It's not impossible

Summary:

It was a productive week at Blockwork’s London event, which beat last year’s attendance record despite the market doldrums. While everyone was monitoring the bond market’s volatility, something very familiar to crypto natives, most saw the space emerging slimmer and trimmer. A new wave of adoption, the halving cycle, innovation and regulation can drive us forward. Building a better financial tech stack for public good, as noted by Stani Kulechov, is not impossible.

It was a tough week market/earnings wise given the stronger-than-expected jobless claims, which pressured rates, and disappointing Tesla and Snapchat reports. It is not impossible that the Fed will have to intervene selectively in the bond market. In crypto, notable positive exceptions were Polygon, Lido, and Maker Dao. L2 solutions remain a key theme (MATIC) as is staking (LDO), while DAO got a boost from A16z speaking out against breaking up the finance protocol.

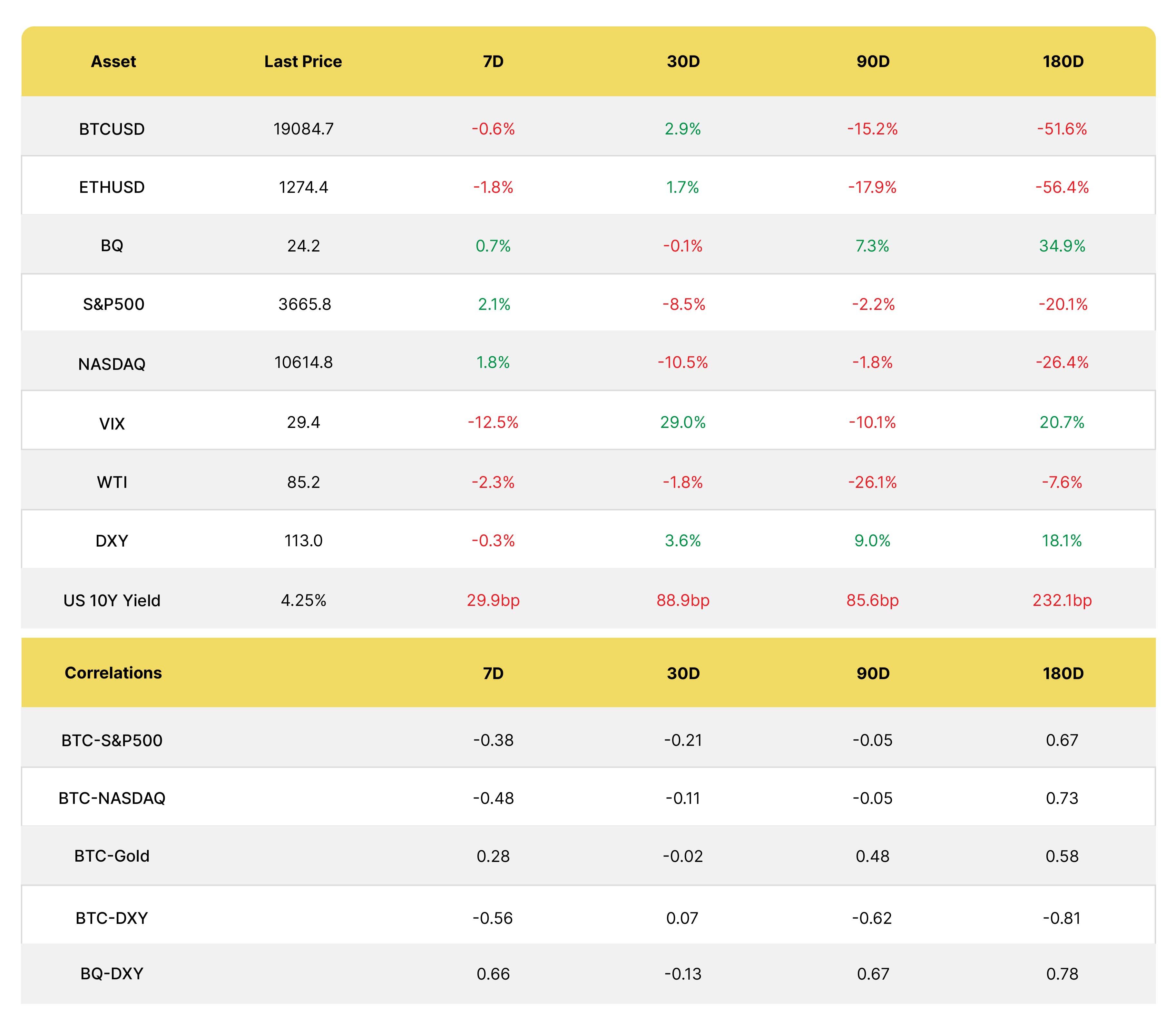

Macro

*Prices at the time of writing

What to watch

- Oct 24 US Mfg PMI, exp. 51.5, prev 52

- Oct 25, Alphabet/Visa/Microsoft Q3 earnings

- Oct 26, September New Home Sales, exp. 591k, prev. 685k

- META Q3 earnings

- Oct 27, 3Q GDP, exp 2.2%, prev. -0.6%, Apple/Amazon Q3 earnings

According to the NYT, Fed officials spent last week interrogating market participants about the risk of a financial accident. It was hardly reassuring that the authorities have things under control. It also risks creating the opposite effect, sending investors scrambling for cover.

Recall the 1994 decision by Mexican president, Ernesto Zedillo, a Yale-trained economist, to convene the business community to ask them if they thought a devaluation of the peso was advisable. They proceeded to dump their holdings, accelerating the breaking of the dollar peg which marked the Tequila crisis. On the other hand, talks between regulators and bankers were pivotal to the handling of the GFC.

