Pinching the pennies

Summary:

It was not the week to jump in front of the Fed steamroller, with the market now seeing a 50 bps hike in May and 75 bps in June. The rotation into defensive areas is notable as the risk of companies disappointing combined with high multiples can lead to steep drops, as we’ve witnessed with Netflix. Will consumers’ lower propensity to spend filter into crypto? For Bitcoin, a large short-term holders cohort in the $38-50k range is a point of interest as a print below 38k could push weak hands to sell. Virtual goods and the metaverse may hold up relatively well, given low penetration and the defensive nature of luxury items, and that’s what Lego, Epic Games and Coinbase bet on this week. Hacks continue to be an issue in DeFi, while a class action lawsuit against leading decentralized exchange, Uniswap, could prove to be an important precedent.

MACRO

FLIGHT TO SAFETY

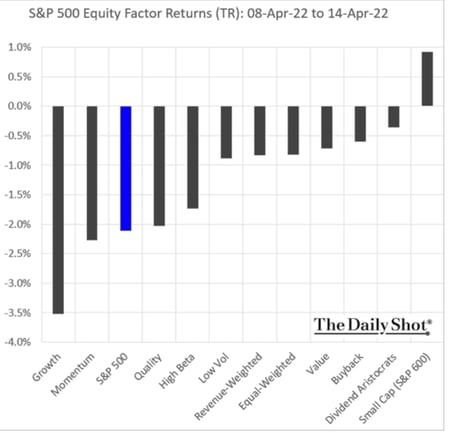

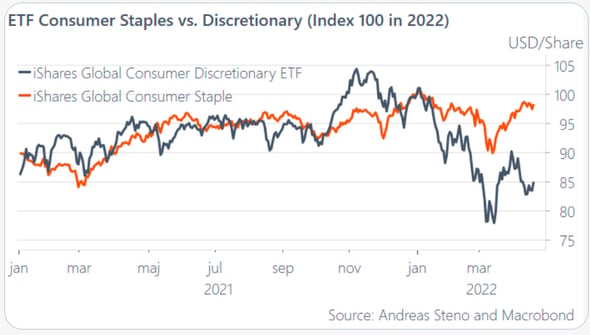

With the S&P down 8% from its high it is worth taking a look at the whiplash rotation out of discretionary into defensive names as investors turn more cautious on the economic outlook. The S&P has fared better than the Nasdaq (-18% from the peak) given it includes more resilient sectors like utilities and healthcare. This week, as the Fed continued to drive rate expectations up, the rotation persisted with growth dramatically underperforming as markets expect cuts to earnings expectations of 10% in 2022. So far, with 20% of the S&P reporting, EPS is at -2% with tougher comps next quarter.

Growth stocks continue to take a beating

NETFLIX: THE HORROR SERIES

The horror show of the week was Netflix’s streaming memberships coming in well below analyst predictions. The company reported 221.6 million streaming memberships, below an anticipated 224.5 million, citing high household penetration and the one-off Covid boost. The message comes through loud and clear, beware of expensive discretionary shares as people cut back on unnecessary spending and stick with companies that sell products that people need.

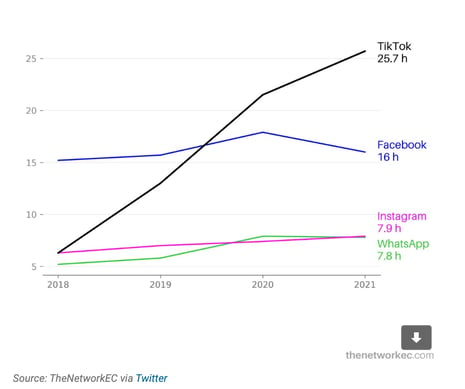

This is the first time Netflix has seen a loss of subscribers in over a decade, with management guided for a 2mn sub loss in Q2. The stock cratered 35% with $54bn in market cap loss and hedge fund manager Bill Ackman taking a $400 mn loss on his $1.1.bn investment. The reality is that content generation has been wanting and competition is heating up with Tik Tok, Apple, Disney, Amazon and HBO Max, coupled with a more cautious consumer. Netflix intends to respond with lower-priced ad supported subscriptions, which could pay off, though the market won’t give them the benefit of the doubt for now.

