Nowhere to Run

Summary:

As a song by my fellow namesake says, sometimes it seems like there’s “nowhere to run to, nowhere to hide” with macro indicators and the bond market still signalling a strong deceleration, despite the Fed Chairman's upbeat tone this week. Add geopolitics into the mix, and it’s not a supportive backdrop for digital assets, which are caught in the political crosshairs. Crypto is a convenient punching bag and a distraction from other issues, whether that is Senator Warren’s anti-Russia bill or EU parliament members who sought to ban interaction with proof of work coins. As the economy decelerates and the energy crunch lingers, those voices may get louder but are unlikely to prevail.

Look to Korea, where adoption to crypto is already high, and you can see a pivot towards a more friendly policy. In the background, steady institutional accumulation continues as evidenced by outflows from Coinbase. Exciting things are also happening in NFTs, from the friendly takeover of CryptoPunks and APE coin listing to the former Disney CEO investing in a make-your-own-avatar platform.Macro

IS POWELL GASLIGHTING US?

The 25 bps hike in the overnight Fed funds rate midweek could not have been less of a surprise, still, the equity market rallied as Chairman Powell enthused about the strength of the economy. What else could he have done?

His key points 1. GDP 2.8% '22 is still very strong (never mind their GDP revision down from 4%) 2. Inflation will peak with a three-month delay due to Ukraine 3. The Fed will hike 50 bps if inflation doesn't fall in Q3 '22 4. No elevated risk of recession (ignoring the flattening of the yield curve).

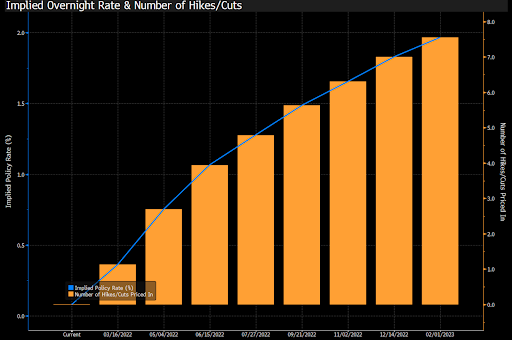

Seven rate hikes are once again the consensus and the Fed’s most recent forward guidance, as Powell highlighted the “very, very tight” labor market. Jarring with Powell’s optimism, the spread between the 10 yr and 2 yr bonds compressed from 30 to 26 bps on the day, levels similar to March 2020. In Europe, markets are pricing in 0% rates this year, moving into positive territory in 2023, while the Bank of England raised rates a third consecutive time to 75 bps.

Lucky Number: Seven rate hikes priced in again

Source: Bloomberg

In the past, we’ve referenced the VIX as a gauge of fear in the equity market, but equally important is the MOVE (U.S. Bond Market Option Volatility Estimate) index which measures sentiment in the fixed income market. At one point it was very close to the levels seen in March of 2020, though still well below the +200 level of the Great Financial Crisis.

On the Move: The MOVE index remains above 100, above the long term average of 70

ZERO COVID

What once looked like a compelling investment case at the beginning of an easing cycle, turned ugly on renewed crackdowns, concerns about Chinese ADR delistings from US markets and this week, a new Omicron wave. The sell-off in Chinese mainland and Hong Kong shares accelerated after news of an Omicron-related shutdown meaning tens of millions of people are confined to their homes in five cities, including major manufacturing hubs.

In a rare instance of negativity, JP Morgan double downgraded several of the internet names, such as retailer J.D.com, calling them uninvestable. This prompted pledges of “substantial measures” for markets and the real estate sector from senior government officials which led to a rebound midweek.