The moves in the bond market continue to cause alarm post-CPI data, with the US ten-year touching 4.26% in overnight Asia trading, fueled by strong jobless claims data (214k vs. 230k exp and 226k prev). It is not impossible that the Fed may have to selectively intervene to buy bonds to maintain financial stability.

UK markets meanwhile, snoozed on the news that Truss would depart No. 10, the shortest tenure in history, which cost the taxpayer $12.4bn in emergency bond purchases transferred to the Bank of England. This marks a reversal from years of the BOE transferring bond gains to the Treasury from QE since 2009 ($120bn).

A bad recipe: Interest rate volatility in tandem with low liquidity

Source: IMF Financial Stability Report

The yen hit a three decade low, whizzing past 150 with the Bank of Japan hoovering up bonds, while the renminbi remains weak despite state banks stepping in. Heat came from US yields rising sharply and expectations for a peak rate in the first half of 2023 reaching 5%. That is 400 bps in 18 months, a “kind of milestone” according to Larry Summers, former US Treasury secretary.

Tesla and Snap results were not received well, the first due to concerns around delivery targets, the second due to weak online ad spend. SNAP has given up all of its pandemic gains, following in the footsteps of META and other tech names. Meta and Alphabet both report next week.

It may be a question of time before the headline indices follow suit, as the Fed wants to engineer a reverse wealth effect. It will take time for that to take hold through housing given that, unlike the UK, most Americans have locked in low rates and debt has not risen much compared to house prices, while debt servicing as a percentage of disposable income is low, as are delinquencies.

The IMF is projecting an 11% decline in house prices in developed economies over the next three years but 24% in fragile emerging countries that are facing exogenous pressures including higher sovereign spreads. Almost a third of EM banks would have less than 4.5% common equity Tier 1 ratios under a stress test scenario.

Frontier markets, as opposed to larger EMs, are under duress as borrowing costs ascend

