This is not a bluff

Summary:

Just last week, some were considering that a de-escalation of events in the Ukraine would lead to a rally. This week, Putin was mustering legions of army reserves, warning that he wasn’t bluffing.

Markets have also woken up to the possibility that the Fed may not be bluffing, at least not until we get more pain. The continued strength in the greenback, the rise in two-year yields, the deepening inversion of the yield curve to levels not seen in 40 years, and the sell-off in equities and crypto have more to do with the Fed’s hawkishness amid slowing growth than with geopolitics.

Despite the ETH sell-off, it still looks exposed to giving up its outperformance versus BTC as regulatory risks increase and the 2021 bubble is pricked. Looking through a longer-term lens, it was encouraging to hear of Nasdaq’s increased participation in digital asset solutions for its clients and of individual protocols reducing inflationary tokenomics amid a tightening global order.

Macro

NO PAIN, NO GAIN

Following the unanimous 75 bps hike on Wednesday to a range between 3% and 3.25%, expectations for rates are now for a +75 bps move in October. All Fed members now see rates at 4-4.5% by year-end, the most hikes in one year since the 1980s.

The Fed’s latest estimates, which rarely prove accurate but signal intent, project rates at 4.6% by the end of 2023. That’s even more hawkish than the market was and means NO rate cuts next year and unemployment up to 4.4%. In just one week, the 2 yr and 10 yr yields shot up 20 bps each to reflect the new messaging: we are going to hike and growth be damned,

|

“A soft landing is very challenging. We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t’, admitted the Fed chairman, to immediate backlash from Democratic leaders ahead of the November 8 midterms. |

A key data point was that the Move index, a coincident indicator tracking the movement in U.S. Treasury yield volatility implied by current prices of one-month OTC options on 2, 5 , 10 and 30-year Treasuries, has been rising. This signals sentiment in the bond market and is a worrying sign as bonds should not be more volatile than equities and the two move in tandem in the long term.

Bond volatility is concerning and could be a sign of things to come in the VIX

Source: Bloomberg

Sentiment is poor and foreigners sold into strength over the summer, however, when looking at fund flows and ETF, those are not so negative, according to data from Fidelity. They also project with current interest rates, the corresponding P/E multiple for the S&P is 14x. Assuming earnings are +10% from here, that is 15% downside, a more realistic flat earnings number given weaker growth means 35% downside. That would take us back to pre-pandemic levels.

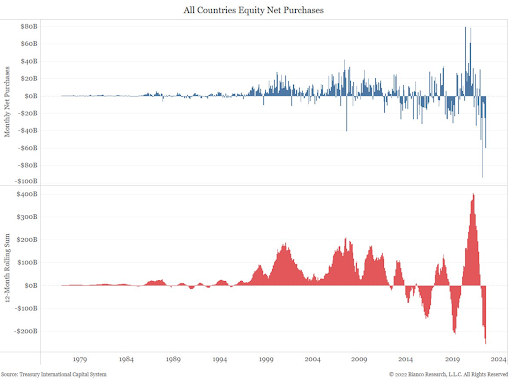

Through the end of July, foreigners sold the most US equities on record, with markets in the red since then

Jim Bianco research

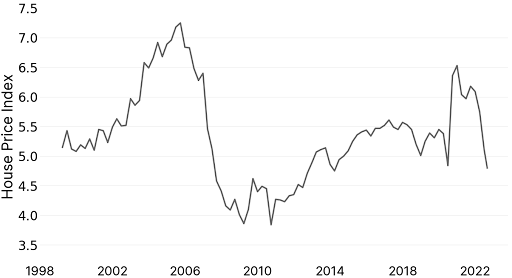

Rate hikes are doing their thing as US home sales fell for the seventh month in a row (in millions)

Source: Bloomberg

INFLATION GOES GLOBAL

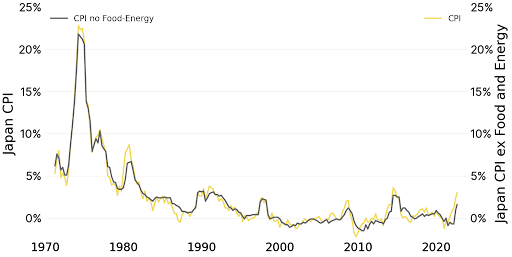

Even Japan, the poster child for chronic deflation, posted higher than expected prices for August, with CPI registering a 3% increase yoy, well above the country’s 2% target, which has been the case since May. This can be partly attributed to rising fuel and food prices, a global phenomenon, and is expected to remain the case for the rest of the year.

