The Case of the Shrinking Balance Sheet

Summary:

A tumultuous week comes to a close after some wild intraday gyration on high volumes, warranting caution as we wait to see who blinks first. A spike in short term yields led to a big move up in the dollar and increased hedging. Earnings season is in full swing but the bond market is looking out further afield, pricing in five rate hikes and a “substantial shrinkage” of the balance sheet.

Digital assets are only slightly down for the week, though off by 22% YTD as of close of Friday.

Over the last 30 days, correlation between coins has spiked to very high levels given macro uncertainty but we also look at longer time periods and find different behavior. Once the dust settles, there are opportunities in coin selection. Investment continues to be the standout, with FTX US, Fireblocks and Ripple all achieving substantial valuations and Mercado Libre, the eBay of Latin America, investing in crypto exchange Mercado Libre. A powerful combination.

Macro

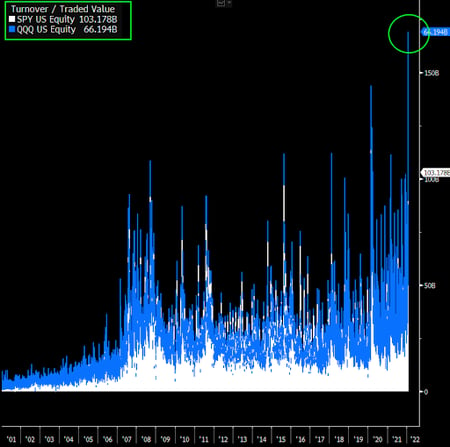

In the face of the Fed meeting and, to a lesser extent, renewed geopolitical tensions in the Ukraine, volatility and volume jumped, particularly in the US markets. This is not a positive development and warrants caution. To start the week, the S&P saw very high volumes, trading over $100 bn for only the second time ever. The Nasdaq also beat records, at $70 bn on Monday. Gold meanwhile had the highest inflow on record last Friday, January 21.

In addition to leaving the magnitude of the rate hike in March open-ended, Fed chairman Powell would not be pinned down on the pace of future hikes and quantitative tightening, specifically saying the balance sheet requires substantial shrinkage. Analysts expect $1.5 trillion in balance sheet shrinkage by the end of 2023, meaning banks and the private sector will have to reduce reserves and zero risk deposits and increase exposure to credit.

Turnover on U.S. exchanges spiked this week

Source: Bloomberg

Gold, had its biggest one-day inflow ever on Friday, January 21, at $1.6b

Source: Bloomberg

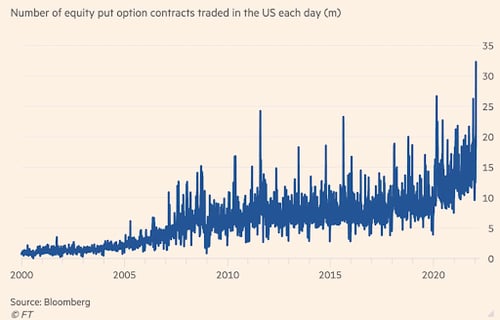

Investors got busy putting on hedges ahead of the Fed decision this week.

+90% odds of five 25 bps hikes post FOMC

The yield curve continues to flatten, an inverted yield curve (where short term rates are higher than long term) is a harbinger of recession.

STRONG 4Q GDP BUT DRIVEN BY INVENTORY REBUILD

The US economy expanded by 6.9% YoY in the final quarter of 2021 as the market recovers from the effects of COVID. For the calendar year of 2021, the economic expansion was 5.7%, the largest rise since 1984. The market initially rallied on the news. However, the growth was largely driven by inventory rebuilding, coming from very low stock levels in the summer due to supply bottlenecks and labor shortages.

STILL TIGHT LABOR MARKET

The US Labor Department released better-than-expected jobless figures on Thursday, posting 260,000 vs. 265,000 expected and upwardly revised to 290,000 the prior week’s data. These results bucked the trend of a third straight increase for initial jobless claims.