Source: IMF Financial Stability Report

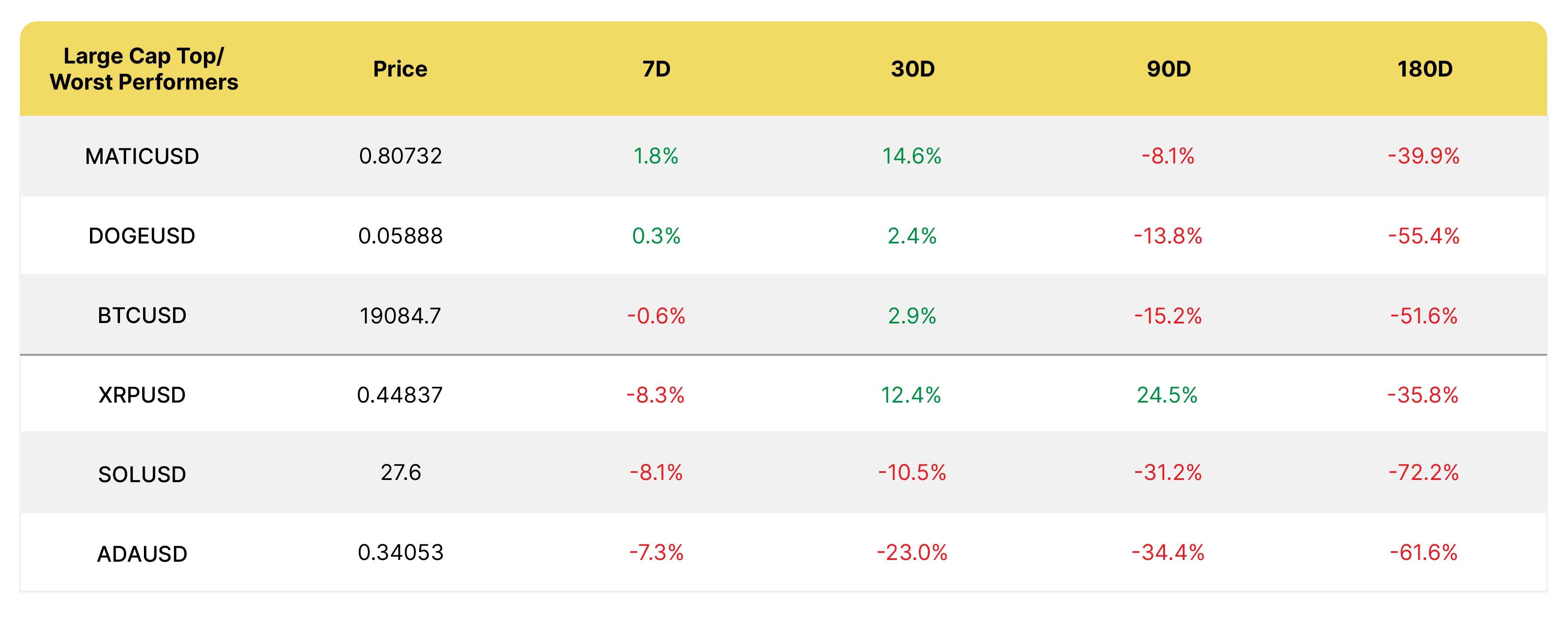

Crypto

*Prices at the time of writing

In a sea of red, Polygon, Aave, Lido and Maker Dao are holding on to weekly gains. Polygon is still benefiting from the release of its zkEVM public testnet, which will let developers test the deployment of privacy-enhancing zk-rollups in their decentralized apps. The rollups will allow for much better scalability on Ethereum, which can only process 15 transactions per second.

The founders of Polygon have said they lean towards ZK over Optimistic rollups as they believe it is more secure given malicious transactions cannot even be submitted to the chain. They require two years of work before being ready for prime time mainstream adoption.

APTOS Launch

Aptos, a Layer 1 blockchain built by former Facebook employees behind the failed Diem stablecoin, finally launched along with its token APT, including a 20 mn airdrop (2% of supply) to early testnet users. It plunged 50% on the first day, which in tradfi would have been deemed a dismal failure.

There were concerns around its tokenomics as these were not revealed until the day before the listing on Binance, FTX and Coinbase. Imagine an IPO debuting without a prospectus. Almost half of the billion token supply is earmarked for investors and the foundation, with a one-year lockup but half can also be staked.