TikTok use has exploded (average monthly hours per user)

Under the hood: Defensive consumer staples have been clear outperformers this year

TWITTER: TAKING OVER THE WORLD’S “TOWN SQUARE”

Centralization versus decentralization is an ongoing theme in digital assets and this week it also extended to TradFi with the Twitter-Tesla saga. Elon Musk has now unveiled a $46.5bn financing package to fund his takeover bid for Twitter at $54.20 per share, which would be one of the largest leveraged buyouts (LBOs) in history. His vision is to fix the issues of content moderation and open source the algorithm but it could become a contradiction of sorts if the company is controlled by one individual.

The financing announcement came despite the social media giant introducing a poison pill to make it difficult for him to take it over. Musk, who now has 9% of Twitter, has lined up $25.5bn in debt, including a margin loan of $12.5bn against his shares in Tesla. He would provide $21bn of equity out of his own pocket. That is a lot of money for an edit button!

Under the new structure, if any person or group acquires ownership of at least 15% of Twitter’s outstanding common stock without the board’s approval, other shareholders will be allowed to purchase additional shares at a discount. This dilutes the stake of the acquirer. Poison pills were introduced in the eighties, when hostile takeovers were a common occurrence.

Crypto

It was a week of flattish performance for digital assets (-0.96%) with no momentum in either direction. Bitcoin has been in a $35-42k range with high demand in that area. Luna continued to power ahead (+16%), with Tron (+9.7%), Pancake Swap (+14%) and Monero (+13%) also up as of Friday morning. Founder Justin Sun announced the launch of an algorithmic stablecoin on the Tron blockchain, USDD, backed by $10bn in crypto collateral, based on the popular Terra model.

In the smaller cap space, 0x (ZRX) the native token behind the Ox protocol rallied 22% on news that it will partner with Coinbase NFT to provide multichain NFT swap support and enable instant royalties for creators and free listings.

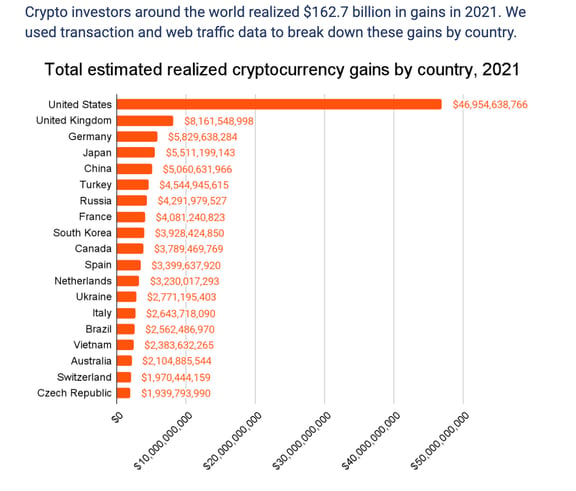

Source: Chainalysis

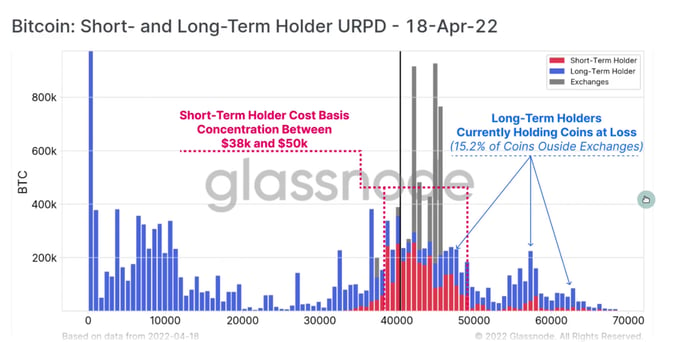

Bitcoin has a large short-term holders cohort in the $38-50k range, with 30% of total supply in a loss, so a print below 38k would warrant caution

