Hard Squeeze

Summary:

After a difficult couple of months, markets ricocheted, thanks to more dovish monetary policy expectations and news around Ethereum’s merge. Technicals had a large role to play as earnings momentum is negative and activity has yet to pick up onchain in crypto. Retail investors once again rode to the rescue and bought the dip. The momentous news in crypto was the partnership between Coinbase Prime and Blackrock to allow their 55k plus institutional investors to trade and custody BTC via their Aladdin platform, which manages a mind-boggling $20 trillion-plus in assets.

Macro

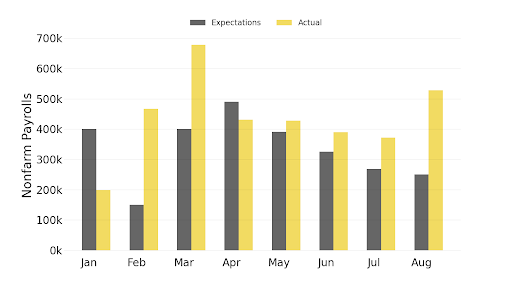

On Friday, blowout NFPs and a 5% increase in hourly wages, threw cold water on a Fed pivot, despite jobs being a lagging indicator.

Source: U.S. Bureau of Labor Statistics

On Friday, a blowout of the water NFP with hourly wages up 5% threw cold water on a Fed pivot in the short term, which had been the narrative all week, despite employment being a lagging indicator.

THE PAIN TRADE

Light summer liquidity juxtaposed with heavy short positioning in the S&P led to a short squeeze as investors, particularly retail, piled into the Fed pivot trade, which now looks overextended. The market went from pricing in seven rate hikes to four by year-end, after Powell’s comments last week, but that is still not a pivot. Since then, several Fed members have made statements to walk back Powell’s unscripted comments, as it has eased financial conditions, the opposite of what they are trying to achieve.

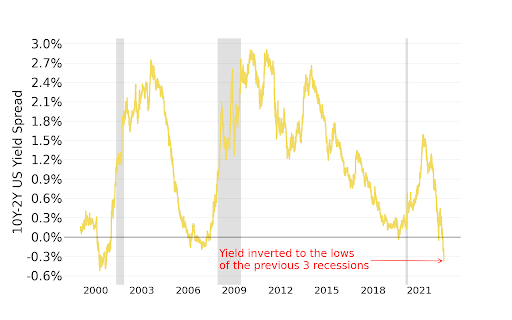

Signals are mixed, with the 2-year yield rising, expressing that there won’t be a Fed pivot any time soon, and long-term rates falling, leading to almost 20 bps of further yield curve inversion since the start of August. Commodities also continue to weaken, another sign of recession angst as oil trades at pre-Ukraine levels. Confoundingly, high-yield bonds and equities have rallied. JP Morgan estimates markets are calculating a 50% chance of recession, versus 90% a couple of months ago.

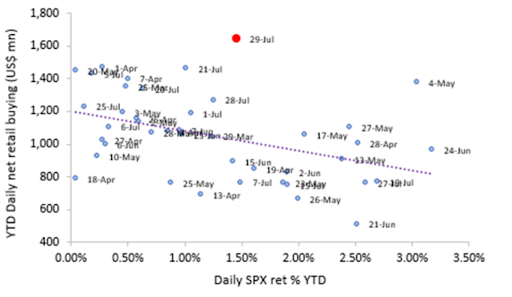

U.S. net retail flows surge as individual traders buy the dip

Source: Vanda Research

Retail flows in the U.S. have been a real outlier during this rally as individuals bought the dip while hedge funds doubled down on their S&P shorts to the most since June 2020. Tesla has continued to be a retail favorite, with net purchases of almost $700 mn in the five days up to August 3 after a 3:1 share split proposal by the company.

While in itself, a stock split does not increase the value of the share or any ensuing payouts, the argument is that it could attract more investors and add to liquidity. Also, a high share price is seen as a good problem to have.