Global fund managers were heavily positioned in commodities last week, but oil did a round trip below $100 as hedge funds cashed out

DEFAULT AVERTED

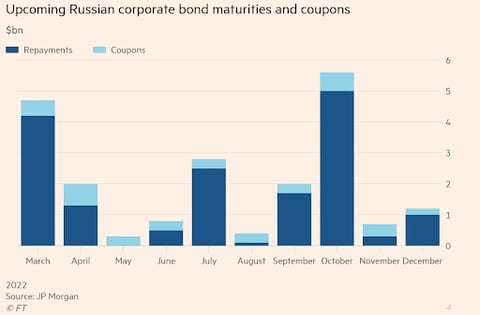

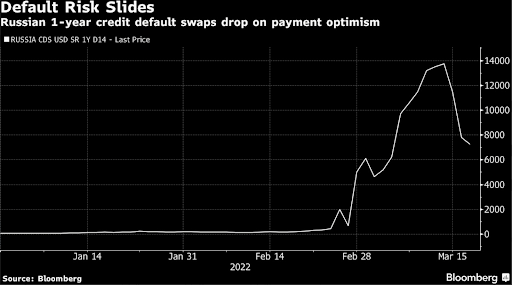

Russian default risk fell as Russia said on Thursday it paid $117mn in interest payments due on its dollar-denominated bonds to Citigroup, The nation has $38.5bn of foreign debt. On Monday, Gazprom had surprised the market by making a $1.3 bn payment in USD instead of in rubles, which the government had been threatening to do. Oil company Rosneft was next, making a $2bn repayment on Thursday. Had they paid in roubles, Fitch would have considered a default (something which Russia did do in 1998). Russian companies have $98bn of foreign currency bonds outstanding, down from $169bn in 2013 as the country has become less reliant on external capital.

Half of Russian foreign debt comes due within three years

There was a relief rally in Russian bonds and CDSs as payments came through

Crypto

DEFI’S WEEK

As of Friday, digital assets were up 5% for the week, with the S&P up 1% to Thursday, The Defi segment outperformed (+9.75%), with Aave (32%) and Thor Chain (+39%) as highlights but Apecoin (+1400%) with its DAO token listing took first prize by far.

Avalanche’s AVAX rise came after Terra’s UST stablecoins were deployed on the Avalanche network. Users can now deposit, borrow, and earn yields on UST deposits using Avalanche. Ethereum (+9.4%), had a successful merge on the Kiln testnet, a fundamental step toward the transition to proof of stake.

Thorchain's RUNE jumped after its synthetic asset trading launch, which allows for faster and cheaper transactions. Thorchain is built on the Cosmos blockchain and is a decentralized liquidity protocol that specializes in cross-chain connectivity, allowing traders to swap tokens between different networks. They will also be introducing lending and borrowing.

ON-CHAIN: SIGNS OF PERSISTENT INSTITUTIONAL DEMAND BUT SHORT TERM HOLDERS ARE IN THE RED

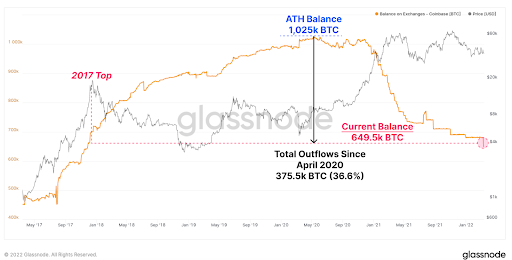

Coinbase in particular has seen large net outflows this week, of 31,130 BTC ($1.18B). This is the largest net outflow since 28-July-2017. So the total balance held on Coinbase to 649.5k BTC, bringing it back to levels last seen at the 2017 bull market (-37%). It is particularly relevant given its popularity with American institutions.

If we look at the Illiquid Supply Shock Ratio (ISSR), there was a jump this week, suggesting that these withdrawn coins have been moved into a wallet with little-to-no history of spending.

This metric will trend higher as more coins move into such wallets. The ISSR is currently at 3.2, which means that the amount of supply held in Illiquid wallets is 3.2x larger than Liquid and Highly Liquid supply.