TETHER TO IMPROVE TRANSPARENCY AS IT LOSES DOMINANCE

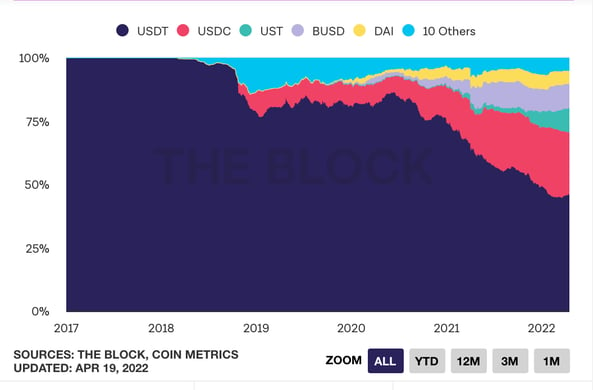

Tether, the largest stablecoin by market cap at $83 bn, is planning to reduce its holdings of commercial debt in its reserves further. Last May, as part of an agreement with the NY state attorney general, Tether revealed that it had almost 50% of its reserves in commercial paper, short-term corporate debt, though at the time it did not report the companies or their ratings. This caused unease and the U.S. Commodity Futures Trading Commission (CFTC) fined Tether $41 million for “making untrue or misleading statements” that its USDT token was backed 100% by corresponding fiat currencies.

Since then, the firm has been changing its reserve composition even as its loss of market share accelerated last year, with USDC and UST, the Luna-backed algorithmic stablecoin, taking a piece of the pie. In the fourth quarter of 2021 in its attestation report, commercial paper made up just over 30% of Tether’s total reserves, down from over 44% in the third quarter.

Tether’s loss of share picked up momentum last year as concerns around its reserves grew, although stablecoin market cap continues to rise

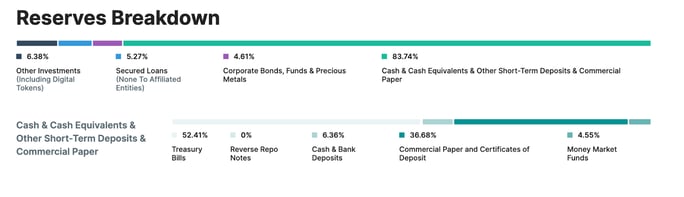

Source: Tether, a/o Dec 21 2021, MHA Cayman attestation report

CRYPTO TAX TEMPORARILY CURTAILS INDIAN TRADING VOLUMES

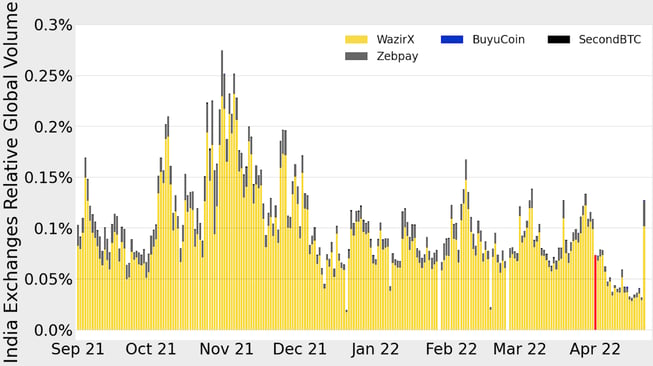

Crypto trading volumes of India’s major exchanges temporarily plummeted as of April 1, the day a new tax on crypto profits came into effect but have since recovered as a percentage of global volumes (though still down in absolute terms with the overall market).

India now has a 30% tax on profits from crypto transactions and doesn't allow offsetting gains with losses from other crypto transactions. In addition, a 1% tax deducted at source takes effect on July 1 and will hit market makers and liquidity providers.

Crypto volumes on the top centralized exchanges in India saw a temporary dip as a percentage of global volumes, post-tax measures

DESPITE HEFTY TAXES, INVESTMENT CONTINUES TO POUR INTO INDIA

It seems India is too big a market to stay away from, with its young demographics and elevated crypto adoption, with Chainalysis ranking them at number 2 globally, especially as we now know the government won’t seek to ban exchanges.

Despite their user growth being hit by the recent tax changes, leading exchange CoinDCX doubled its valuation to $2.15 billion following a $135 million funding round. The Indian exchange, the first on the subcontinent to achieve unicorn status, looks to expand its product offerings and staff. They now have over 10 million users.

ROBINHOOD BUYS A UK REGULATED CRYPTO EXCHANGE

Robinhood has agreed to buy UK crypto company Ziglu for an undisclosed sum, as the retail trading app looks to expand outside of the US and equities. Ziglu was founded in 2014 by entrepreneur Mark Hipperson who helped establish UK digital lender Starling Bank and was an attractive target as it is one of only 33 crypto firms that has received FCA approval.