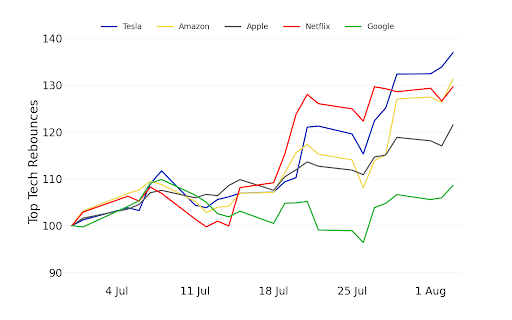

Some of the most popular tech companies snapped back strongly during the July rally

Source: Bloomberg

Source: Bloomberg

Investors flocked to tech names as, ceteris paribus, lower long-term rates lift valuations. The lower the rates, the lower the risk premium investors require to hold stocks. Secondly, rates impact the net present value of a firm’s discounted cash flows. Finally, lower rates reduce a company’s financial expenses. Consumer discretionary stocks also performed well.

The interest rate spread between the 2YR/10 YR widened a further 18 bps last week

Source: Bloomberg

Source: Bloomberg

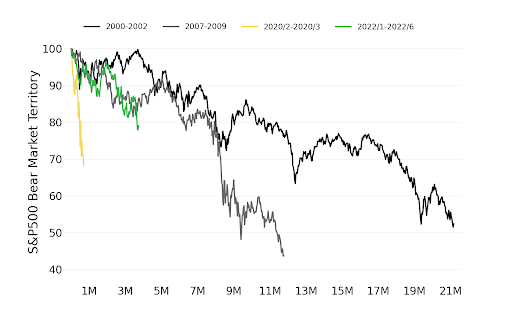

S&P performance today versus previous bear markets

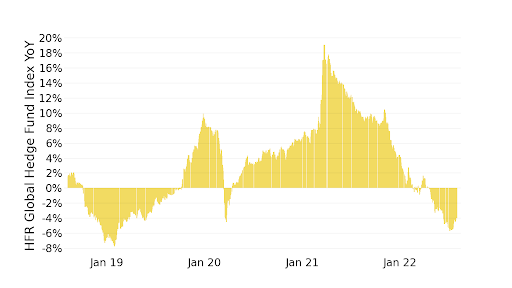

Unhedged: Traditional hedge funds have had a tough time of it this year

Source: HFR, Bloomberg

Source: HFR, Bloomberg

This week, we learned that Tiger Global, one of the world’s largest hedge funds, ended Q2 with a 50% drop as it underestimated inflationary pressures. According to HFR, long-short strategies have been the worst performers among hedge funds, dropping an average of 12% in the first half of the year. But it wasn’t all doom and gloom as specific strategies, such as systematic, performed strongly.

On a positive note, in its 4th Annual Global Crypto Hedge Fund Report 2022, PwC said one-third of traditional hedge funds surveyed are already investing in digital assets such as BTC but most hold less than 1%. Multi-strategy funds were most likely to invest, followed by macro strategy and equity strategy firms. Two-thirds of the firms currently invested plan to increase their holdings.

Crypto

BTC (-2.8%) and ETH (-3.5%) are down modestly for the week, despite positive performance from the S&P (+1.6%) and Nasdaq (+3.9%) at the time of writing. Binance’s coin (BNB) continued its strong momentum (+8.7%), while below the top 20, FLOW (+59%) and Filecoin, FIL (+39%) are worth a mention. Solana underperformed on a wallet hack and news about individuals pumping developer activity to gain traction.

FLOW was created by Dapper Labs and is best known for the wildly successful NBA Top Shots. This week, META announced that it was commencing NFT integration on Instagram and would support NFTs on the Flow blockchain, the only other one besides the leading chain, Ethereum.

COINBASE + BLACKROCK IT’S ALL IN THE TIMING

A little over a week after Cathy Wood’s Ark ETF sold over 1.4mn shares in Coinbase, presumably on an insider trading case against an employee and a report that the Securities and Exchange Commission (SEC) is investigating the platform for trading unregistered securities, the stock is up 60%.

Ark, the third largest holder of COIN, with 9 mn shares, sold $75 mn worth of its position ahead of this week’s announcement that the exchange has partnered with Blackrock to offer institutional access to crypto trading and custody services. The news, coupled with short interest as a percentage of the free float of 23% helped lift the shares higher (a level above 20% is considered very high). Something to also watch is the earnings report next Tuesday.