Bitcoin Balance on Exchange took a step down this week and has been on a downtrend since 2020

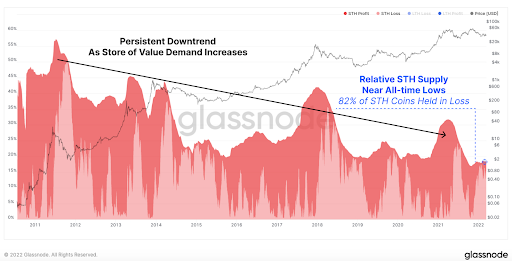

STH supply is currently near all-time-lows however, 82% of these coins (2.51M BTC) are currently held at a loss, and could have weak hands.

BTC Short term Holder (less than 155 days) Supply in Profit/Loss, most held at a loss

THE GRAYSCALE DISCOUNT: AN EXERCISE IN PATIENCE

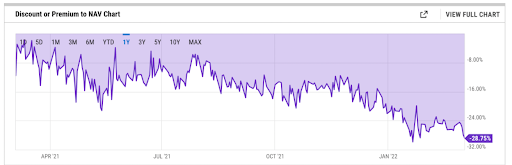

Morgan Stanley filings show that the bank held more than 13 million shares of Grayscale Investments’ Bitcoin Trust (GBTC) across 17 funds at the end of 2021, at a value of US$458 mn, around 1% of the fund assets.

Some of the funds increased their positions, however, the Greyscale discount has only widened into 2022 to almost 30%. The $10.7 billion Morgan Stanley Growth Portfolio held about 4.3 million shares of GBTC at the end of 2021, the most of any of the funds, almost 20% more than it held in Q3. This comes as Grayscale launched a campaign to encourage public comments on its Bitcoin ETF application.

The Grayscale discount to NAV is wider than ever as alternatives grow, but some bet on a positive outcome

CONSENSYS FUNDING SHOWS INTEREST IN WEB3

ConsenSys, the Ethereum technology solutions company behind Metamask closed a $450 million funding round that values the firm at $7 billion. The Series D round, led by ParaFi Capital, more than doubles ConsenSys’ valuation based on its previous $200 million fundraise in November 2021. Microsoft is also an investor as it seeks a foothold in Web3. The firm’s Ethereum wallet and browser extension, MetaMask, just hit over 30 million monthly active users.

Co-founder Joe Lubin confirmed rumors of a token in future, with the aim to decentralize gradually via a DAO.

BEATING A DEAD HORSE?

Some ex-Meta employees are trying to keep the Diem blockchain flame alive, a network that they say will serve billions and is designed to cater to large corporate customers. One project, called Aptos, has already secured funding from Andreessen Horowitz and other top web3 investors. The valuation was not disclosed but is at unicorn level, according to the project.

Regulation

WARREN’S ANTY-CRYPTO CAMPAIGN

Senator Warren, famous for her crusade against the banks, introduced a bill titled the Digital Asset Sanctions Compliance Enhancement Act, which would place wide restrictions on crypto with the pretext of strengthening sanctions against Russia. The bill establishes a broad definition for "digital asset transaction facilitators" -- which could include anyone from nodes to miners to developers, which is similar to the Infrastructure bill. This contradicts various officials from the White House, Treasury, and the Department of Justice rejecting that cryptocurrency is a tool for sanctions evasion.

The bill, if passed, would allow the Treasury Secretary to ban operators from having any business interaction with anyone or any address that might be Russian. However, there is no consensus on the left when it comes to digital currencies and it would be difficult to monitor.

"No one can argue that Russia can evade all sanctions by moving all its assets into crypto," Warren said during a Senate Banking Committee hearing where she combatively questioned the co-founder of Chainalysis.

EUROPEAN BITCOIN BAN STAVED OFF

A proposed rule that could have banned bitcoin across the European Union because of its energy-intensive proof of work was rejected this week from the Markets in Crypto Assets (MICA) framework. It was a tight vote, as the European Parliament’s economic and monetary affairs committee voted 30-23 against it. BTC rallied 2% on the day.

NEW KOREAN CRYPTO-FRIENDLY PRESIDENT WANTS TO DEREGULATE

Korea is an important country to monitor as it is one of the larger digital assets markets and politicians have pivoted in their approach. Conservative South Korean President-elect Yoon Suk-yeol, popular with young males, has promised to deregulate the crypto industry and introduce favorable tax laws.

