What is Fraud?

Summary:

Powell’s speech this week did not reveal much that was new except a preoccupation with wage inflation and the chasm between job openings and job seekers as house prices and markets keep people home. He must have seen the hot jobs report ahead of time! We still have a long way to go, to quote the Fed chairman, is also applicable to cleaning up crypto. Auditing will become a necessity rather than a luxury. SBF continues to receive plenty of airtime, ducking and diving his way through interviews. Was it fraud (the DoJ wants an investigation) and what is its history and meaning? The good news is that every boom and bust has brought improvements, the bad, risk resurfaces in new places.

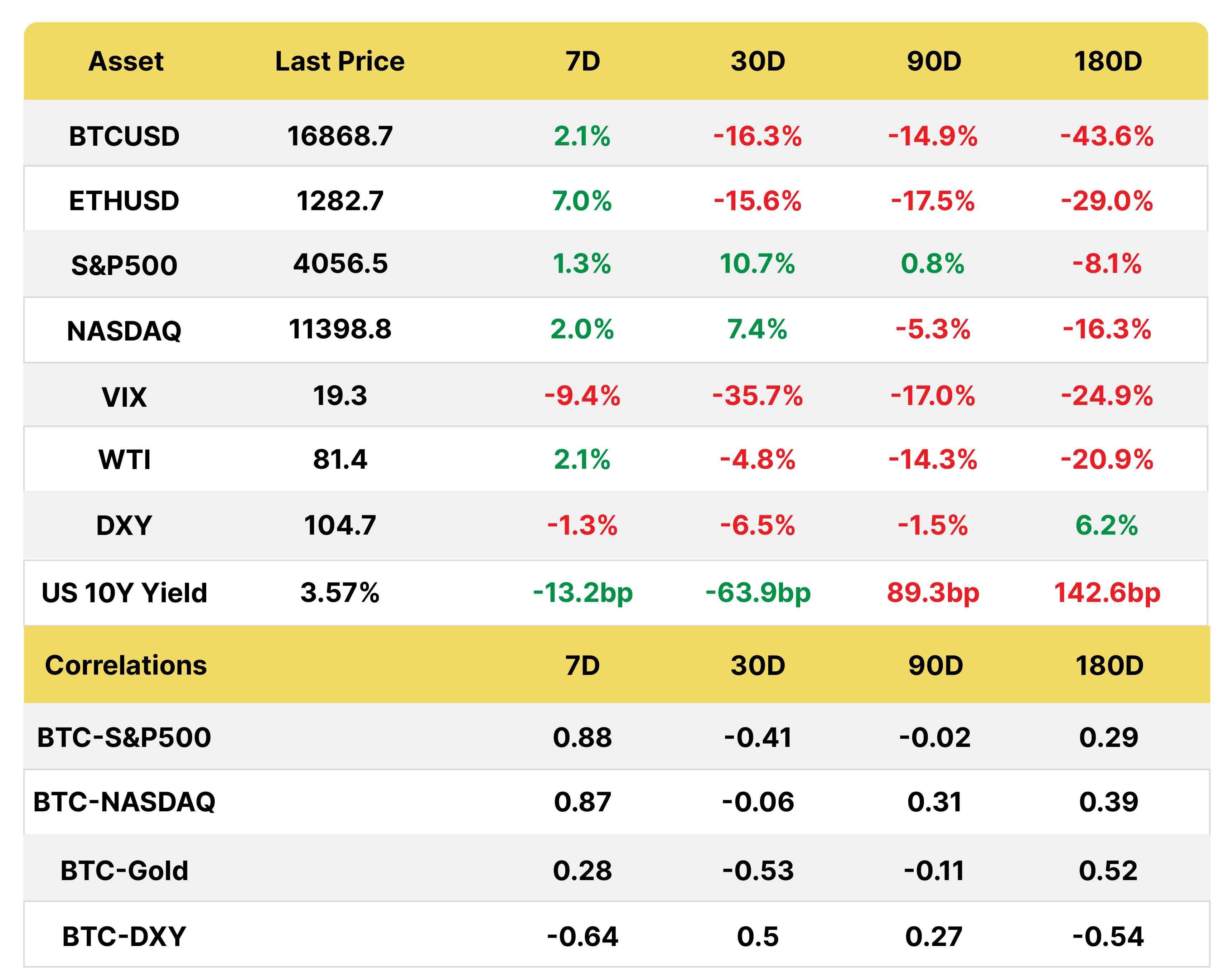

Macro

*Price is at the time of writing

JOBS COMING IN HOT

Jerome Powell spoke on Thursday and confirmed what he said previously, a slowing in the pace of hikes to 50 bps in December may be possible but that they still had a long way to go. Markets took to heart, breaking a three-day losing streak, though this (and cuts by mid-2023) are already reflected in the bond market. Even as we saw one of the worst personal savings rates ever recorded, he warned that wages could be a future source of inflation, while acknowledging their forecasting has been less than stellar.

