Crypto in 2022

2022 is only days away so we thought it would be a worthwhile exercise to identify the trends that we think will dominate the year, including NFTs, GameFi and ESG. What do you think will be the overriding themes?

MACRO: Taming the hawks

Let’s set the backdrop, given that digital assets do not operate in isolation. 2022 is unlikely to deliver the sort of returns we saw this year across many asset classes (at least outside of digital assets). Inflation coupled with low rates pushed investors into digital assets, real estate, commodities, equities, and even meme stocks. There was some turbulence along the way, including fears of Evergrande contagion. Post-Thanksgiving, short term yields rose and the yield curve flattened, with the market fearful of Fed overdosing on rate hikes into a slowing economy caused by Omicron. We did not get the expected strong runup into year end, but at the time of writing, Nasdaq is only 3% off its highs while the S&P is practically back at ATHs, with low volatility in both stocks and bonds.

The good news is that inflation may have peaked and bottlenecks have begun to ease, so we should see less inflationary pressure in 2022, lower growth but still healthy earnings and a stepping away from the three rate hike scenario that the market is already pricing in. The Fed will be cognizant of the looming midterm elections. This setup should be benign for crypto. China could be a standout in 2022, after a brutal 2021, as inflation has peaked there and the government continues to cut reserve requirements for banks as well as outright rate cuts. Equity valuations are also at a record discount relative to the U.S. after the government crackdowns but investors will stick to the onshore market given delisting risks.

REGULATION: On the steps of Capitol Hill

Regulation is set to move. China’s ban and U.S. regulatory progress have significantly shifted the landscape. Bitcoin miners disappeared from China seemingly overnight, with the US gaining share and the added benefit of mining becoming more renewable.The U.S. Securities and Exchange Commission (SEC) approved several bitcoin futures-based ETFs, after years of dillydallying. The $1 trillion infrastructure bill, which contains a provision that would require brokers of digital assets to record and report transactions to the Internal Revenue Service as of 2023, was approved. Congressional testimonies from CEO’s of crypto companies show a clear desire from US lawmakers to understand crypto and make a decision on how to regulate investments in this new space, but not ban it.

Regulation is set to move. China’s ban and U.S. regulatory progress have significantly shifted the landscape. Bitcoin miners disappeared from China seemingly overnight, with the US gaining share and the added benefit of mining becoming more renewable.The U.S. Securities and Exchange Commission (SEC) approved several bitcoin futures-based ETFs, after years of dillydallying. The $1 trillion infrastructure bill, which contains a provision that would require brokers of digital assets to record and report transactions to the Internal Revenue Service as of 2023, was approved. Congressional testimonies from CEO’s of crypto companies show a clear desire from US lawmakers to understand crypto and make a decision on how to regulate investments in this new space, but not ban it.

Any form of clarity is a positive, and if the US moves, which seems likely at this point, other jurisdictions will follow suit and more traditional investors such as pension funds that have virtually no exposure can justify investment in this burgeoning asset class.In addition to their remit of consumer protection, regulators look at systemic risk. The fact that financial institutions are getting involved with digital assets is pushing them to act as they can foresee continued growth and integration with the traditional system. Fund managers, family offices and hedge funds now see the benefit of holding even a relatively small weighting in crypto, especially given its lack of correlation to other asset classes and high risk adjusted historical returns. Quant traders are utilising the high volatility and inefficiencies of the market to make attractive returns for their clients.The strong growth in stablecoin and the DeFi ecosystem is also drawing the attention of the regulators. Stablecoins grew 450% to $156 bn according to Fitch Ratings, driven by DeFi, which grew over tenfold to almost $250 bn in total value locked, as per Defi Llama.

Once regulation is clearer, we may finally see the approval of a spot bitcoin ETF in the U.S. which will allow investors access to the digital asset without the high cost of the future ETF or the need to custody coins. This will prove appealing to retail and institutional investors, as surveys have shown.

NFTs to unlock crypto for millions

Professional art investment has been a profitable asset class for generations but now, with NFTs and tokenisation, the space has been democratized and expensive intermediaries removed thanks to decentralised platforms such as OpenSea. Centralised exchanges and platforms are getting in on the action, too. NFTs allow investors to get closer to the creator, give artists control on future royalties through smart contracts and, through limited collections, create virtual communities. These opportunities have attracted retail and institutional investors alike.