Blackrock had expressed interest in allowing access to cryptocurrencies for its clients a few months ago and is now enabling this for its 55k Aladdin clients on Coinbase Prime. As a first step, this will only apply to bitcoin. This is quite an important announcement. The equivalent on the retail side was Fidelity revealing that it would allow access to crypto for 401k accounts, of which it controls about a third of $7 trillion in assets, last spring.

|

What is Aladdin (Asset, Liability, Debt, and Derivative Investment Network)? It is a portfolio management platform used by 55k investments professionals that provides a whole portfolio view, including risk analytics across asset classes, public and private. It manages a staggering $20 trillion-plus in assets, more than Blackrock itself has in AUM ($8.5 trn) |

PLACING IT ALL ON RED

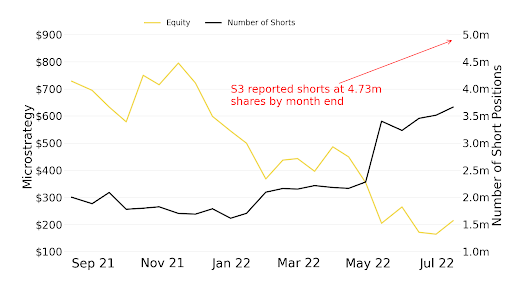

Another equity highly correlated to BTC, in particular, is software provider Microstrategy, given its large Treasury position in the cryptocurrency. Very high short interest in the stock (the most updated data was 51% of the free float as reported by S3, (Bloomberg only reports data with a two-week lag), led to a 14% bounce on Wednesday. “The company reported a loss of $1bn mostly from its BTC investments, for a total of $2bn, and announced that CEO and BTC evangelist, Michael Saylor, would be stepping down. The company had raised $2.4 bn in debt and $1bn in equity to accumulate its position and has a market cap of $3.5bn...

Bears got squeezed on Microstrategy earnings this week

Source: Bloomberg

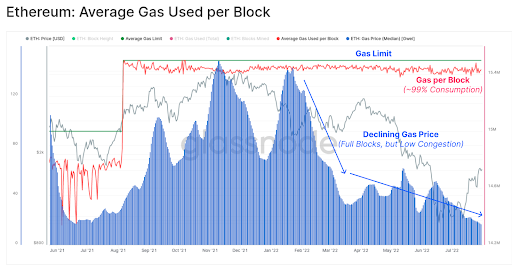

Pre-Defi days: activity on Ethereum is back to the May 2020 lows

Independently of price action, Ethereum gas prices have recently declined to just 17.5 Gwei (one billionth of one ETH), the lowest since May 2020, which was prior to DeFi Summer. The average cost of a transaction is around $0.50. Despite the rally, we haven’t yet seen new users clamoring to use the blockchain. As reported by Glassnode, even though blocks are mostly full, there is low congestion.

ETH burned is now at only 11% of total issuance, though on several occasions it has dipped into the deflationary territory since the London hard fork.

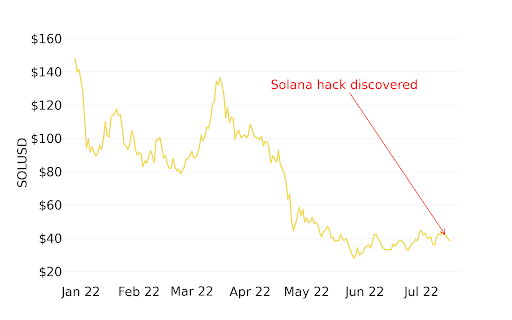

SOLANA WALLET “HACK”: JUST A BLIP

Solana fell 8% on the news that over 9k users’ hot wallets (likely Slope mobile wallets) had been hacked for $4mn, although the coin has been in a consolidation phase since May. The original concern that it was a direct bug on the blockchain turned out to be unfounded. Solana users and investors have had to deal with frequent and prolonged outages on the chain in the past. You can dig deeper here

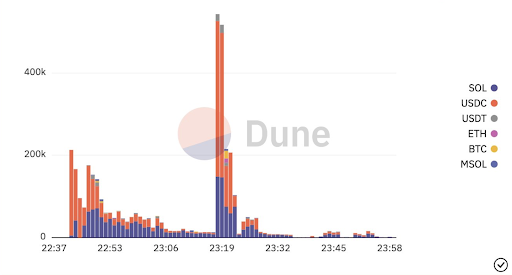

Assets hacked time series (USD): most of the funds were USDC and SOL

Source: Dune Analytics, Trystan0x

Until next week!

The Bequant Team

Martha Reyes

Emiliano Bruno

Callum Greaves

Artur Sakovich

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group. Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group. Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group