Excluding volatile food and energy, inflation came in at 1.6%, though, as companies in the service sector so far are not passing on increased costs to consumers. This data will likely keep the Bank of Japan on its unyielding bond buying path, anchoring 10 yr rates at 0.25% and weakening the yen further.

The Ministry of Finance intervened in the markets on Thursday, to smooth the volatility, selling dollars from its $1.3 trillion reserves, after it kept ultra-low rates steady. However, it is unlikely to assume significant ongoing intervention given the rate differentials with the US.

Even deflationary Japan is seeing higher than expected prices

Renminbi weakness, with the Chinese currency falling below the important 7.0 threshold will also drag other Asian currencies down.

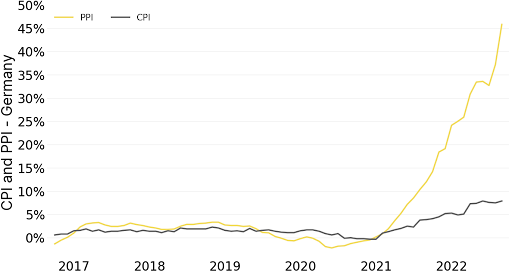

Japanese inflation underwhelms when compared to what Germany posted this week, with PPI surprising on the upside +45.8% yoy (vs. +37.1%e), the highest number since records began, and CPI at 7.9%. The discrepancy between the two indices points to further pressure in CPI over the coming months and a margin squeeze for corporates.

Deutsche Bank is forecasting a deeper recession for Europe next year, revising their forecasts down to -2.2% for 2023, with German activity down -3.5%, the worst performance since 2009 and 2020.

The gap between PPI and CPI in Germany means inflationary pressures will persist

Source: Bloomberg

Regulation

ETH: MADE IN AMERICA?

Soon after declaring that Ethereum may qualify as a security now that it is proof-of-stake, the SEC in its lawsuit against crypto influencer Ian Balina for shilling an unregistered coin argued that Ethereum falls under American jurisdiction.

The agency based its claims on the fact that a large “cluster” of validators (46%) for the blockchain resides in US territory. The US government is firmly planting its flag on Ethereum grounds, stirring the debate around the centralization of the chain post-Merge once again.

JUDGE ASKS TETHER TO PROVE ITS RESERVES

Tether, the leading and unaudited US-backed stablecoin, was ordered by a judge in New York to produce financial records relating to its reserves. The request is part of a lawsuit that alleges Tether issued the stablecoin as part of a campaign to inflate the price of bitcoin and is one of the reasons the SEC cites for not granting spot ETFs.

The renewed attention could not come at a worse time given market uncertainty. USDT briefly de-pegged during the spring rout and lost share to alternative USDC and we are likely to retest those lows.

EARLY DAYS FOR THE STABLECOIN BILL

On the stablecoin front, a very early draft bill in the House Finance Committee in Congress would require the Fed and state regulators to approve stablecoin plans for nonbanks while traditional institutions could gain approval through the federal bank regulators. Stablecoins will need to be fully backed by cash or highly liquid assets, including US Treasury bills. “We are talking to you, Tether.”

The definition of “liquid assets” will be key to determining what stablecoins will have to change, for example, overcollateralized DAI or MIM, that are partially backed by ETH

Algorithmic stablecoins would see a two-year ban and would be allowed time to change their business model. This is likely a result of the issues with the Terra ecosystem earlier this year, with the founder now apparently on the run.

LEAKED MICA TEXT, ALMOST FINALIZED

CoinDesk revealed that the European Union has completed its Markets in Crypto Assets legislation, even though it is technically still open to comments. They apparently will prioritize substance over form, with perhaps some implications for NFTs.

The bill will require issuers of crypto assets to publish white papers, platforms to register with the authorities, and stablecoin issuers to hold capital and be prudent. Algorithmic stablecoins will also fall within their scope even though they were not contemplated in the original document.

A positive was that the proposed limit on non-euro-denominated stablecoins was withdrawn, as the major ones are pegged to the USD, helping to sustain liquidity.

Crypto

RIPPLE RIPS

Ripple has been on a tear, up 30% in the last week. The company’s defense attorney has been actively tweeting about a motion for a summary judgment and they, along with the SEC, have asked a judge to settle their long-standing lawsuit. A commissioner from the Commodity Futures Trading Commission met with Brad Garlinghouse, CEO of Ripple, fueling speculation of a favorable settlement.

The SEC accuses Ripple of misleading buyers of XRP by failing to register it as a security and failing to provide sufficient disclosure.