The current market cap is $940mn but in July, Aptos closed a $150 million funding round co-led by FTX Ventures and Jump Crypto valuing it at over $2 bn.

zkSync 2.0 has also confirmed a token a week before it goes live on mainnet. It is a zero knowledge solution for Ethereum built by Matter Labs. Validation of state changes in rollups is done through the computation of a validity proof: if any of the state changes is invalid, a proof cannot be produced and, in turn, this means that the validating entity cannot include invalid state changes. That’s why they are sequencers and not validators: they don’t validate transactions - the Ethereum smart contract does. By relying on pure math, trust or monitoring for fraud is not required.

zkSync 1.0 has been live for payments for almost 2 years, reducing the cost of transfers by 50x, securing close to 4mn transactions. You can see the documentation here: https://docs.zksync.io/zkevm/

Correlations across crypto remain high, with Ripple and Doge doing their own thing over short horizons

DAS BLOCKWORKS LONDON

Despite the market doldrums, DAS attendance beat last year’s and the space devoted to the event was expanded. Overall, the message was that there was a flight to quality and deleveraging but investors remain interested given better entry points. Dry powder remains to be deployed so expect to continue to see innovation. There were diverging views on the place BTC will take within the financial structure but optimsm that macro issues will lead to increased adoption.

Those in DeFi remain steadfast in their mission to build a better, transparent financial tech stack for the benefit of the public, with real world use cases a priority. On the investment side, passive staking, OTC derivatives and zero-knowledge technology will be instrumental for institutional investors. Ease of user experience is also a priority. For VCs, the infrastructure around the financial primitives is compelling.

Some of the highlights:

BTC and the Dollar

Understandably, there was focus on the liquidity squeeze caused by the greenback and tightening by monetary authorities, and the 40 trillion dollars lost in stocks and bonds so far this year, which equates to half of global GDP, according to Michael Dicoletos, of DeFi Advisors. An area of concern is that private markets have yet to reprice, and that won’t happen immediately as is the case with listed markets.

The weaponization of international banking (i.e. Russia’s expulsion from SWIFT) was brought up as a driver for countries to reduce exposure to the dollar, however it is hard to see that happen in the short term as we are witnessing the opposite, an increased bid for US dollars, the currency of choice for trade and financing.

There was consensus that markets were distorted and liquidity is the number one issue. This will hit bitcoin in the short term but ultimately adoption will grow. This will likely be the case, both in vulnerable frontier markets that are at danger of default, as underscored by the IMF, and in developed economies that are also going through major devaluations of their home currencies. There will be another wave of grass roots adoption as people seek alternative ways to protect their wealth. The halving also tends to kick off new cycles.

I am more cautious on the idea that central banks themselves will add BTC to their reserves any time soon, barring pariah states like Russia and there was divergence among the panelists as well. Dr. Adam Back, founder of Blockstream, thinks countries with cheap energy should make use of it to mine bitcoin and we are already seeing this happen in Russia.

There was disagreement on whether BTC can replace the dollar, as the user experience is still not great and you cannot increase liquidity in a time of crisis. But Dr. Back brought up an interesting case whereby the Swiss proposed going back to the gold standard but it was voted down. With generational change, perhaps young people will vote for a Swiss franc backed partially by bitcoin.

Investing in a Crypto winter

Cautious optimism was evident in the room as panelists such as Wave Financial still observe high levels of engagement from traditional financial players, given they view current prices as better value entry points. They have done a lot of educational work and people are feeling more comfortable with the space.

There has been a flight to quality and a return to fundamentals, a healthy development and opportunity to reset, with developers planting the seeds for the next cycle. Investors have become more rational and realized that crypto can be very reflexive both on the way up and also down. Ultimately the time series is short, only 13 years, so we need to give the asset class time to consolidate.

Nikita Fadeev of Fasanara Capital had an interesting take, viewing crypto as an excess liquidity absorber that front runs other assets. “Leveraged beta with negative theta, the longer it lasts the more value it accrues.”

There was also a view expressed by Matteo Dante Perrucio of Wave, that the next cycle may have a heavy regulatory slant, which will either catapult the sector forward or bring real setbacks.

Moreover, the VC’s have a lot of dry powder given the strong capital raises in the first half of the year.

Scalability, interoperability, security, and tokenization are all strengths of blockchain technology and younger generations know it. There has been a brain drain from tradfi, especially among the younger generation.

One of my favorite takeaways was that Nikita was especially excited about NFTs, seeing them as an intersection of crypto, finance, art and gambling, though the subject was not broached much at this year’s event.