During the Q&A the Fed chairman spent a good deal of time going through the recent JOLTS report which showed 1.7x job openings for every job seeker, down from 2x a few months ago. This is still a problem in his eyes, even if labor demand has eased. Strong wages are a good thing, according to Powell, but they need to be consistent with 2% inflation.

He must have had a whiff of the hot November jobs report released on Friday. Non-farm payrolls grew by 265k vs. 200k est, with average hourly earnings +0.6% m/m vs. +0.3% expected, a move down in the participation rate to 62.1%. The concern is that wage pressure may offset the easing in rents and goods prices. While Covid explains part of this, it’s mostly early retirees lulled by higher house prices and financial markets. This ties back to the negative wealth effect that the Fed feels it needs to create to ease inflation.

⬇️ IN CONSUMER CONFIDENCE AND ⬆️ IN INFLATION EXPECTATIONS

Confidence, which encompasses attitudes, buying intentions, plans and expectations, is worth watching as when the economy goes into a recession, it generally falls sharply and often peaks before the economy enters a recession.

Consumer confidence fell for the second month in a row in November. The index dropped 2 percentage points to 100.2, almost in line with the 100 expected. Current conditions at 137.4 were the worst since April 2021. A spike in gas prices probably added to deteriorating current conditions.

The short-term outlook on income, business and labor, also worsened to 75.4 (-2.5 pp) and under the key 80 level, remains gloomy. According to the Conference Board, inflation expectations increased to their highest level since July, with both gas and food prices as the main culprits. Intentions to purchase homes, automobiles, and big-ticket appliances all cooled.

Down we go: two months in a row of consumer confidence dips

Source: Conference Board

Under Pressure: The Case-Schiller Index 3 Mth change is the worst since 2008, though house prices YoY remain elevated

EVEN THE AIRBRUSHED CHINESE PMIS WERE ALARMING

Appalling PMI numbers came out of China this week, the lowest since April. as the Covid lockdown measures took a toll. Both non-manufacturing (services + construction) and manufacturing PMIs ventured further into contraction. Services dove to 46.7 from 48.7, while manufacturing went from 49.2 to 48. The non-manufacturing drop is concerning given it constitutes over 50% of the economy, double what it was two decades ago.

Perhaps the difficulty in maintaining strict lockdown measures and the protests across major cities and universities is what drove the government to allow low-risk Covid cases in Beijing and Shanghai to self-isolate. The China Dissent Monitor, run by U.S.-funded Freedom House, estimated at least 27 demonstrations took place across China last weekend.

The China Non-Manufacturing PMI dragged the composite deeper into contractionary territory

Source: Bloomberg

S&P SECTOR PERFORMANCE: WHAT A DIFFERENCE A YEAR MAKES

As we approach year-end, it’s a good time to assess the damage. The sectors that have outperformed the S&P (-14%) to December 1 have been defensive, with the exception of energy (+64%), which has done well for a second year running, due to idiosyncratic factors.

Communication (-35%), Consumer Discretionary (-30%), IT (-22%) and Real Estate (-25%) have fared the worst as interest rates spiked as should be expected in this part of the cycle. Utilities (-0.9%), Healthcare (-1.3%) and Consumer Staples (-0.5%) have proven their resilience and may remain a place to hide into 2023 as recession indicators get louder. The caveat is there can be a wide divergence of performance among the industry subsectors.

With the exception of energy, defensive sectors have led S&P performance this year

Source: Bloomberg

TECH: CUTTING THE FAT

Notwithstanding the heated jobs data, Kraken announced that it would be slashing 30% of its workforce, affecting over a thousand employees. This follows from Coinbase and Gemini, and there will likely be future rounds after the hiring sprees of 2021. Coinbase, for example, more than quadrupled its staff in 2021, before reducing numbers by 18% this year. Consensus stands at -$428mn in EBITDA expected in 2022. They do have a strong cash position of over $5bn to face the crypto winter.