Ziglu was valued at £85mn last November when it raised £7mn, and grew its customer base fourfold last year as investor enthusiasm for crypto exploded. The acquisition by Robinhood comes as the pandemic-fuelled retail trading boom is cooling and Robinhood shares have plummeted. However, a recent survey by eToro showed that retail investors continue to gradually grow their exposure to digital assets, and it is now the second most owned asset class apart from domestic equities, with a clear skew towards younger people.

BLOCKCHAIN.COM MAY IPO THIS YEAR

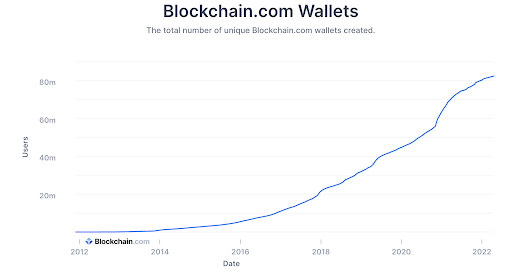

Startup Blockchain.com, founded in 2011 and valued at $14bn in March, is said to be interviewing banks for an initial public offering that could take place as soon as this year. The company allows users to buy and custody digital assets and has just launched an asset management arm in partnership with Altis Partners.

Binance US is another platform with listing aspirations in two to three years. FTX US was recently valued at $8bn and FTX at $32bn in funding rounds, while competitor Coinbase was valued at $86bn at the time of listing last year, though it is down 60% since then.

Blockchain offers more resources and tools than Coinbase, is easy to use, and only facilitates crypto transactions.

Regulation

UNISWAP ACCUSED OF “RAMPANT FRAUD” AND SHOULD BE REGISTERED

In a development that is being followed closely by the industry, a class action lawsuit was filed in the U.S. against the Uniswap protocol. The lawsuit alleges that one of the largest crypto exchanges, with over 50% of DEX volumes, “permits the unlawful promotion, offer, and sale of crypto tokens as unregistered securities.” It claims that the exchange has no barriers to entry for users looking to trade or swap crypto tokens on the exchange. It requires no verification of identity and conducts no “know-your-customer”. This has allegedly led to enrichment of the protocol and its VC backers via transaction fees.

The lawsuit states that the exchange and the tokens it facilitates trading in should be registered. The action came soon after the U.S. Securities and Exchange Commission (SEC) proposed amendments to the Securities Exchange Act that would significantly broaden the definition of an “exchange” in order to address a “regulatory gap”.

The rule would cover platforms for all kinds of asset classes that bring together buyers and sellers, including communication protocol systems. Though the regulation never mentions blockchain, tokens or crypto specifically and is meant to cover bond trading, there is still concern that it may be used to regulate DeFi.

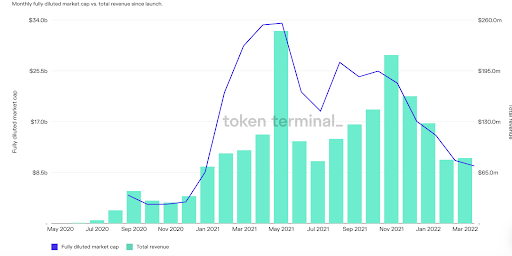

Uniswap revenues are 65% below their May 2021 peak, investors include Paradigm and a16z

DeFi / NFTs / Metaverse

COINBASE NFT: IF INSTAGRAM AND OPENSEA HAD A BABY

American crypto exchange Coinbase, with its huge 89 million user base, finally revealed the beta version of its NFT marketplace to a small number of people. Coinbase NFT allows users to buy and sell NFTs on the Ethereum blockchain for now but will eventually allow other blockchains as well as minting. The spin is that the platform bases its model on social media algorithmic feeds with the ability to follow, comment and interact with one another.

Differently from Meta’s much criticized 47.5% take on metaverse goods, it is not charging any fees for now, but they will be high single digits, much higher than OpenSea and other crypto native platforms. The exchange does not yet offer the option to pay with a Coinbase account or credit card (though they have partnered with Mastercard). So far, the proposition does not seem attractive enough to entice OpenSea users away.