Next-gen financial primitives

Panel participants included the founder of Aave, Stani Kulechov, and Michael Anderson from Framework Ventures. They remain excited to be working on creating a new economy with reliability, security and most of all, verifiable transparency.

Aave’s CEO views it as upgrading the financial tech stack and innovating, something which the big institutions are not doing. The benefits of the next generation financial primitives is that they provide smart contract-based execution that is trustless and open, that you can build on and that offers access to global liquidity in all market scenarios, unlike traditional finance. The latter is possible due to automated market makers.

The view was expressed that DeFi survived centralized financial turbulence but perhaps the centralized players need to be regulated as banks. In DeFi, you can build better risk mitigation tools and operate without the need for intermediaries.

Stani summed it up brilliantly, with his idea of DeFi as finance as a public good, with community based software or infrastructure. You can build anything, there are no technical restrictions to building more efficient financial ecosystems. Moreover, some protocols may be experimental but they are built to scale and designed to be governed by the users.

Aave’s founder sees them solving real world problems such as payments and protection against hyperinflation. He believes we will eventually get stablecoins onto the internet for payments and that the bigger benefits will come from building closer to the consumer.

Exchanges, borrowing and lending, and derivatives are the primitives that have been built out and where the opportunities lie, according to Michael. The infrastructure around these are also interesting, such as custodians, institutional connections to bring more liquidity, risk management, and Layer 2s reducing transaction costs, which open new doors to higher frequency products.

In addition to speculation, it was agreed that DeFi can export property rights to a global audience but bridging permissionless innovation with traditional financial transactions still needs to be solved for.

The dominant trend is easing user experience in areas such as custody, wallets, and connections to tradfi. New models for trade execution are one of the most interesting areas, as they don’t require the same level of liquidity that a traditional order book does. We are seeing the brightest minds in math and physics gravitating to this field.

As for big firms, they are looking at passive staking and OTC structured products on defi.

Zero knowledge tech will be essential for big firms to move onchain as it allows you to selectively reveal information necessary for validation while keeping other data confidential

Stani pointed out that permissionless will be the fastest way to test and experiment, but there is also room for permissioned pools and innovation can be exported from permissionless to permissioned.

The challenge of higher yields in conventional markets arose as a topic. There are actors like MakerDao importing liquidity from tradfi. While a global market means cheaper liquidity may ultimately become available, yields need to be real and sustainable. There are also attempts at providing undercollateralized loans in DeFi, which are mainly fixed rate but there will be demand for longer term loans which will be benchmark plus a spread depending on borrower specific risk.

DeFi credit markets

The panelists are active in different areas of the credit market, with Maple providing $1.8 bn in loans on the blockchain, Credora making credit more transparent while preserving sensitive data and monitoring risk in real time and Voltz, offering interest rate swaps, a huge market in tradfi that provides stability in volatile markets.

It is nascent, but the advantages of DeFi credit are clear: it is non-custodial in nature, the assets sit in smart contracts and credit managers approve loans. Transparency means you can always see the counterparties and if overcollateralized, you can see the pool.

Lending rates are anti-correlated to tradfi rates. Defi rates are coming down and the cost of borrowing has come down, too. Perhaps people will eventually go into defi to borrow at lower fixed rates than in tradfi was one bold prediction.

Corporate spreads in DeFi have compressed: 9%-11% borrow for market makers vs 4-5% Treasuries, but traders aren’t able to bear high interest rates. So short term, lenders are getting a touch underpaid vs risk such as hacks whereas longer term you can get 18-20% yields, 15% net of fees, so lenders are getting paid reasonably well.

These distortions are due to limited liquidity in DeFi, but we should see more correlation as liquidity improves and the borrowers become more diverse. For example, lending to fintechs who don’t rely on market trading for returns

Thankfully, today there is more emphasis on due diligence and risk-adjusted returns than before the crash. In future, we will see more collaboration between CeFi and DeFi. CeFi will use DeFi for transparency and that will be a good thing.

Until next week!

The Bequant Team

Martha Reyes

Emiliano Bruno

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high-risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group.

Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group