto holdings.

Microstrategy holds approximately 125k bitcoins, purchased for nearly $3.8 billion, or an average price of $30,200, with the help of about $2.4 billion in debt. Silvergate has over $13 bn in crypto deposits and its BTC-backed loan portfolio is around $570mn.

DIGITAL ASSET INVESTMENT PRODUCTS SAW THE BEST INFLOWS SO FAR THIS YEAR

As sentiment improved at the end of March on peace talks, US$ 193 mn flowed into digital asset investment products. This was the highest number since last December, with 76% coming from Europe and the US lagging with only $45mn. Bitcoin was the main beneficiary at $98 mn, with Solana seeing the largest single week on record at $87mn.

COINBASE SET TO ACQUIRE LATIN AMERICA’S LEADING CRYPTO EXCHANGE

Consolidation among centralized exchanges marches on. Coinbase is in talks to acquire 2TM, owner of Mercado Bitcoin, Brazil’s largest crypto exchange and the deal could be finalized this month, according to local media. The South American exchange had 3.2 mn customers last year, of which 1 mn were added in 2021 alone and they have ambitious plans to expand in the rest of Latin America as well as Portugal, where they have made acquisitions. In its recent Series B, the exchange was valued at $2.2 bn.

The region is attractive for crypto firms given the high adoption levels, high growth rates, relatively underbanked populations and popular peer to peer trading. One of the most retail-oriented exchanges, Binance, also has its eye on the Latin market, with plans to acquire banks and payment processors in Brazil. Recently, it signed a Memorandum of Understanding (MoU) to acquire Brazilian brokerage Sim; paul Investimentos. Will Mexican unicorn Bitso follow the same path? They will probably have to in order to compete with Mercado Bitcoin after this.

BITCOIN MINING IS SET TO GROW 60% THIS YEAR

Following the Conoco-Philips announcement a few weeks ago, oil giant Exxon Mobil will run a bitcoin mining project using wasted gas from its North Dakota oil well. ExxonMobil has a deal with Crusoe Energy Systems, one of the pioneers of using wasted gas to power bitcoin mining, as they aim to achieve World Bank Zero Routine Flaring by 2030. Given the quantity of excess gas in that part of the world, we should expect oil companies to become more active miners.

In the meantime, pure crypto miners continue to add capacity. Greenidge Generation Holdings, the owner of a large crypto mining center in New York, secured $100 million to fund its growing operations. They plan to triple their capacity to 4.7 EH/s this year mainly in the state of New York.

Marathon Digital, one of the few miners that is not vertically integrated, expects to have 199,000 bitcoin miners producing 23.3 EH/s by early 2023. Compass Research estimates the global hashrate will rise to 327 exahashes per second (EH/s) by the end of 2022 — a nearly 60% year-over-year increase, and 587 EH by the end of 2023.

|

Hashrate is the total computational power that is being used to mine and process transactions on a Proof-of-Work blockchain, such as Bitcoin and Ethereum (prior to the 2.0 upgrade).A “hash” is a fixed-length alphanumeric code that is used to represent data. 1 exahash=1 quintillion hashes per second |

Regulation

Just as we were making progress on the regulatory front, with the rejection of a proof of work ban in the European parliament and the US executive order, two blows came out of left field.

REDEFINING THE TERM “SECURITIES DEALER” COULD IMPACT DEFI

First, in the U.S. there was a new proposal by the Securities and Exchange Commission (SEC) to redefine the term “securities dealer” and make it broader, thus including automated and algorithmic trading technology to execute trades and provide liquidity. This could apply to DeFi assets classified as securities, which may be most if regulators have their way, even though the proposal is targeted at electronic traders of U.S. bonds.

Also in the U.S. the Office of the Comptroller of the Currency (OCC) warned banks about getting involved in crypto and cited the recent OTC transaction between Goldman Sachs and Galaxy Digital as an example. The head of the OCC claims pricing is too unreliable for banks to get involved in trading futures, even though this is an area regulated by the CFTC.