There are many other use cases such as music, sports, gaming, virtual land and goods in the metaverse, and even traditional mortgages and other financial products as an NFT is at its simplest, a digital representation of a virtual or physical good. Expect major brands to explore this area as an extension of their identities, accelerated by investments in the metaverse by Facebook, Microsoft, Nike, Adidas and others such as traditional gaming companies. Businesses will also be drawn to NFTs as a way to provide traceability and transparency and generate future streams of income for everyone from podcasters to filmmakers.

BLOCKCHAIN: ETH watch your back!

Defi and most NFTs still rely on the Ethereum blockchain but rising gas prices have led to a number of competitors, or Layer 1 solutions, raising their heads. While Ethereum continues to be the chain of choice, it also faces risks. From a dominance of 95% at the beginning of 2021, it has fallen to 63%. This trend is likely to continue, though as the whole system is growing, in absolute terms so will Ethereum. Ethereum has been a victim of its own success with slowing transaction times and high fees, despite the London hard fork in 2021. The NFT craze last summer added to its woes. An upgrade, Ethereum 2.0. to make it more secure and scalable, has been in the works for years, but if it is delayed, developers and users may choose to migrate to competing technologies.

Defi and most NFTs still rely on the Ethereum blockchain but rising gas prices have led to a number of competitors, or Layer 1 solutions, raising their heads. While Ethereum continues to be the chain of choice, it also faces risks. From a dominance of 95% at the beginning of 2021, it has fallen to 63%. This trend is likely to continue, though as the whole system is growing, in absolute terms so will Ethereum. Ethereum has been a victim of its own success with slowing transaction times and high fees, despite the London hard fork in 2021. The NFT craze last summer added to its woes. An upgrade, Ethereum 2.0. to make it more secure and scalable, has been in the works for years, but if it is delayed, developers and users may choose to migrate to competing technologies.

Competition from other smart contract blockchains like Binance Smartchain (10%), Terra (8%), Solana (6%) and Avalanche (5%) mean it is not certain that Ethereum will ultimately prevail or there may be room for several competitors, as in any industry. This comes at a cost, however, because of the classic trilemma that blockchains can only deliver two out of three characteristics: decentralisation, scalability and security. Cross-chain bridges such as Avalanche Bridge are also helping this movement as they facilitate transfers from Ethereum to other blockchains. On Ethereum itself, roll up and zero knowledge solutions such as Abritrum or Optimism are also gaining in popularity, as are Polygon and Immutable X, designed especially for NFTs. In 2022, expect to see further investment to improve scale and security and general infrastructure such as custody to meet growing usage. It remains to be seen whether Ethereum will continue to lose dominance, especially if the upgrade is delayed again.