Although the labor market, a lagging indicator, remains tight in the US, technology companies are now a larger component of layoffs than in the past. Crypto fits into the fintech bucket, which is also gaining relevance. In November, tech personnel reductions jumped to approximately a third of the total. This number was boosted by cuts at Twitter, Amazon and Meta, companies that expanded aggressively in previous years but may have to downsize as the top line slows. Housing-related layoffs are also rising.

Technology companies suffered the largest job cuts in November, a trend which may not abate after years of growth

via Liz Ann Sonders, Charles Schwab

Crypto

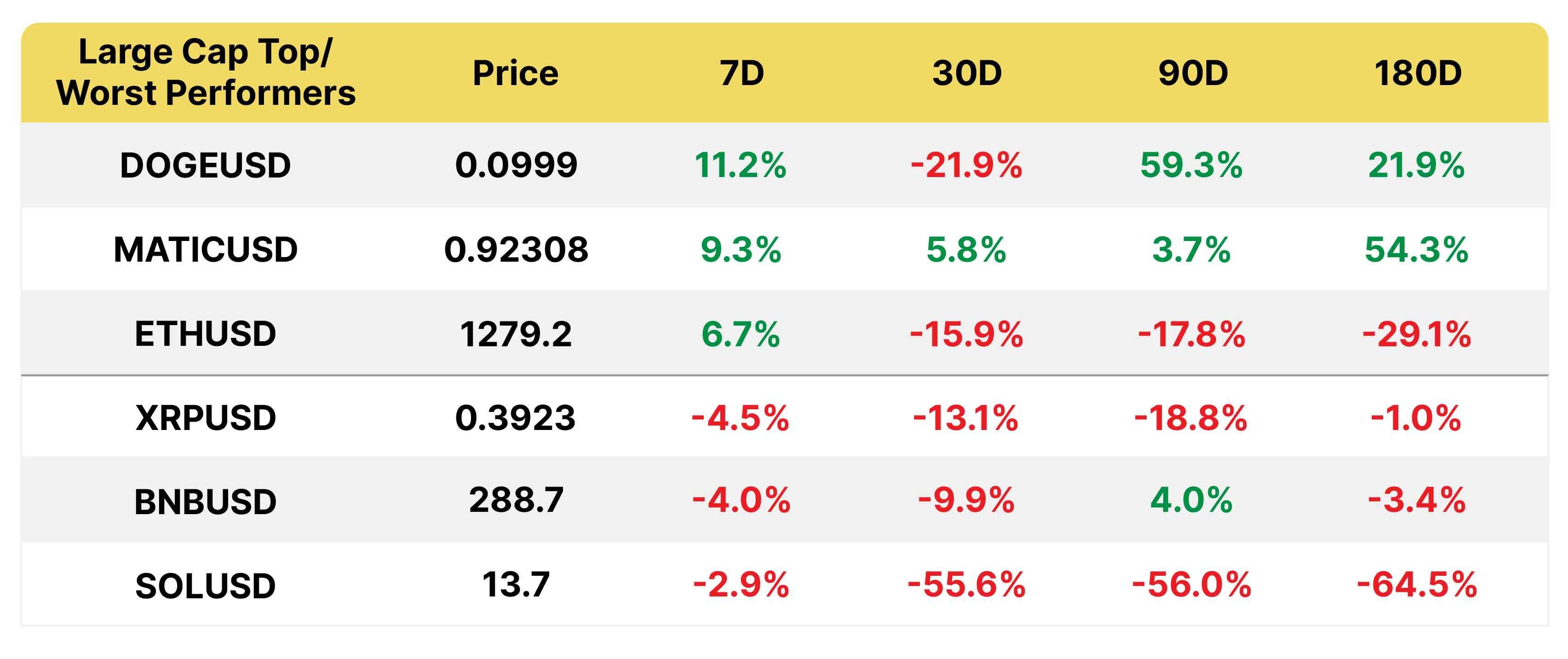

*Price is at the time of writing

Regardless of the better performance in the last days of the month, both ETH and BTC suffered a 16% drawdown. Solana is still heavy from the FTX fallout while BNB weakness may be due to noise around exchange coins in general.