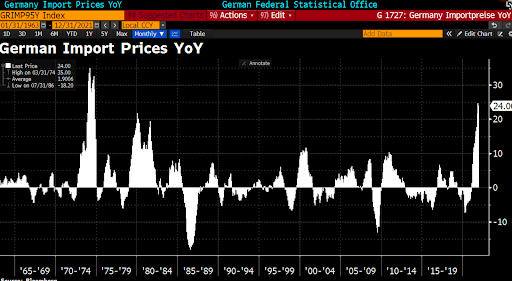

DECELERATING INFLATION IN GERMANY

In Europe, Germany is finally seeing some easing of inflationary pressures, as import prices came in below expectations, +24% vs. the 26.4% expected and down from 24.7% in November.

APPLE Q4 SURPRISES TO THE UPSIDE

The phone maker posted record quarterly results Thursday as bottlenecks ease, Tim Cook, the CEO guided for less challenges come Q2 and the stock rose over 4% as EPS came in at $2.10 vs. 1.90 expected, on a revenue of $123.9 bn. Amazon, Alphabet and Meta all report next week.

Crypto

TIED AT THE HIP FOR NOW

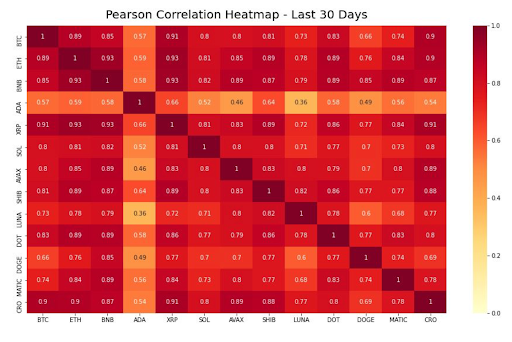

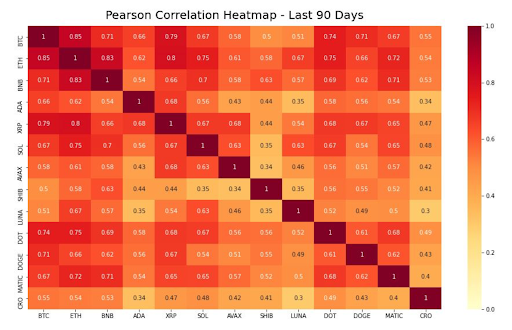

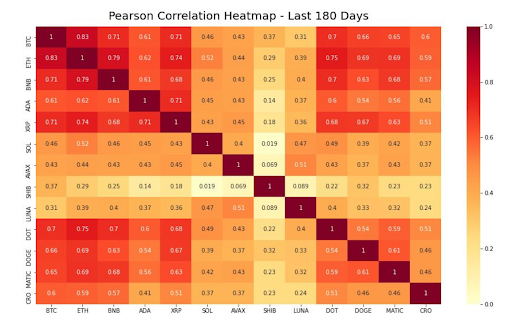

This week, in light of the spiking short term correlation between crypto and traditional markets, we looked at correlations amongst the top traded coins, finding a similar pattern. As volatility rises, correlations rise in the short term as you can see over the 30 day period versus longer horizons as coefficients skyrocket to +.80 and +.90 levels. Over longer time periods, there is a lesser effect, though it is still very high between BTC, ETH, BNB, ADA and XRP. However, the correlation between SHIB and DeFi tokens such as SOL, AVAX, and LUNA is insignificant, given the different investor profile. This shows that coin selection can be key to performance in a less risk on environment.

Poor sentiment has driven correlations between the top digital assets to very high levels

However, outside of the main coins, high correlations do not hold up over longer periods

Retail-led coins like SHIB show weak correlation to DeFi tokens

BEQUANT STRENGTHENS PARTNERSHIP WITH XINFIN

XinFin, the enterprise-ready, open-source, hybrid blockchain protocol specializing in tokenization for real-world decentralized finance, has strengthened its partnership with BEQUANT this week. We have launched a campaign promoting the XDC token to the Bequant and XinFin communities; firstly to our institutional clients on BEQUANT Pro and secondly to our retail clients on BEQUANT Exchange. We’ve had an amazing response and welcome the XinFin community to ours!

BLACKROCK TO LAUNCH CRYPTO LINKED ETF

In a sign of just how accepted crypto is becoming, BlackRock, the American investment behemoth that manages US$10 trillion, plans to launch a blockchain ETF that would invest in companies that are related to the development and use of digital assets. There are already several out there in the US market, but others could follow suit. Charles Schwab also offers four mutual funds and four ETFs connected to crypto.