DeFi: 2022 could be the tipping point

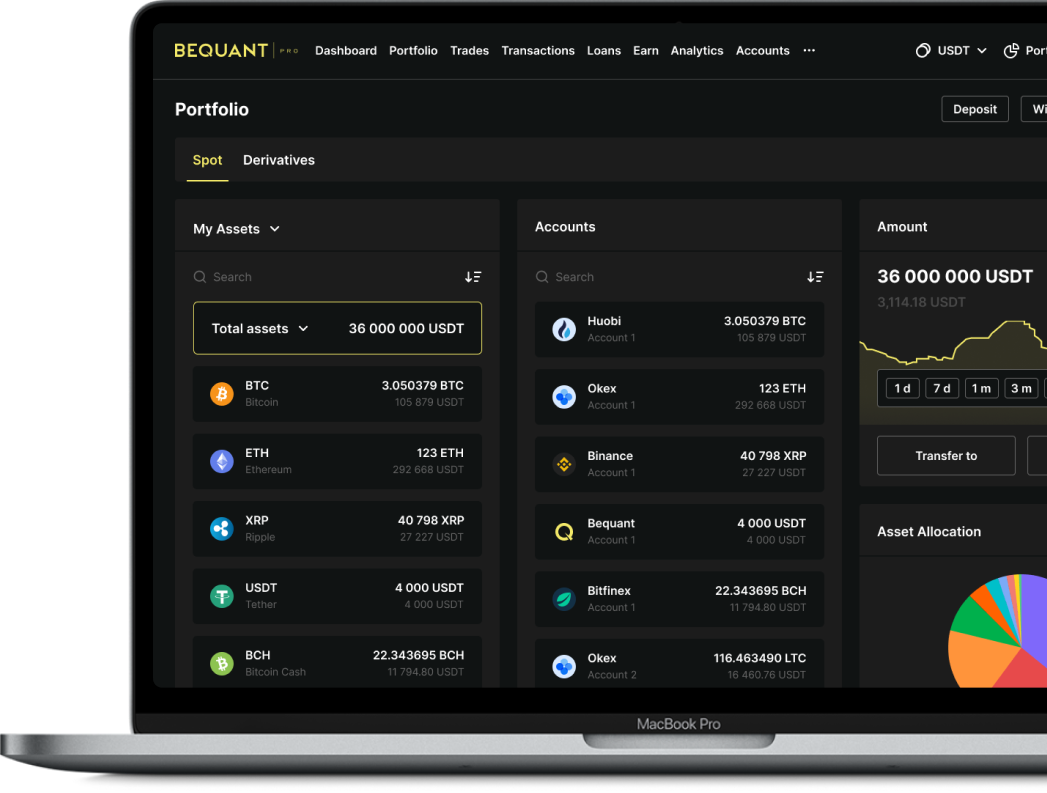

With NFTs growing in popularity, Coinbase launched its own NFT marketplace, with 1m early access subscribers in the first few days of the announcement. Since then, it launched a DeFi offering available to customers outside of the US for now, enabling users to earn a yield from stablecoins on their Coinbase account. This could eventually lead to mass adoption. In short, DeFi provides the billions of unbanked or those looking for better returns with an opportunity to access banking products in the crypto sphere, such as high yield deposits and loans collateralized with digital assets. In this use-case, crypto holders can loan their assets directly to another user in near-real time, reducing market friction and costs for the borrower while enabling the lender to earn higher rates than in traditional banks. This space is set to blossom in 2022, with crypto lending in particular set to make strides in the new year. Expect better user experience, easier access, regulation and better infrastructure to be key themes in 2022.

With NFTs growing in popularity, Coinbase launched its own NFT marketplace, with 1m early access subscribers in the first few days of the announcement. Since then, it launched a DeFi offering available to customers outside of the US for now, enabling users to earn a yield from stablecoins on their Coinbase account. This could eventually lead to mass adoption. In short, DeFi provides the billions of unbanked or those looking for better returns with an opportunity to access banking products in the crypto sphere, such as high yield deposits and loans collateralized with digital assets. In this use-case, crypto holders can loan their assets directly to another user in near-real time, reducing market friction and costs for the borrower while enabling the lender to earn higher rates than in traditional banks. This space is set to blossom in 2022, with crypto lending in particular set to make strides in the new year. Expect better user experience, easier access, regulation and better infrastructure to be key themes in 2022.

GameFi: Coming to a computer screen near you!

Sitting above the DeFi platform and leveraging the utility of NFTs, GameFi is set to take off. This area could be even larger than the art market given that the total gaming category, at $200bn, is four times the size of the art market, with over 3 bn gamers around the world. GameFi allows your avatar to access the metaverse to game and use your paid-for NFTs to express yourself digitally. You can earn additional NFTs or tokens which can be monetised or exchanged on transparent marketplaces. The gaming economy has evolved to the point where you can lend out your NFTs or accessories to other gamers and continue to earn a passive income from them. After the success of Axie Infinity, which achieved 1 mn daily average users and $200 mn in trading volumes per week, big studios are investing in this area, so expect to see much more from the GameFi community in the coming months.

ESG: Crypto goes green

There is an increased awareness that the blockchain could be the answer to problems around consistency of reporting and collection and verification of ESG data. The U.N. itself believes that blockchain technology will play an important role in sustainable development through climate data transparency, fostering climate finance and enabling clean energy markets. For energy consumption, parties, both at government and private level, can submit their reports and be independently checked against other data for consistency. This makes them less likely to be misreported, promoting a higher degree of accuracy and helping the world hit its climate targets.

Blockchain can play an important role in driving greater use of renewable energy, for example.There are already blockchain communities that are looking to drive the energy transition by helping to integrate renewables into the grid. There are also open source applications that will allow bitcoin miners to verify their energy usage on the blockchain or for carbon offset via investments in environmental projects. DLT could also be helpful in verifying ESG compliant sourcing, with easier verification of provenance and safer data transmission.

Finally, green coins and others that have a socially conscious objective are likely to blossom as more institutional funds get involved and retail investors become more selective, meshing the worlds of ESG and crypto.

Until next year! We welcome comments and suggestions. Martha @reyeshmartha

Disclaimer: The views expressed in this newsletter are my own and not intended as financial advice or a recommendation, but only for informational purposes. You should carry out your own independent research or consult a financial adviser if you are unsure. Please also be advised that I hold investments in some of the assets mentioned in this report, including digital assets, equities and ETFs.