In what proved to be a volatile month, onchain volumes increased by 10% to $260bn, and stablecoin volume rose by 58% to $919 bn, a new peak.

GMX, the derivatives exchange built on Arbitrum, did particularly well (GMX +19%), flipping Uniswap fees for the first time on November 28 ($1.16mn vs. $1.05mn). Token holders own and govern the protocol and take a cut of fees. Value accrual to token holders and LPs is in ETH and the token is non-inflationary. Instead of a traditional order book, which some DEXes have, it uses automated market making. Users trade against tokens in the liquidity pool where prices are mathematically derived. A yellow flag with this one is that the team behind it is anonymous.

GMX, the DeFi derivatives exchange, was a beneficiary of volume into DEXes from CEXes

Source: TokenTerminal

Spot CEX volumes also rose by 24% to $673bn, with Binance, Kraken and Coinbase winning share, as per Cryptocompare/The Block. BTC monthly futures volumes fell by 22% but ETH by only 6%. The BTC spot-to-futures ratio shot up from 0.16x to 0.4 since July, while ETH has experienced the opposite trend, from 0.25x to 0.14x.

In terms of stablecoin volume on centralized exchanges, USDT continued to lose ground primarily to BUSD, going from 59% to 56% in November, from a high of 70% in 2020.

AUDITING AND A BRIEF HISTORY OF FRAUD: IT TAKES A CRISIS

The spotlight on auditing as a tool to mitigate counterparty risk in crypto is a positive development but will take time to implement meaning a market recovery is not imminent. Investors, politicians and regulators are demanding transparency, which is what tends to happen after a boom turns into a bust and the post-mortem begins. Auditing has had its own rocky evolution, with improvements made amid the wreckage of each financial crisis.

The early part of this century was littered with scandals, some of which went undetected for decades. Changes in management, whistleblowers or businesses failing under the weight of fraud during a crisis usually revealed the deception. Perhaps the most similarity with FTX is the MS Global tampering of custom funds, though on a smaller scale. The parties settled and no one went to prison as loose risk controls were blamed rather than outright fraud.

Auditing in some way has been around at least since at least the ancient Egyptians. In the UK, after the South Sea bubble in 1720, which hurt many small investors with the promise of high returns, sales of company shares were restricted for many years under the Bubble Act. When sales were finally allowed again, audited financial statements were made a requirement. In the US, it took the 1929 stock market crash for auditing to be made mandatory for listed companies and independent auditing came even later. It was also when the Securities and Exchange Commission was created.

As the world became more global, international standards were put in place, followed by standardized auditing procedures. However, auditing continued to face issues. There was a series of incidents in 2001 and 2002, the most famous of which was Enron, that led to the Sarbanes-Oxley Act, which imposed tighter requirements on boards, management and accounting firms. It also included criminal penalties and mostly bans accounting firms from providing consulting to avoid major conflicts of interest, as we saw with Arthur Andersen. The latter has been difficult to enforce given market concentration.

|

Fraud: the intentional use of deceit, a trick or some dishonest means to deprive another of money, property or a legal right. There are two types, misappropriation of assets and fraudulent financial reporting. The Legal Dictionary |

The list of accounting disasters is so long that the below is hardly comprehensive, with most involving inflating revenue, minimizing costs or hiding debt. Attempts at sweeping losses under the rug, and short-term market pressures to perform and claim bonuses led many astray.

1991- Bank of Credit and Commerce International or BCCI (PriceWaterhouseCooper). This sprawling international bank went under owing more than £10bn to its creditors. Former shipping tycoon Abbas Gokal was sentenced to 14 years in prison and fined almost £3m for, along with BCCI officials, fraud totalling around $1.2bn. Gokal defrauded the bank while its officials were accused of rampant money laundering and illegally gaining control of a US bank.

1998 - Waste Management Inc. a listed US company (Arthur Andersen). The company’s new CEO, discovered over $1.7 billion in fake earnings. The previous CEO and his team were found guilty by the SEC and the company paid $457 mn in a class-action lawsuit while the auditors, Arthur Andersen, were also financially penalized.

2001 - One of the most well-publicized was Enron, the US energy, commodities, and services giant based out of Houston (Arthur Andersen). The company, led by CEO Ken Lay, hid billions of dollars in bad debt off-balance sheet and inflated earnings. Again, Arthur Andersen was involved and it was one scandal too many as one of the Big Five went under. The CEO and his predecessor were both convicted and Enron did not survive, wiping out $74 bn in market cap.