IMF VERSUS EL SALVADOR

El Salvador came under attack by the IMF again this week as its board recommended the country stop using Bitcoin as currency. So far, the country has accumulated 1,500 BTC, recently buying another 410 coins.

However, Bitcoin is the least of this highly indebted nation’s problems. Fitch estimates a $1bn financing gap for 2022 and rising rates in the US won’t help. Thus, El Salvador is still trying to negotiate a $1.3bn loan from the multilateral agency and plans to launch a $1 bn bitcoin bond this year. The idea would be half of the proceeds would be invested in bitcoin yielding 6.5%, much lower than government bond yield of 17%.

In an innovative move, President Bukele also plans to offer SMEs $10 mn in crypto-backed loans. The partnership with Solana-based platform Acumen means loans will mostly have an annual rate of 6%-7% as opposed to the 2,300% average rate paid by informal businesses.

TESLA HODLs ITS BITCOIN POSITION

Tesla’s latest financial statement shows it did not sell any Bitcoin in the fourth quarter of 2021. The report shows the electric car company holds $1.26bn, a position that did not change from Q3 to Q4. Nor did it show impairments as the price of BTC was flat in the period. Currently, the company does not accept Bitcoin payments but does accept Dogecoin for some merchandise.

GAAP VS NON GAAP

The SEC has said that Microstrategy, which also holds large investments in bitcoin, cannot show non-GAAP numbers in its reporting. This means that Michael Saylor’s company cannot show what its net income would be if it did not have to impair the digital assets. Under GAAP accounting, Microstrategy must record the bitcoin at historical cost and adjust that if the value falls, but not rises. The software company held $3.75 bn of the coins at YE21.

HEDGING THEIR BETS ON ETH 2.0

Luxor Mining is launching a mining pool service even as Ethereum is moving to a proof-of-stake (PoS) consensus model from its proof-of-work mechanism, which means miners would be redundant. But because the upgrade has been delayed before, Luxor thinks it is still in time to launch the service as, in their view, the move won’t happen in 2022.

FTX ADDS DEBIT CARD

FTX is rolling out a Visa debit card to bring it in line with the likes of Coinbase, Crypto.com but it does not include the U.S. yet as some of the others like Coinbase do. They have a waiting list for the card, which won’t charge fees.

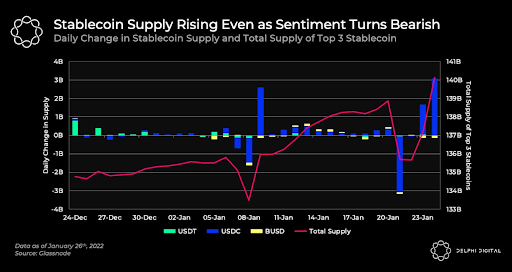

STABLECOIN SUPPLY SURGES, BENEFITTING USDC OVER USDT

New research from Delphi Digital has shown that despite the current volatility in crypto-asset space, stablecoin supply has grown by $5.3B over the past month. USDC’s growth, in particular, has recently become more pronounced, surging by $5.2B in supply in the last month. To compare, USDT has only grown by $700M. Perhaps the recent Fed report on stablecoins and Biden’s comments around regulation in the space are a determining factor as USDT is perceived to be higher risk given it is not predominantly backed by cash and cash equivalents.

ROBINHOOD TO ALLOW BTC WITHDRAWALS

Robinhood has started rolling out its long-awaited bitcoin withdrawal feature but it’s only in the beta stage. Users will be able to send and receive crypto to external wallets.

BINANCE SPONSORS ARGENTINE FOOTBALL TEAM

Following the success of sports sponsorships by the likes of FTX and Crypto.com in gaining market share, Binance will become the main sponsor of Argentina’s national football team, one of the best in the world. This is a first for the crypto exchange and will also include a fan token.

CHINESE SANCTIONED NFTS

China’s state-sanctioned blockchain infrastructure project, the catchily named Blockchain-based Service Network, said it is releasing its NFT platform. The BSN is making ten open permissioned blockchains available that restrict who can participate in network governance and use fiat for payment. Of the ones named so far, they will be based on Ethereum, Cosmos, Corda, EOS and Fisco.