LEGO + EPIC GAMES: AN ONLINE PLAYGROUND

Fortnite-maker Epic Games announced last week that it has raised $2 billion in funding from Sony and Kirkbi, the parent company of the Lego Group, with both investing $1 billion each. This latest funding round gives Epic a post-money valuation of $31.5 billion, and the proceeds will go toward building a kid-friendly metaverse and continued growth. Epic is partnering with Lego to build out this metaverse, a sort of online playground, according to Epic’s CEO, Tim Sweeney. Lego already has several mobile and gaming apps and has been investing more heavily in consumer experiences that blend digital and physical play.

The Danish toy group, a family-owned entity, has plenty of cash to splash. 2021 was a great year financially, with revenue up 27% in FY2021 and operating profit up 32% to almost $2bn USD, with $1.9 bn in free cash flow.

METAVERSE PLAY THE SANDBOX COULD BE GETTING NEW CAPITAL

Bloomberg broke the story last week that gaming company The Sandbox is reportedly raising $400 million at a $4 billion valuation from both new and existing investors. So far there has been no comment from the company, but if true, adds to the recent wave of capital being deployed to building out the metaverse.

STATE SPONSORED CYBERCRIME BEHIND AXIE HACK

The FBI has pinpointed North Korea as the culprit behind last month’s $625 million hack on the Ethereum-linked sidechain Ronin Network. The network hosts play-to-earn game, Axie Infinity, which had already been struggling with inflation of its Smooth Love Potion (SLP) tokens and saw trading volumes collapse.

Hacker collectives Lazarus Group and APT38, who are behind several thefts, are responsible, using hacked private keys to forge withdrawals on March 23. The breach wasn’t discovered until days later, when a user was unable to withdraw 5,000 ETH and is one of the largest ever with the wallet now sanctioned by authorities. North Korea does not just hack digital assets, however, as over the years they have infiltrated everything from Sony Pictures to the SWIFT payment system and Japanese ATMs.

Victims will be reimbursed with Sky Mavis funds, the company that created Axie Infinity. In addition, Sky Mavis has raised $150 million, including Binance and Animoca Brands funds as they seek to support the ecosystem.

Axie Infinity (AXS)peaked with the rest of the market in November but GameFi has underperformed the ecosystem in 2022, down 49% YTD

Source: Messari, Kaiko

ANOTHER DEFI HACK: FALLING DOWN THE BEANSTALK

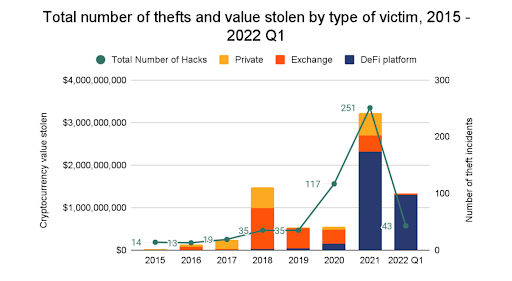

Beanstalk Farms, an Ethereum-based stablecoin protocol, was exploited for $182 million Sunday. The attacker ingeniously used a flash loan to take control of the project and award themselves at $182 million in crypto, although the losses suffered by the protocol were much larger as the market for Beanstalk’s BEAN stablecoin collapsed by 94%. The attack once again highlights the security weaknesses inherent to relative centralization.

Most hacks are in DeFi, with a TVL of $217 bn, up from $18 bn in 2020, and we are well above 2021 run rates so far this year

Source: Chainalysis

ANDRE CRONJE: WE ARE NEVER EVER GETTING BACK TOGETHER

It didn’t take long before Andre Cronje, famous for creating Yearn.Finance resurfaced after quitting the Fantom protocol just last month and causing associated tokens to plummet in value. Then again, he has a history of quitting but not being able to stay away. For now, however, he has posted a blog entitled “The Rise and Fall of Crypto Culture '' where he bemoans crypto culture strangling the ethos of crypto. What will be his next project???

|

“I now more than ever see the need, or even necessity for regulation, not as a mechanism to prevent, but as a mechanism to protect…. we will see the rise of a new blockchain economy, not one driven by greed, but instead driven by trust, not trustlessness.” |

https://andrecronje.medium.com/the-rise-and-fall-of-crypto-culture-3d0e6fd3e0e9

Until next week!

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice nor any other sort of advice. None of the information on this document constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group. Any transaction is subject to contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group does not make any representation or warranty or gives any undertaking as to the accuracy, timeliness or completeness of any such information and assumes no liability for losses arising from the use thereof. This document may not be reproduced in whole or part, without the written permission of the BEQUANT Group.