The Giant Sucking Sound

Summary:

The “giant sucking sound” was a phrase used by presidential candidate, Ross Perot, in 1992 to argue against the North American Free Trade Agreement (NAFTA). The independent candidate was referring to the potential loss of jobs to its southern neighbor. Bill Clinton won that election and the treaty was passed. But the phrase could just as well be applied to the cascade effect from the FTX collapse and the ensuing sapping of liquidity from the crypto ecosystem. This reflects what we are seeing at a global level, from UK pension fund margin calls to Chinese investors rushing to sell fixed-income products. In crypto, it’s been brutal, due to poor regulation, weak governance and no government intervention. It’s a new world, where too much leverage is bad, whether you are a company, a country, or a crypto yield provider.

Macro

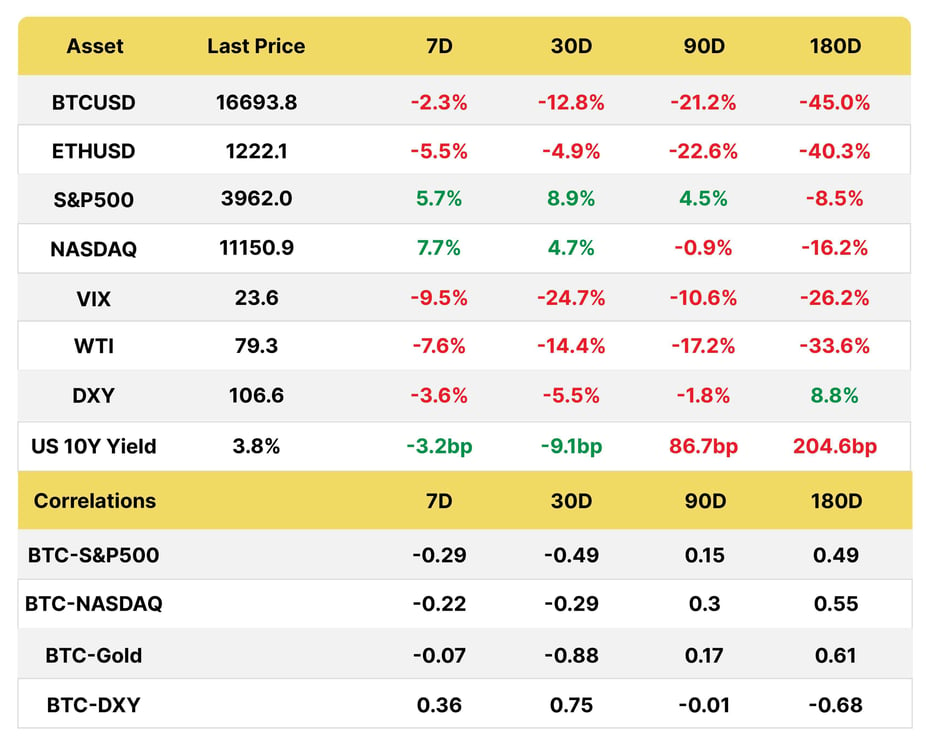

*Prices at the time of writing

SOFTER INFLATION DATA = SOFTER DOLLAR

We kicked off the week on a positive note after the soft CPI last week, as PPI also underwhelmed in October, up 8% YoY below the 8.3% that was expected and below September’s 8.4%. MoM, it was flat at 0.2%. Services finally fell after two years, as we approached a step down in the pace of rate hikes. Goods were pressured by gasoline prices.

The USD continued to retrace versus the euro, the yen and the pound. This took the DXY back to August levels. The 10/2yr interest rate curve inverted even more to -70bps as investors focus increasingly on the coming deceleration in growth. In 1980, this measure got as low as -200 bps. It is highly unusual for short-term debt to carry a higher risk than longer-term bonds and foretells negative GDP in the US in the near future.

Soft inflation data interrupted the dollar rally but other data are conducive to a further rally

Source: Bloomberg

Services PPI finally printed a negative number though gasoline pressure fed into goods

IT’S GOING TO BE A VERY MERRY XMAS: US CONSUMERS KEEP SPENDING

Despite the weaker University of Michigan consumer confidence data last week (54.7, down 8% mom), spending has slowed down from 2021 (+11.5% vs +16.8% in 2021) on an annualized basis but is still remarkably high.