EUROPEANS TIGHTEN AML MEASURES ON CRYPTO EXCHANGES

Second, the European Parliament passed a bill extending money laundering identity checks to payments made in crypto even if they are below the 1k euro threshold as well as the monitoring of privately managed unhosted or self-hosted wallets that store crypto. The bill will discourage individuals from maintaining their own private keys, which seems unnecessary.

UK REGULATION IS COMING, WITH A STABLECOIN FOCUS

CBNC broke the news that the UK Treasury is set to create a broad regulatory framework detailing how crypto companies can set up shop and operate in the country and focusing on stablecoins. In February, the Treasury had said they needed to act quickly and that the framework should be similar to the European Union’s (EU) Markets in Crypto-Assets (MiCA) package, which should be ready by mid-year.

MORE CITIES AMENABLE TO PAYMENTS IN CRYPTO

In the week, more cities announced they are studying the acceptance of digital assets as payment, including Austin, Texas and Rio de Janeiro, Brazil, which will start doing so for municipal real estate taxes as of next year. The city Treasury had already announced it would be allocating 1% of its reserves to cryptocurrencies as it seeks to attract crypto investment, mimicking the efforts of other cities around the world.

THE GRAYSCALE TRUST DOES NOT RULE OUT SUING THE SEC OVER A SPOT BTC ETF

The SEC has yet to approve a Bitcoin spot ETF and investment firm Grayscale has been pushing for that to change given it has over $28.5bn in AUM and over 800,000 accounts under its BTC Trust which it would like to convert into an ETF. So far, the SEC is not budging and the trust trades at almost a 30% discount, leading its CEO Michael Sonnenshein to consider suing if their application is rejected. A decision is expected by July 6.

DeFi / NFTs / Metaverse

ARE BRIDGES TOO UNSTABLE? ONE OF THE LARGEST HACKS SO FAR ON RONIN

The big event within DeFi this week was the Ronin Network hack for approximately $600 million, one of the largest ever. The network is an Ethereum-linked sidechain used for the play to earn game, Axie Infinity. Exploiters used hacked private keys to forge withdrawals on March 23 from the Ronin Bridge, which lets users send crypto back and forth between Ethereum and Axie’s Ronin sidechain. The breach wasn’t discovered until Tuesday, when a user was unable to withdraw 5,000 ETH. The Ronin bridge and its Katana exchange have been halted as a result.

The hack wasn’t a result of a smart contract bug but an issue with centralization. Sky Mavis’ Ronin chain has 9 validator nodes, this means in order to recognize a deposit or withdrawal, five out of the nine validator signatures are needed and the attacker managed to get control over them. RON, the Ronin coin, is down -23% since the news.

Sky Mavis, the creator of Axie Infinity, is working with law enforcement and investigators to get the funds back. Most of the stolen ETH is still in the hacker’s wallet but in a puzzling twist $21 million have been transferred out, some of it to centralized exchanges such as FTX.

Some are speculating that Sky Maven will have to reimburse users, which is what Jump Crypto did with the Solana bridge hack, and would mean selling down 20-30% of their equity.

NFTS ARE IN HYPERGROWTH MODE, WHO WILL PREVAIL?

A Deutsche Bank report on NFTs said that the market is currently in hypergrowth, having grown from $90 min in sales to $25 bn in one year, and that Meta could supercharge the market, as NFTs could come to Instagram in the near term. However, this is up for debate. The platforms that kick off wider adoption may well be crypto native, whether that is Coinbase with its much awaited launch or OpenSea allowing fiat to crypto purchases. Even Visa wants in on the action, and just launched a digital creator program.

DB calculates that an Insta NFT marketplace could generate $8bn in annual revenue. OpenSea is likely around the $1bn mark extrapolating this quarter’s sales, with over 1 million active user wallets, while Instagram has 30 million users. However, active user wallets on Metamask, a target audience for OpenSea are already at over 30 million. DB estimates the total addressable market at $1 trillion but if you include metaverse opportunities, that number is likely much higher.

Until next week!

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice nor any other sort of advice. None of the information on this document constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group. Any transaction is subject to contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group does not make any representation or warranty or gives any undertaking as to the accuracy, timeliness or completeness of any such information and assumes no liability for losses arising from the use thereof. This document may not be reproduced in whole or part, without the written permission of the BEQUANT Group.