Regulation

A MATTER OF NATIONAL SECURITY

The Biden administration is preparing an executive order that will direct federal regulators to regulate digital assets as a matter of national security, according to Bloomberg. It will come in the next few weeks and include stablecoins and NFTs as well as seeking cooperation among jurisdictions. Agencies would have six months to come up with proposals.

PUTIN IS ORANGE PILLED

Russian President Vladimir Putin has backed a government proposal to regulate crypto mining and allow it in regions with excess electricity, going against the Central Bank’s recommendation to ban it. He probably recognizes the investment potential and the high profitability of miners, as well as Russia’s low energy cost advantages. Plus, some sources say he is looking at circumventing any additional US sanctions with digital assets.

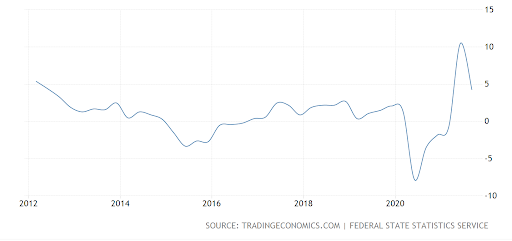

Russia already captures 20% of mining share. Let’s not forget that Russia’s nominal GDP is only $1.7 trillion and has been lacklustre for years. Its economy is in dire need of diversification, with two-thirds of exports composed of oil and distillates.

Russia GDP Annual Growth Rate

EX-SEC COUNSEL JUMPS TO COINBASE

Crypto exchange Coinbase has hired former U.S. Securities and Exchange Commission (SEC) counsel Thaya Knight as its senior public policy manager. She had been counsel to Commissioner Elad Roisman since 2020, who has also left the SEC. It is a timely move as regulatory activity is likely to ramp up this year.

BLOCKCHAIN FOR TRADITIONAL EXCHANGES

The SEC approves BSTX, a JV between tZero and Boston Options Exchange, to operate a securities exchange based on blockchain technology. The idea is to accelerate settlement to T+0 or T+1 and will also eventually allow crypto trading

ASIA

Indonesia's Financial Services Authority (OJK) warned that financial firms are not allowed to offer and facilitate sales of crypto assets in an attempt to curtail trading activity. The country is the fourth most populous nation (278 mn) and fell from upper-middle income to lower-middle income status due to the pandemic.

In Thailand, the regulators plan to ban operators from facilitating crypto as a means of payment for goods and services as they fear it may lead to wider adoption and the oft- cited concern, financial stability. Thailand comes in at number 12 in terms of digital asset adoption, according to a recent Coinalysis study.

DeFi/NFTs/Metaverse

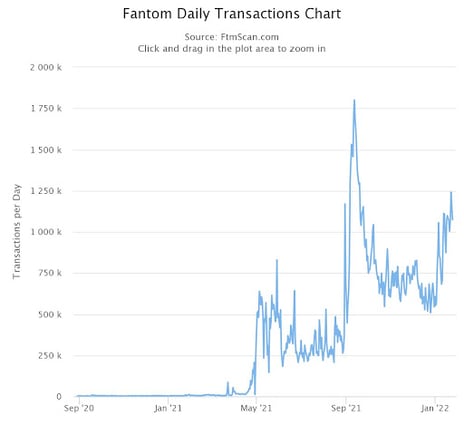

FANTOM MENACE

Fantom overtook Binance Smart Chain (BSC) over the weekend to become the third-largest DeFi ecosystem by total value locked. Transactions on Fantom surpassed Ethereum for the first time ever last Monday, exceeding 1.2 mn transactions.

YOUTUBE MAY OFFER NFTS TO HELP CREATORS

YouTube is considering offering non-fungible tokens (NFTs) as a way “to help creators capitalize on emerging technologies including things like NFTs," CEO Susan Wojcicki wrote in an open letter. The company sees the potential of NFTs and Daos to connect creators and their fans. This comes after Twitter started offering verification of NFT profile pictures.

MORE TURBULENCE IN THE OPENSEA

A bug in the OpenSea NFT marketplace has been exploited by hackers, allowing them to buy rare NFTs for far below market value and make hefty profits when reselling. It has been reported that at least three attackers exploited the bug, making over $1m, according to Elliptic. OpenSea has reimbursed clients $1.8 mn as it struggles to manage the explosive growth of the last year.