ETHEREUM ECONOMICS

Much like governments around the world, Ethereum is reversing liquidity with the Merge given miners will no longer be required to be compensated and ETH gas fees are burned. So far, it is not helping performance as the event was priced in ahead of time and coincided with a poor macro backdrop,

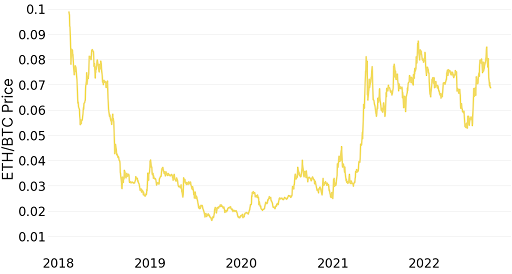

Risks are reduced but remain given the uncertain timing of the stake unlock and subdued activity in Defi keeping fees low. To add to that, regulatory risk around Ethereum as a potential security is rising. The outperformance of ETH to BTC since 2021 looks vulnerable as risk aversion rises.

The issuance of ETH is the process of creating ETH that did not previously exist. The burning of ETH is when existing ETH gets destroyed, removing it from circulation. The rate of issuance and burning gets calculated on several parameters, and the balance between them determines the resulting inflation/deflation rate of ether.

-

Mining rewards ~13,000 ETH/day pre-merge

-

Staking rewards ~1,600 ETH/day pre-merge

-

After The Merge, only the ~1,600 ETH per day remain, dropping total new ETH issuance by ~90%

-

The burn: At an average gas price of at least 16 gwei, at least 1,600 ETH is burned every day, which effectively brings net ETH inflation to zero or less post-merge.

Source: Ethereum.org

In sum, the two variables that determine the rate of ETH issuance are the number of validators operating and earning staking rewards and the average fee. There are 428,000 active, according to beaconcha.in. At the current stake rate, Ethereum becomes deflationary at an average gas rate of 16 gwei.

ETH is not quite deflationary yet (annualized)

Source: https://ultrasound.money/

Will ETH hold on to its outperformance as the 2021 froth collapses?

Source: Bloomberg

GROUND ZERO: COSMOS OUTPERFORMS

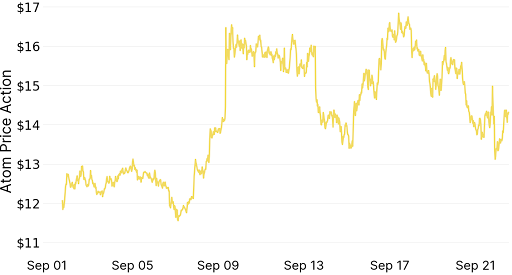

In this environment, finding positive performance is tough, but ATOM, the Cosmos Hub security and governance token, is one that rallied ahead of its conference this week in Medellin, on the possibility of announcements such as better tokenomics. At the moment, the challenge is low value for token holders and issuance in the low teens, which in a monetary tightening environment is not ideal.

Proof-of-stake Cosmos, founded in 2014, styles itself as the internet of blockchains. It is unique in that it allows developers the ability to create their own PoS blockchains, which are then linked within the ecosystem.

It is a different approach to handling interoperability between blockchains, which remains a security issue. Thus, they offer security to blockchains and are known as a Layer 0 solution, with low fees and instant transactions. Cosmos has over 260 apps and services, including Binance Smart Chain.

Infamously, Terra was built on Cosmos, however, it has other successful projects, including Osmosis, a multi-chain DEX and dYdx, the leading derivatives exchange. Speaking of dYdx, a competitor has emerged in GMX, which has been posting 40% of the volumes of its competitor.

ATOM, the native Cosmos coin, bucked the downmarket, up over 60% in the last 90 days, finally giving some of it back in the last week as its conference kicked off

NASDAQ DIGITAL ASSETS IS BORN

Tech-heavy exchange, Nasdaq is to launch its own crypto custody service for institutions, subject to regulatory approval, as the institution seeks to advance broader institutional adoption. It will be competing with multiple offerings in the market, from State Street to Coinbase.

No trading will be offered, though the exchange does already provide marketplace technology to crypto exchanges and security and monitoring services. Nasdaq joins a long list of heavy-hitters joining the ranks including Blackrock, Fidelity, and Citadel.

|

“The technology that underpins the digital asset ecosystem has the potential to transform markets over the long-term.’ Adena Friedman, President and Chief Executive Officer, Nasdaq. |

Until next week!

The Bequant Team

Martha Reyes

Emiliano Bruno

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high-risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group.

Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group