2002 - WorldCom, a telecom company now known as MCI (Arthur Andersen). CEO Bernie Ebbers inflated revenues and under-reported expenses. Internal auditors uncovered the $3.8 billion fraud. Investors lost $180 billion and Ebbers got 25 years in prison.

2002- Tyco International was an American security systems company based in Princeton, NJ. The CEO and CFO stole over $150 million and inflated earnings by over $500 million. Both men were sentenced to prison while a class action suit paid out almost $3bn.

2003- The Federal Home Loan Mortgage Corporation, colloquially known as Freddie Mac (PriceWaterhouseCoopers). The colossal federally-backed mortgage financing firm misstated over $5 bn in earnings and was fined $125 million.

2005 - American International Group (AIG), the global US insurance firm (PriceWaterhouseCoopers). CEO Hank Greenberg was found guilty of stock price manipulation. The SEC’s investigation also revealed a fraud of almost $4 billion whereby the company booked loans as revenues. AIG paid a whopping $1.64 bn fine to the SEC and over $800 mn to several pension funds.

2008 -Lehman Brothers, one of the top investment banks in the US (Ernst & Young). During the 2008 financial crisis, the company had hidden over $50 billion in loans. The SEC found that these loans had been disguised as sales where toxic assets were sold to Cayman banks on a short-term basis to give the impression that they had less leverage. We know how that story ended but no one was indicted.

2009 - Bernie Maddoff, a New York money manager (Friehling & Horowitz) . He delivered what seemed to be high returns for almost two decades with a $65 bn Ponzi scheme that paid investors with new deposits. It finally unraveled when markets soured in 2008. Maddoff was sentenced to 150 years in prison and ordered to pay back $170bn in restitution.

2011-MF Global, a commodity brokerage run by ex-Goldman Sach co-chairman and NJ governor, John Corzine (PriceWaterhouseCoopers). The firm ran into trouble after making a $6.3 bn bet on European sovereign bonds including Portugal, Spain and Italy, leading to bankruptcy. A $1.6 billion shortfall in customer funds that were supposed to remain segregated went AWOL but was later recovered. Both PwC and Corzine settled the case. Tampering with customer funds is a crime under the Commodity Exchange Act of 1936.

2011 - A $1.5bn fraud at Japanese optical equipment manufacturer, Olympus (Ernst & Young), was perpetrated by the CEO. Previous management had buried losses for years. The company’s former chairman and two others received suspended prison sentences and an adviser to the company was sent to jail for four years.

2014 - Petróleo Brasileiro, the Brazilian oil & gas company (PriceWaterhouseCoopers) The state-controlled firm disbursed $853 mn to settle charges that former executives broke U.S. anti-corruption laws by bribing politicians. Political appointees on its board awarded overpriced contracts to engineering firms in return for illicit party funding and bribes amounting to several billion of dollars. The scandal, dubbed Operation Car Wash, extended to other Latin American countries.

2020 -Wirecard, German payments processor and financial services provider (Ernst & Young). Yet another case of inflated figures. The company filed for insolvency after revealing that €1.9 billion was missing from its books. The court case against the CEO/CTO is still pending

2022 - FTX???

Until next week!

The Bequant Team

Martha Reyes

Emiliano Bruno

This document contains information that is confidential and proprietary to Bequant Holding Limited and its affiliates and subsidiaries (the “BEQUANT Group”) and is provided in confidence to the named recipients. The information provided does not constitute investment advice, financial advice, trading advice or any other sort of advice. None of the information on this document constitutes or should be relied on as, a suggestion, offer, or other solicitation to engage in or refrain from engaging in, any purchase, sale, or any other investment-related activity with respect to any transaction. Cryptocurrency investments are volatile and high-risk in nature. Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. No part of it may be used, circulated, quoted, or reproduced for distribution beyond the intended recipients and the agencies they represent. If you are not the intended recipient of this document, you are hereby notified that the use, circulation, quoting, or reproducing of this document is strictly prohibited and may be unlawful. This document is being made available for information purposes and shall not form the basis of any contract with the BEQUANT Group.

Any transaction is subject to a contract and a contract will not exist until formal documentation has been signed and considered passed. Whilst the BEQUANT Group has taken all reasonable care to ensure that all statements of fact or opinions contained herein are true and accurate in all material respects, the BEQUANT Group