BEATLEMANIA

John Lennon's son Julian is selling a collection of Beatles memorabilia as a set of NFTs on the YellowHeart platform. It includes notes by Paul McCartney while writing "Hey Jude,". The song was written by McCartney as a comfort for Julian during his parents' divorce.

Investment Tracker

RIPPLE BUYBACK

Blockchain company Ripple was valued at $15 billion after a private stock buy-back, where it repurchased equity shares from investors in its Series C. There is an ongoing SEC investigation for issuing unregistered securities in the form of XRP token.

ON FIRE

Custody provider Fireblocks has raised $550mn in a Series E round co-led by D1 Capital PArtners and Spark Capital, valuing the company at over $8bn. Their services offer multi-party computation and sharding of private keys, with its client base growing from 150 to 800 last year.

FTX U.S. VALUED AT $8BN

The American affiliate of cryptocurrency exchange FTX, FTX U.S, said this week it has raised $400 million in its first external fundraising round. This round gives it a valuation of $8 billion, placing it among the world’s most valuable private crypto firms. Investors in the round include Temasek, the Ontario Teachers’ Pension Plan Board and SoftBank’s Vision Fund 2. Incredibly, Robin Hood, which IPo’ed at US$32 bn, now sits at under $10 bn in market cap.

CRYPTO MINER TO GO PUBLIC VIA SPAC

Despite the poor performance of SPACS, Bitmain-backed cryptocurrency mining services company BitFuFu, is to go public in the United States by merging with a special-purpose acquisition company in a deal that will value the company at $1.5 billion. It was announced this week that it would enter a definitive business combination agreement with Nasdaq-listed Ariz Acquisition, including a $70 million of fully committed private investment in public equity.

VC DRAGONFLY CAPITAL TO RAISE $500MN

Dragonfly Capital Partners has announced it is raising $500m for a new fund, according to a new regulatory filing. To date, Dragonfly has raised over $300m across two funds. The Dragonfly portfolio includes the Avalanche and Near blockchains, crypto exchange Bybit and blockchain interoperability project Cosmos.

LATIN AMERICA’S EBAY INVESTS IN MERCADO BITCOIN

Mercado Libre, Latin America’s largest e-commerce company by market value, has invested in 2TM, the holding company for Brazil's largest crypto exchange Mercado Bitcoin, and blockchain infrastructure company Paxos. The eBay of Latin America is “committed to the development and use of crypto assets and blockchain technology in the region” as it seeks to meet the demands of its customers in an area where digital assets have proven popular.

Mercado Bitcoin is valued at US$2.2bn and has 3.2 million users. It wouldn’t be surprising to see $50 bn market cap MELI (its Nasdaq ticker) working together with the Brazilian exchange in future.

NFT INVESTMENT TO ACQUIRE PLUTO TO EXPLORE THE METAVERSE

NFT project incubator, NFT Investment, is set to acquire Pluto Digital for about $129 million, or £96 million, the company said in a statement Monday. The acquisition will result in a reverse takeover of NFT Investments by Pluto. The two companies will create a significant global metaverse offering, allowing Pluto to scale up its NFT business as well as exploit opportunities in the decentralised finance and metaverse sectors for its software products.

UK CRYPTO START UP COMPLETES SERIES A

BCB Group has announced a $60 million Series A investment co-led by Foundation Capital in a Series A round. The London-based startup provides business accounts, payment services, and foreign exchange custody services for exchanges.

BUILDING WEB3

The Graph, a startup that indexes and queries information that lives on blockchains, has raised $50 million in a funding round that was led by Tiger Global Management. Clients range from Uniswap to Decentraland.

META THROWING IN THE DIEM TOWEL

The Diem Association, the consortium Facebook founded in 2019 to build a digital payments network, is selling its technology to a small California bank that serves bitcoin and blockchain companies, for about $200 million.

Until next week!

Disclaimer: The views expressed in this newsletter are my own and not intended as financial advice or a recommendation, but only for informational purposes. You should carry out your own independent research or consult a financial adviser if you are unsure. Please also be advised that I hold investments in some of the assets mentioned in this report, including digital assets, equities and ETFs.