Upstaged

Summary:

This week we attended DAS New York, a conference for institutions interested or involved in crypto. It was unsurprising to see the focus on macro, with discussions around the role of the dollar in the international financial system, the European energy crisis and monetary policy. At times, I thought I had been transported back to tradfi.

While there was a general sense of caution because of the tightening environment, at the crypto level there was excitement around the Merge as an important step to scaling DeFi, staking and the potential creation of a “risk-free” rate on top of which new products can be built.

The Merge also intensified the debate around whether Bitcoin will be left in the dust or the migration to PoS is a blunder that will lead to more, not less, centralization. Adding fuel to the fire were the SEC chairman’s comments in the WSJ that proof-of-stake blockchains could classify as securities.

There is still an abundance of experimentation, whether that is Maker Dao seeking yield for its excess USDC reserves by lending to banks, or Osmosis launching innovative super liquid staking products. It was encouraging to see mainstream finance businesses active in lending to crypto or others looking to tokenize real-world assets such as accounts receivables and emerging market consumer loans.

OTC derivatives trading is an area of focus for companies already operating in that space in traditional markets, that has plenty of room to grow versus the more retail-friendly perpetual futures traded on exchanges. DYDX, the DeFi derivatives platform could take a share of that market given the efficiencies of decentralized, trustless transactions with instant settlement.

Even stalwarts like Charles Schwab, Citadel and Fidelity joined forces to launch the EDX crypto exchange.

Macro

What to watch next week:

- FOMC rate decision, Sep 21, expected 3%-3.25%, 75 bps hike

- MBA mortgage applications, Sep 21, prior -1.2%

- Existing home sales, Sep 21, 4.7 mn expected, prior 4.81 mn

In what was to be a historic week for crypto, the event was upstaged by ugly inflation data, leading to an unwinding of ETH’s outperformance over BTC and fallout in both equities and fixed income. The aggregate bond index and S&P are now neck and neck in negative returns this year.

CPI data, facing tough comps from last year, came in at +8.3% you versus 8.1% and +0.1% mom. Core inflation was +0.6% versus 0.3%, expected. Core sticky CPI is rising at a 6% yoy clip and will be a concern for central bank officials.

This led to an immediate repricing of odds of a 100 bps hike next week by the Fed to over 30% and two-year yields climbed another 30 plus bps this week. Almost 8 additional hikes are on the table by year-end.

The Bloomberg Total Aggregate Index of investment-grade bonds is down 17% for the year, not dissimilar to S&P’s performance, which has yet to catch up to the higher real yield expectations.

30-year fixed mortgage rates jumped to levels not witnessed since 2008, almost doubling from the beginning of the year, which will help the Fed’s aim of slowing the housing market.

Despite record-high prices and low affordability, homeowners have twice the amount of equity in their homes than they did in 2007 and total mortgage debt has increased only 10%. Delinquency is at a record low, so it does not look like 2008 all over again.

Two-year yields march relentlessly upwards, +32bps this week alone, post CPI data

Source: Bloomberg

US Fixed 30 yr mortgage rates are back at 2008 levels

Source: Bloomberg

Crypto

INVESTORS SHORTED ETH INTO THE MERGE

The Merge turned out to be somewhat anticlimactic after all the hubris, buildup in leverage and price action leading up to the event. Given the deficit of short-term catalysts in crypto, all eyes were on the upgrade to proof-of-stake and there was caution despite the successful Bellatrix upgrade, as reflected in the derivatives market.

It went without a hitch, with 95% of validator participation, although the hard fork ETHW did not do as well, debuting the day after, with problems caused by the use of a chain ID that was already taken.

ETH prices were muted in the hours after the event on September 15, with lower volumes on centralized and decentralized exchanges. ETH funding rates were already negative before the CPI numbers and turned the most negative ever after their release and as we approached the upgrade. Bitcoin funding rates remained slightly positive in comparison. In addition, net flows of ETH onto exchanges for the week were the largest since November of 2021.

Traders were right to take a bearish view, as ETH soon had another leg down when other markets opened on Thursday, still feeling the overhang from bad inflation data. Of note, leverage did not fall back much post-Merge.

Round trip: ETH sold off post-CPI, was muted in the hours after the Merge, then tumbled in sympathy with the rest of the markets on Thursday

ETH funding rates plummeted to their most negative ever ahead of the Merge as traders speculated, correctly, that ETH outperformance would unwind

Source: IntotheBlock

ETH PoW lifted off post-launch but crashed back down, trading on FTX, OKX and Bybit

Source: CoinGekko

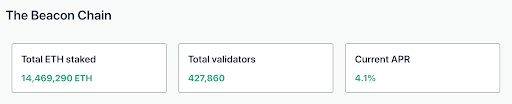

Merge completion will help reduce the risks around staking, paving the way for more participation, although investors who choose to stake and earn yield will not be able to withdraw their staked ETH until the upgrade is complete, potentially in 2023.

As a reminder, staking requires depositing 32 ETH to activate validator software. Validators store data, process transactions, and add new blocks to the blockchain to keep Ethereum secure. Rewards for this role come in the form of ETH.

It is for this reason that pooled staking and staking on centralized exchanges are popular alternatives which allow institutional and retail investors to stake and receive rewards without owning the requisite 32 ETH. Pooled staking can also be liquid, meaning investors receive a synthetic token that represents their staked ETH. sETH can then be deployed onto the $60 bn DeFi ecosystem.

NEXT UP, THE SURGE

There are no imminent catalysts although we should get an increase in staked ETH and yields as issuance drops 90% and stakers get rewarded in fees instead of the much higher rewards for miners in PoW. Traders have already been speculating on this using interest rate swaps on the Voltz automated market maker defi protocol..

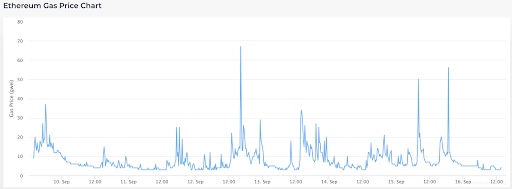

ETH could potentially turn into a deflationary asset, depending on gas fees being above 16 gwei, which is not the case now, as a percentage of ETH is burned with each transaction. Finally, energy is reduced by over 99% which some claim could unlock ESG investment.

Gas prices spiked on the inflation disappointment and Merge event, but fell back, with the average fee at 14 gwei

Source: ethereumprice

Sharding will happen sometime in 2023 which will spread the database load and allow more capacity to store and distribute data, coupled with Layer 2 rollups. This will lead to massive scalability improvements. You can check out the details as posted by Vitalik Buterin, co-founder of Ethereum.

https://notes.ethereum.org/@vbuterin/data_sharding_roadmap

Ethereum dashboard: Yields have remained steady despite the bear market

Source: ethereum.org

Until next week!

The Bequant Team

Martha Reyes

Emiliano Bruno

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high-risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group.