US real sales growth remains robust despite lower consumer confidence: nominal sales trumped CPI for now

Source: Bloomberg

After the retail data came out, the Atlanta Fed Q4 GDP Nowcast printed a new high at +4.4% sequentially, led by the consumer, of course, as well as business investment and exports, while real estate remains a drag.

The GDPNow printed a strong 4.4% rise QoQ on the back of rosy retail sales

CONSUMERS EXPECT PRICES TO KEEP RISING, KEEPING THE FED ON ITS TOES

One of the key metrics that the Fed follows, the NY Fed inflation expectations survey rose across the board in October. Median one, three and five-year ahead inflation expectations increased to 5.9%, 3.1% and 2.4%, from 5.4%, 2.9% and 2.2%, respectively. People were optimistic about their income growth expectations as well, touching a series high of 4.3% from 3.5% in September but home prices were expected to be lackluster at 2%.

The Fed’s job isn't done: Consumer inflation expectations are on the move again, in the wrong direction

Source: NY Fed Survey of Consumer Expectations

The NY Fed suggested in a study last August that supply shocks account for 40% of inflation, with 60% explained by aggregate demand.

COVID ZERO TOLERANCE CONTINUES TO WEIGH ON CHINA

In China, October data disappointed and lost steam versus September. Retail sales fell by 0.5% YoY vs. 1% expected, meaning a tepid YTD rise of 0.6%, while industrial production grew by 5%. The country eased some quarantine measures but is far from a full lifting of lockdown as Covid cases explode. The renminbi weakened on the news, after a reprieve for its currency and markets in line with a pullback in the dollar. The expectation is that they will ease bank reserve requirements by another 50 bps by year-end.

In echoes of what has been happening in crypto, banks experienced a crisis of confidence as price declines in bonds triggered a run on fixed-income products, with authorities demanding banks report their ability to meet short-term obligations. Some banks issued statements to reassure investors but a government liquidity injection was required to stem the tide.

No end in sight: COVID cases in China are skyrocketing

THE UK TIGHTENS ITS BELT TO THE TUNE OF 2% OF GDP, AFTER THE 2025 ELECTIONS

Chancellor Jeremy Hunt announced £55 billion in a balanced mix of spending cuts and tax increases over the next five years, with the caveat that most of the pain will take effect starting in 2025, after the next general election. The cuts are in line with what was widely communicated and bring the tax burden to the highest level since after WWII.

The government will freeze the threshold at which people pay higher rates, which means many will be bumped up to the higher band due to inflation and wage increases. The energy subsidy will be reduced in the spring and there will be a windfall tax on energy companies.

The Office of Fiscal Responsibility is forecasting a steep drop in growth in the UK (we are likely in a recession already), so the government is kicking the spending cuts down the road

Crypto

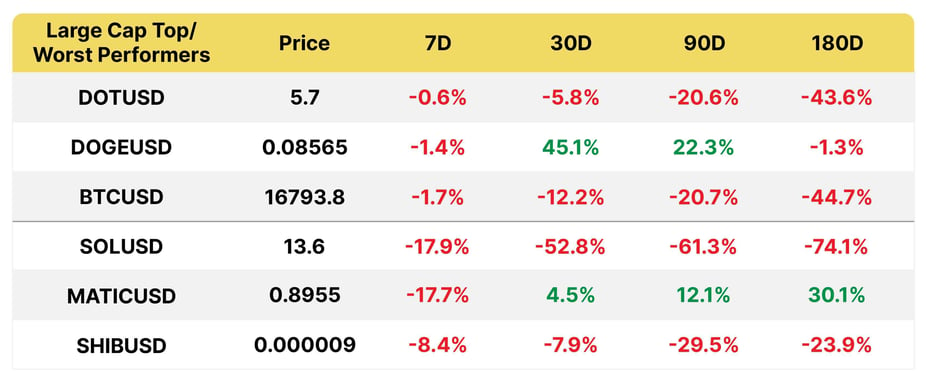

*Prices at the time of writing

BTC/ETH funding rates nosedived as the FTX debacle unfolded, with the BTC 7D moving average at almost -7% and the annualized daily basis for futures at -2%.

We came into the FTX crisis with low volumes across decentralized and decentralized exchanges. Given the volatility, CEX spot volumes rose and are set to exceed last month at $470bn versus $544 bn in October, but DEX volumes picked up as well, as did the transfer of BTC and ETH off exchanges ($3bn this week, as per Into the Block).