Suk-Yeol wants to raise the capital gains threshold from $2k to $40k, which would be one of the more generous levels globally, and review the Initial Coin Offering (ICO) ban. Last year, South Korea banned about half of the country’s exchanges and does not allow cross-trading between platforms.

EXCHANGES PUSH INTO THE MIDDLE EAST, THE WORLD’S 4TH TOP WEALTH HUB

Both FTX Europe and Binance received licenses to operate in Dubai this week. It was only a matter of time given Dubai’s position as a high net worth hub in the Middle East & Africa region and estimates that the region’s HNWI will grow by 25% over the next five years.

FTX Europe, the new European unit of FTX, became the first firm to receive a license to operate a crypto exchange in Dubai. This will allow them to offer derivatives to institutional investors and comes right after Dubai announced the creation of a new industry regulator, the Virtual Asset Regulatory Authority (VARA).

Binance also received a license this week, as had been expected given their partnership with VARA.The license will allow the exchange to operate within Dubai’s “test-adapt-scale” model and serve pre-qualified investors and professional financial service providers.

In Bahrain, Binance was also awarded a full license that allows it to operate in the country, providing services including crypto trading, custody, and portfolio management services to local customers. The small nation is attractive because it recognizes crypto as an official means of payment, making interaction with banks easier.

DeFi / NFTs / Metaverse

BUILDING AN NFT EMPIRE

Yuga Labs, the company behind the Bored Ape Yacht Club NFT collection, has acquired 423 CryptoPunks and 1711 Meebits from the developer Larva Labs.This includes brands, copyright and other IP rights and comes after criticism that the Cryptopunk brand was being underutilized. Yuga Labs also says it plans to grant the commercial rights to all CryptoPunk and Meebit images to their respective owners.

Yuga Labs, which receives a 2.5% royalty on each Bored Ape sale, now owns five of the top 20 collections and has a successful model based on the concepts of exclusivity and community but also looking to maximize the brand through commercial activity such as gaming, films or music partnerships so they are replicating that model with other well-known NFTs to build out an ecosystem with scale.

A DAO collective then released a token called ApeCoin (APE), 15% of which was airdropped to BAYC and MAYC holders and listed on major exchanges on Thursday. 62% of the 1 bn tokens will be allocated to the community over time, with holders having a say in governance. It started trading at $1 on Thursday and was at $15 on Friday, trading north of $9bn in 24 hours and a substantial $1.9 bn market cap. With a separate DAO listing the coin, supported by Yuga, issues with the SEC are skirted.

FORMER DISNEY CEO BETS ON THE METAVERSE

Robert Iger was head of Disney for decades and now he is backing a startup that allows users to create avatars for the metaverse. Mr. Iger is now an investor and board member at L.A. firm Genies. “I was particularly interested in companies that were using technology for disruptive purposes and, where possible, the intersection between technology and creativity,” he said to the WSJ.

Genies has raised $100 million in funding and offers tools for making virtual characters, clothing and accessories backed by nonfungible tokens and operates an NFT marketplace, with partnerships with Universal Music Group and Warner Music Group.

SILICON VC’S OPTIMISTIC ON OPTIMISM

Optimism, the Layer 2 Ethereum scaling solution based on Optimistic rollups, closed a $150 mn Series B round led by Silicon Valley’s Andreessen Horowitz and Paradigm for a unicorn valuation of $1.65bn.

|

Rollups are one of the most promising categories of Layer 2 solutions. These solutions move transaction computations off-chain, but store transaction data to the Ethereum chain, which means that rollups are secured by Layer 1. |

Until next week!

Disclaimer: The views expressed in this newsletter are my own and not intended as financial advice or a recommendation, but only for informational purposes. You should carry out your own independent research or consult a financial adviser if you are unsure. Please also be advised that I hold investments in some of the assets mentioned in this report, including digital assets, equities and ETFs.