Binance’s share of the spot market rose to 65% in November from 60% in October as traders flocked to what they perceived as a more secure exchange. Trading in derivatives and ETFs also surged. We will likely see more pressure on exchanges to disclose proof of reserves, as Binance and others have announced. This is no panacea, however, as PoR has limitations given there is no insight into the liabilities, whether on or off-balance sheet and simple wallet tracking is of limited use.

In the meantime, Nansen has created a free dashboard to monitor exchange wallets and stablecoin outflows from some of the main exchanges. Stablecoin outflows are over $5bn since the crisis commenced by this measure

Stablecoin outflows and exchange wallets can be monitored on Nansen

Source: Nansen

Tether sees a slight de-pegging as concerns persist on their exposure, despite their reassurances of no exposure

Source: Bloomberg

Dex to Cex trading volumes hit a peak at 25% in February before dropping to 10% and are now rising again, to 17%

Source: The Block

Midway through November, DEX spot trading volume exceeded all of October, with Uniswap behind only Binance last weekend

Source: Cryptocompare

BITING THE HAND THAT FEEDS YOU: CRYPTO WHALE DIGITAL CURRENCY GROUP FALLOUT

When Coindesk published the Alameda balance sheet just over two weeks ago, it was hard to fathom that it would boomerang back to them, with repercussions for the crypto publication’s parent company, Digital Currency Group (DCG). Mega crypto player DCG boasts a VC arm and owns Genesis (trading, lending and prime brokerage), Grayscale (asset management) Luno (exchange and wallet) and Foundry (advisory for mining and staking).

This week events continued to escalate, first with BlockFi announcing it would file for bankruptcy after losing its credit line with FTX and then the more surprising news that Genesis would pause withdrawals on its yield products and loan origination as institutions tested its liquidity. Gemini soon followed suit with $700mn in deposits because it was partnered with Genesis to provide an earn product to its retail users. The WSJ revealed that Genesis had sought an emergency loan of $1bn before suspending withdrawals.

Circle, the issuer of USDC stablecoin also got caught up in the fallout, as it dropped the yield on USDC from 0.25% to 0%. The company had a partnership with Genesis to offer USDC yield and lending products, launched with a $25 mn capital injection from DCG.

This was a big blow to the ecosystem given DCG was perceived to have a sizable balance sheet, despite Genesis having been crippled after it was exposed to the 3AC hedge fund to the tune of $1.2 bn. As its parent, DCG stepped in to plug the gap in that instance but it appears it was unwilling to do so this time. In an eerie coincidence with Alameda, the head of trading at Genesis, Michael Moro, stepped down last September. Their head of risk lasted only three months on the job.

DCG owns Grayscale, the largest digital investment asset manager, including the BTC Grayscale Fund (GBTC) which trades at a record 40% plus discount to spot BTC. It has a value of $10.8bn, down from $56.7 at its peak in February 2021, signaling a lack of institutional demand given other alternatives and no approval yet from the SEC to convert to an ETF. Because it is a closed-end fund, the BTC remains locked for a six-month period, which is risky for such a volatile asset. Some investors, such as Cathie Wood of Ark Invest, continue to bet that the premium will eventually close with the approval of an ETF.

Genesis’s lending operations up to Q322

BINANCE FILLS THE VACUUM

In a new twist, Blockworks reported that along with market maker B2C2, Binance was considering bidding for Genesis’s $2.8 bn loan portfolio, as well as Voyager. CZ, CEO of Binance, has also announced the creation of a crypto recovery fund to help promising but liquidity-constrained businesses but did not divulge any numbers. PR stunt or substance? The CEO has certainly been much more in the limelight than usual, active on Twitter, the press and conferences and generally filling the void left by SBF.

SIDE BENEFITS: ETH TURNS DEFLATIONARY AND STAKING YIELDS SPIKE

One side effect of the turbulence is that Ethereum turned deflationary for the first time since the Merge, as more ETH is burned than minted. Yields for staked ETH on Lido, which holds over 30% share, briefly spiked to over 11% annualized and is now 5.5%. Unlike consensus rewards for validator behavior on the network, execution rewards are more variable and depend on demand for blockspace. One risk, however, is that the SEC may consider staked ETH to be a security.

Ethereum turned deflationary as increased usage led to more ETH burn

Source: ultrasound.money

On November 9, 5,242 ETH were burned

Hope to see you on November 23rd at our Cap Intro event!

The Bequant Team

Martha Reyes

Emiliano Bruno

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high-risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group.

Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group